Accumulate Tata Consumer Products Ltd For Target Rs. 1,200 By Elara Capital

Margins to recover in FY26

We believe margins for India business may have bottomed out for Tata Consumer Products (TATACONS IN), as the management expects softer tea prices due to better crop yields this season. While this could limit pricing-led growth in tea, the management indicated a likely recovery in margin to 16% by H2FY26. NourishCo’s recovery following pricing adjustments remains strong and it is expected to maintain momentum. Despite the ongoing economic slowdown, TATACONS’ diversified product portfolio and expanding distribution provide solid visibility for double-digit sales growth and margin improvement. We reiterate Accumulate with SoTP-based TP raised to INR 1,200 (from INR 1060).

Core businesses delivered strong growth, primarily led by pricing: Net sales rose 17.3% YoY in Q4 to INR 46bn, 2% ahead of estimates, with 12% organic growth (ex-acquisitions). India beverages and foods grew 17% and 27% YoY, driven by organic growth of 9% and 17%, respectively. India branded business posted a 5.9% underlying volume growth. The tea segment posted 9% value and 2% volume growth, as only 46% of steep inflation was passed on in Q4 (30% for FY25) through calibrated price increases. NourishCo rebounded with a 10% revenue growth (versus a 2% decline in Q3), led by 17% volume growth and a strong March exit at 38%. Salt revenues rose 13%, backed by 5% volume growth and price hikes, while Tata Sampann grew 30% YoY. New acquisitions of Capital Foods and Organic India contributed INR 2.1bn and INR 1bn to overall revenue in Q4, respectively, ending FY25 with a combined 19% revenue growth.

Positive outlook for growth businesses: In FY25, growth businesses contributed 28% to the India business, driven by an 18% YoY organic growth, below the expected 30% due to muted performance in the ready-to-drink (RTD) segment (up only 2%). However, the management is confident of achieving the 30% target ahead, backed by corrective actions in Tata Gluco Plus and strong momentum across the rest of the portfolio. In addition, newly acquired Capital Foods and Organic India are helping strengthen the food services channel, now present in 16 cities, while efforts to scale up in the pharmacy segment are also underway

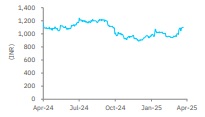

India business – Margin hit significantly by inflation in tea: Q4 EBITDA margin contracted 260bps YoY to 13.5% (14.1% in FY25), versus our estimates of 13.2%, dragged down by 360bps decline in margin for the India business on account of inflation in tea. Adjusted for tea inflation, consolidated EBITDA margin for Q4FY25 would have expanded 80bps YoY. The management expects input prices for tea to correct as the crops are better compared with last year and hence, margins are likely to return gradually to 16% (consolidated) in H2FY26E.

Reiterate Accumulate with a higher TP of INR 1,200: We raise FY26E/27E estimates by 3%/5% due to lower-than-earlier estimated tax rate. So, we raise our SoTP-TP to INR 1,200 from INR 1,060 as we assign India business 53x FY27E P/E (from 50x) given strong visibility on doubledigit revenue growth, and Starbucks JV INR 50 per share (unchanged). Reiterate Accumulate.

Please refer disclaimer at Report

SEBI Registration number is INH000000933

.jpg)