Buy Wipro Ltd For Target Rs. 290 By JM Financial Services

.jpg)

Balancing bookings with margins

WPRO reported 0.3% cc QoQ growth, ahead of JMFe: 0%, and in the upper-half of its -1% to +1% cc QoQ guided band. It guided for -0.5% to 1.5% cc QoQ growth in 3Q, as Phoenix deal (USD 650mn TCV) starts to ramp. Booking momentum continued with USD 4.8bn TCV (book-tobill: 1.8x), reflecting its success in multi-vendor competitive bids. These are likely to weigh on its margins. WPRO was able to offset these pressures in 2Q though. EBIT margins, adjusted for a client bankruptcy impact (50bps), were down just 10bps (JMFe: -70bps). FX benefits and operational efficiencies (higher utilisation, FPP productivity) helped. Such deal transition cost will likely sustain, testing WPRO’s cost discipline. Moreover, higher renewals (both the mega deals it won in 2Q were renewals) will possibly deflate revenues initially, further limiting operating levers. That said, LTM TCV of USD 17bn (+20% YoY) at a book-to-bill of 1.64x (from 1.34x a year-back) positions WPRO well to accelerate growth in FY27 and bridge growth gap with peers, in our view. We have therefore built 5.4% cc YoY growth in FY27E (-1.4% in FY26E), closer to peer average. 2Q miss (on reported margins) and marginal cuts to our FY27-28E margin assumptions drive 2-5% cut to FY26-28E EPS. Sustained deal momentum and valuation comfort (17x FY27E EPS) however keep us constructive. BUY with a revised TP of INR 290.

* 2QFY26- Topline beat: WPRO reported 0.3% cc QoQ growth in 1Q, beating JMFe : 0% (Cons. est. : 0.2%). This was in the upper half of WPRO’s -1.0% to +1.0% guidance. Barring BFSI (+2.2%cc QoQ) and Technology and communications (+0.8% cc QoQ), all other verticals declined. Among geographies, EU returned to growth as the phoenix deal starts to ramp (+1.4% cc QoQ), APMEA (+3.1%) was led by India, Australia and SEA, while Americas were weak (Americas 1: 0.5%; Americas 2: -2.0%). Capco grew both sequentially and YoY led by newer markets such as LATAM and APMEA. EBIT margin declined 60bps to 16.7%, in-line with JMFe. However, adjusting for client bankruptcy impact (INR 1,165mn), margins stood at 17.2%. Margins were aided by rupee depreciation, higher utilisation and better pricing through fixed price projects while Investments towards large deals was a headwind. PAT came in at INR 32.6bn, vs Cons est. of INR 33.0bn. Lower other income and higher ETR impacted PAT.

* Deal wins, guidance and outlook: WPRO reported TCV of USD 4,688mn, at a book-to-bill of 1.8x. LTM deal TCV grew 20% YoY to reach USD 17.1bn, book to bill of 1.64x. Large deal TCV grew 91% YoY to reach USD 2,853mn. There were 13 large deals in 2Q with two mega deals (USD 500mn+),one in healthcare vertical and one in BFSI. Significant portion of the deals won were renewals. Out of the 13 deals won, two were net new, 6 were renewals and the rest were a mix of the two. Net new will add to growth and renewals will see deflation while growth from scope expansion will be pushed out. Management is confident on a good showing in Q3 despite furloughs. Momentum in BFSI, healthy pipeline and ramp up of large deals won informs their confidence. WPRO guided for -0.5% to +1.5% cc QoQ growth for 2Q, 50bps higher than our expectations. In margins, WPRO reiterated its intent to keep margins in a narrow band between 17-17.5%. However, competitive intensity in vendor consolidation deals, investments required to ramp up large deals, potential 50bps margin diltuion from Harman DTS acquisition (not included in guidance yet), will weigh on margins going forward.

* Marginal cuts to EPS; maintain BUY: We have largely maintained our topline estimates and build 5.4% YoY cc growth in FY27E, closer to industry average. We have marginally lowered our margin estimates, given higher investments towards ramp up of large deals. This drives 2-5% cuts to our EPS estimates. Attractive valuations keeps us constructive. Maintain BUY.

