Buy Apollo Pipes Ltd For Target Rs. 641 By Yes Securities Ltd

Laudable performance on volume front; reiterate BUY!

Result Synopsis

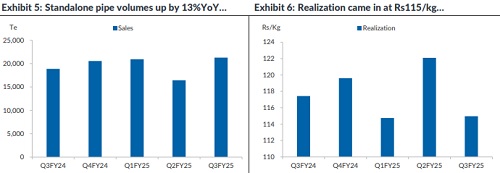

Apollo Pipes Ltd (APOLP) delivered strong volume growth despite the weak macroenvironment. Company’s standalone volumes (excl Kisan) grew by 13%YoY (2-year CAGR stood at 9%) and volume from Kisan stood at 5,708Te Vs 3,722Te in previous quarter. Though standalone ASP declined by Rs7/Kg on sequential basis, margins contracted by mere Rs1/Kg to Rs10/Kg largely owing to better product-mix. Margins for Kisan improved marginally on account of better operating utilization. Overall for 9MFY25, standalone volumes remained flattish at 58,646Te while revenue declined by 6%YoY. EBITDA/Kg for 9MFY25 came in at Rs10.8 Vs Rs11.8 in 9MFY24. Overall slump in demand and higher competitive intensity have kept margins under pressure.

Management guidance

Management is confident of deliver a volume growth of 25%CAGR over coming 2-3 years with ROCE of 25%. Incrementally, company expects standalone margins to improve by Rs1-1.5/Kg with higher contribution of O-PVC pipes and window profile segment. For Kisan as well, management believes margins will expand to Rs6-7/Kg with better volumes.

Our View

We believe APOLLO PIPES should deliver overall volume growth of 17%CAGR (13%CAGR on standalone) over FY24-FY27E, on the back of expected pick-up in infra spends and healthy demand from plumbing segment with construction of new projects. New products viz, O-PVC and window profiles should enable the company to report healthy growth. Moreover, upcoming capacities in Varanasi and South will boost overall volumes. Margins should also improve gradually from hereon, owing to better operating utilization and improving product-mix. Hence, we expect EBITDA growth of 22%CAGR over FY24-FY27E. We continue to value the company at P/E(x) of 30x on FY27E EPS of 21.4 with a target price of Rs641. Hence, we maintain our BUY rating on the stock

Result Highlights

* Consolidated revenue stood at Rs3.08Bn (in-line with our est), 23% sequential growth. (YoY consol nos are not comparable owing to acquisition of KISAN).

* Total volumes stood at 26,987Te, a sequential growth of 34%. (6% above our est).

* EBITDA/Kg came in at Rs8.6 Vs Rs9.6 in previous quarter. (Vs our est of Rs9.5).

* Net profit stood at Rs64Mn Vs Rs40Mn in Q2FY25.

Please refer disclaimer at https://yesinvest.in/privacy_policy_disclaimers

SEBI Registration number is INZ000185632