Hold SRF Ltd for the Target Rs. 2,947 By Prabhudas Liladhar Capital Ltd

Based on investigation of Apr’23-Mar’24 data, Indian government has applied anti-dumping duty (ADD) of ~USD4,500/mt on import of R134a from China. SRF is the only manufacturer of R134a in India. However, currently, the difference between import-export realizations has already narrowed down, which would limit the benefit of ADD. Our estimate suggests that for every USD1/kg benefit in domestic realization, impact on FY27 EBITDA would be ~2%. For every 1,000mt additional sales, the impact would also be limited to ~2% of EBITDA. The stock is trading at 43x FY27 EPS. Based on SOTP, valuing the chemicals segment at 27x FY27 EV/EBITDA and packaging and technical textiles at 11x, we arrive at a target of Rs2,947 (earlier Rs3,071). In our earlier note, we had highlighted how R32 prices are likely to come down. Bearing the same in mind, we re-iterate our Hold rating on the stock.

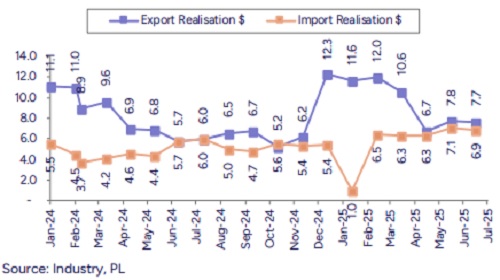

Import-export realizations have converged: During the investigation period of Apr’23-March’24, import realization of R134a was USD3.4/kg lower than the export realization. However, the difference appears to have narrowed to USD1.5 in AprJul’25. As a result, it is unlikely that the full impact of ~USD4.5/kg would accrue to SRF. It is more likely that non-Chinese importers would increase their market share. SRF could also sell more quantity in the domestic market.

SRF is the only domestic supplier of R134a: We understand that SRF has ~20,000mtpa capacity for R134a. Indian market is also roughly the same size. In FY25, as per export data, SRF exported 3,439mt of R134a. Considering 70% utilization, domestic sales would be 9,873mt. Our estimate suggests that for every USD1/kg change in domestic realization, EBITDA impact would be ~2% of FY27. We also estimate that for every incremental 1,000mt of domestic sales of R134a, the impact would be ~2% of FY27 EBITDA.

Valuation and view: SRF is currently trading at 43x FY27 EPS. The agrochemical segment continues to face pricing pressure although volumes appear to be gaining strength. More so, the commentary of global players suggests lack of revival in the coming months. We also highlighted in a recent note how we expect R32 prices to decline going forward. As a result of this, we find the valuations too rich to leave any significant upside for investors. We value SRF using SOTP. We value the chemicals segment at 27x FY27 EV/EBITDA. We value both packaging and technical textiles segments at 11x FY27 EV/EBITDA. With a target price of Rs2,984 (earlier Rs3,071) we reiterate our Hold rating on the stock. Risk to our call would be pick up in realizations for agrochemical and refrigerants or other ADDs.

Exhibit 1: Difference between import & export realizations have narrowed (USD/kg)

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271

.jpg)