Commodity Morning Insights 26th December 2025 - Axis Securities

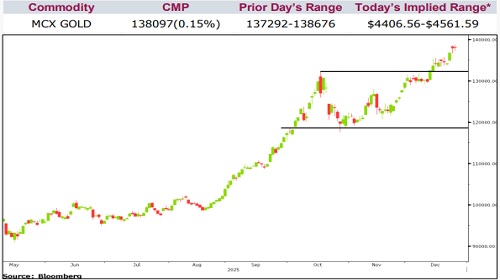

* Spot Gold was flat after a strong three-day rally that pushed prices to an all-time high above $4,500 an ounce. Some profit-taking emerged as year-end approached, following an exceptional run that still leaves gold up nearly 70% in 2025. Platinum saw sharper selling pressure, tumbling more than 6% after retreating from a record high touched overnight, reflecting broader profit-booking across precious metals

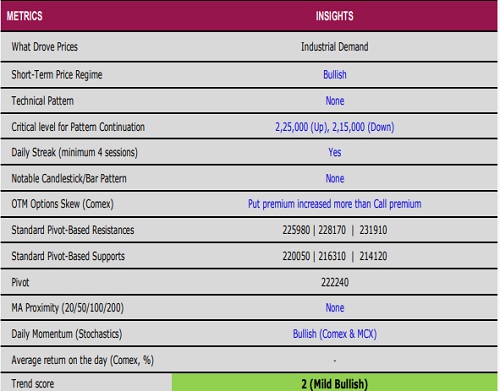

* WTI Crude Oil closed largely unchanged on Wednesday after rallying earlier in the week on heightened supply-risk concerns linked to Venezuela and ongoing Ukraine–Russia tensions. Prices continue to find underlying support from Baker Hughes data showing that active US oil rigs fell to an over 4-year low last week, signalling tighter future supply, despite the latest count showing a modest increase of three rigs

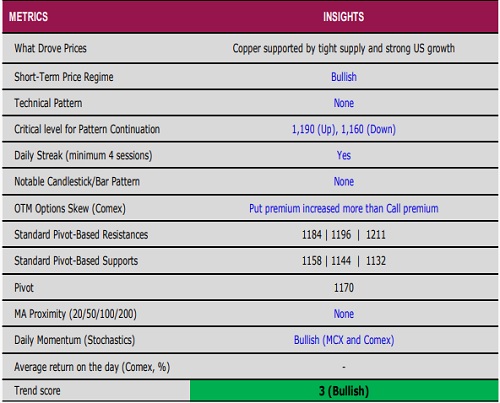

* Comex Copper futures climbed to around $5.5 per pound in late December, hovering near a five-month high. Prices were supported by tight global supply conditions and robust US economic data, with the economy expanding at its fastest pace in two years in Q3. Strong consumer spending, exports, and industrial activity continued to underpin demand from copper-intensive sectors

* Nymex Natural Gas prices declined as updated forecasts turned slightly warmer for the US East Coast during 3rd to 7th January, easing near-term heating demand expectations. However, forecasts shifted colder for the Interior West and Plains regions. The EIA announced that this week’s natural gas storage report has been rescheduled from 24th December to 29th December at noon (ET) due to the Christmas holiday.

Gold

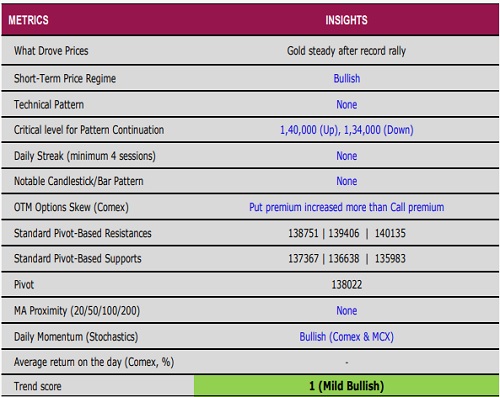

Silver

Crude Oil

Copper

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633

.jpg)