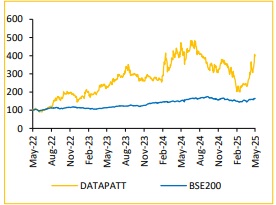

Add Data Patterns Indian Ltd For Target Rs. 2,915 - Choice Broking Ltd

Scaling Up the Value Chain: Transforming into a System Integrator

Following the recent India-Pakistan conflict, the MoD has accelerated emergency procurement programs, with DATAPATT expected to benefit from a potential order inflow of INR 10-20 Bn in FY26E. This is linked to radar systems, electronic warfare suites, communication equipment, and seeker technologies for the BrahMos missile program, where repeat orders and full-system development are gaining strong traction.

What makes DATAPATT increasingly attractive is its strategic transition from being a component supplier to a full-fledged defense system integrator, supported by robust R&D investments and a healthy order book pipeline. We anticipate significant orders from BrahMos Aerospace for the supply of seekers and critical components for the BrahMos missile system. On May 11, 2025, Defence Minister Rajnath Singh virtually inaugurated the BrahMos Aerospace Integration and Testing Facility in Lucknow, Uttar Pradesh. The facility is designed to produce 80-100 BrahMos supersonic cruise missiles annually, with plans to scale up to 100-150 next-generation BrahMos-NG missiles per year. Although still in its early stages to say, but we believe DATAPATT’s export potential is growing, as several friendly nations have initiated inquiries regarding the BrahMos missile system. With a well-defined technology roadmap and growing system integration capabilities, the company is strongly positioned for long-term structural growth in defense sector.

Strong Quarter, Delivers Ahead of Street Estimates

* Revenue for Q4FY25 up by 117.4% YoY and up by 238.5% QoQ at INR 3,962 Mn (vs Consensus est. INR 3,357 Mn).

* EBIDTA for Q4FY25 up by 60.7% YoY and up 176.7% QoQ at INR 1,495 Mn (vs Consensus est. INR 1,345 Mn). The EBITDA Margin stood at 37.7%, contracted 1,330bps YoY (vs Consensus est. of 40.0%).

* PAT for Q4FY25 up by 60.5% YoY and up 155.4% QoQ at INR 1,141 Mn (vs Consensus est. INR 1,015 Mn). PAT Margin contacted by 1,021bps YoY, reaching 28.8%

View & Valuation:

By factoring the recent developments, we revise our FY26E and FY27E revenue growth estimates Upwards by 15.4% and 15.5%, respectively, and we project company’s Revenue/EBITDA/PAT to grow at a CAGR of 28.7%25.9%/25.9% over FY24-27E. We also revise our FY26E and FY27E EPS growth estimates Upward by 18.8% and 18.1%, respectively, However, in light of recent rally in the stock, we downgrade our rating from BUY to ADD and revise our TP upwards from 2,450 to INR 2,915 while maintaining 45x FY27E PE multiple.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131