Key Highlights from the call

* Demand: WPRO reported 0.3% QoQ growth in IT services revenue (cc terms), towards the upper half of the guided range. Enterprises are prioritizing cost optimization, vendor consolidation, legacy modernization and scaled deployment of Agentic AI, with efficiency and speed becoming key decision parameters. Discretionary and transformation-led spending remains selective. Management highlighted that tariff-related uncertainties persist but are also prompting clients to re-evaluate operating models, creating new engagement opportunities.

* Outlook: Management guided for -0.5% to +1.5% QoQ cc growth in 3QFY26, factoring in seasonally weaker furlough-led headwinds. Execution of large deals, including the Phoenix contract in Europe, is expected to support growth momentum through 2H. Management maintained its focus on profitable growth while acknowledging that deal-transition costs could weigh on near-term margins. The medium-term outlook remains positive given sustained largedeal visibility and strong participation in ongoing vendor consolidation programs.

* Margin: Adjusted EBIT margin stood at 17.2%, up 40bps YoY (reported 16.7% including a oneoff bankruptcy-related provision). Management reiterated its focus on maintaining margins within a narrow 17-17.5% band. Tailwinds included rupee depreciation, higher utilization, lower attrition, and improved profitability in fixed-price programs. Headwinds were investments linked to large-deal ramp-ups and growth initiatives. The recently announced Harman DTS acquisition, not yet reflected in numbers, is expected to dilute margins by c.50bps initially. Management continues to drive margins through utilization gains, fixed-price productivity and SG&A optimization.

* Bookings: WPRO reported total bookings of USD 4.7bn in 2QFY26, closing 13 large deals including two megadeals (one each in healthcare and BFSI). Demand continues to be driven by vendor consolidation and AI-led transformation programs. The mix comprised a healthy combination of renewals, renewal-plus-expansion, and net-new deals, with net-new wins expected to ramp from 3Q onwards. Management highlighted strong traction in Europe through new multi-year partnerships in BFSI and logistics, underpinned by WPRO’s VEGA AI and Wings delivery platforms. The overall pipeline remains robust and evenly distributed across large and mid-sized deals.

* Verticals and geographies: Three of four SMUs reported sequential growth; Europe returned to growth after several quarters, led by BFSI, while APMEA delivered strong results across India, Australia and Southeast Asia. Americas 1 grew on strength in healthcare, communication and tech, whereas Americas 2 declined but is expected to recover as large deals ramp up. BFSI reported sequential growth, driven by Europe and APMEA, and remains supported by robust bookings, vendor consolidation and modernization of core systems. Capco continued to grow sequentially and YoY, with strength in wealth and asset-management platforms. Healthcare remained a strong sector despite structural transitions, aided by modernization programs and a new megadeal in the quarter. Technology and Communications grew modestly on AI and engineering productivity initiatives, while consumer, energy and manufacturing were impacted by tariff-related uncertainty and cautious spending. Client-specific challenges in Europe are now behind, and management remains focused on sustaining win rates in a highly competitive vendor-consolidationenvironment.

* AI strategy: Management unveiled Wipro Intelligence, a unified suite of AI platforms, solutions and agents aimed at enabling clients to scale confidently in an AI-first environment. The platform integrates capabilities across delivery (software development, infrastructure and BPO) and industry domains, featuring 200+ AI agents across verticals. Flagship offerings include AutoCortex for automotive, Wealth AI for BFSI, and Payer AI for healthcare. Management emphasized that the platform embeds productivity gains, assured outcomes and responsible-AI guardrails, reinforcing WPRO’s consulting-led approach and positioning in AI-driven transformation programs.

* Supply and delivery: Headcount increased sequentially, with freshers onboarded ahead of deal ramp-ups. Management expects hiring to continue both laterally and on campus as bookings convert to revenue. Attrition declined further and utilization improved. The US delivery workforce remains largely localized (c.80%+), minimizing exposure to H-1B visa restrictions; management reiterated that onsite centers in the US will continue to scale with demand.

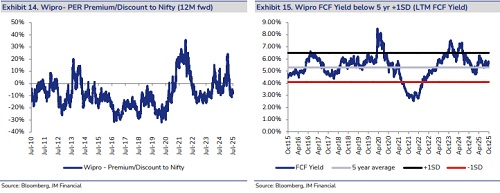

Valuation charts

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361