Neutral Balkrishna Industries Ltd for the Target Rs.2,510 by Motilal Oswal Financial Services Ltd

Demand weakness continues in global OHT market

Favorable currency to provide some respite

* Balkrishna Industries’ (BIL) 1Q earnings at INR2.9b were below our estimate of INR4.3b due to an adverse mix, the impact of US tariffs, and weak demand.

* BIL continues to face demand headwinds in its key global markets. Further, its foray into the PCR/TBR segments is likely to be closely monitored for: 1) the pace at which it gains material traction and 2) whether the margins and returns will be materially dilutive in the long run. While the stock has underperformed in the recent past and valuations at 29.8x FY26E and 24.2x FY27E are not too demanding, the future target multiple will likely depend on the company’s ability to succeed in these new segments—not only by capturing market share, but by doing so without materially hurting core returns—which, in our view, remains a challenge. Reiterate Neutral with a TP of INR2,510.

Weak 1Q due to subdued demand and adverse mix

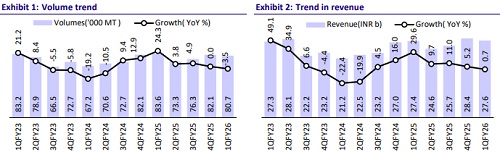

* Volume declined 3.5% YoY to 80,664 MT (in-line), impacted by weak global demand.

* Revenue rose marginally 1% YoY at INR27.6b (in-line), despite weak volumes, aided by favorable forex movement that drove a 4.3% YoY growth in blended average ASP.

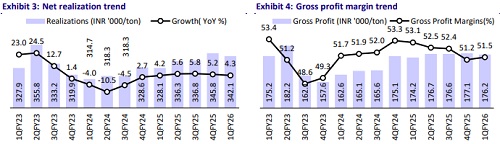

* Gross profit margin was impacted by a lower share of exports (India mix now at 35% of total volumes).

* EBITDA margin contracted 220bp YoY (-100bp QoQ) to 23.8% (below our estimate of 25%). Apart from the adverse mix, margin was impacted by: 1) the impact of tariffs on sales to the US (Americas now at 17% of the mix) and 2) lower sales volumes.

* As a result, EBITDA dipped 8% YoY to INR 6.56b (vs est. 7.05b).

* There was an MTM loss of INR 1.54b in 1QFY26 (vs a gain of INR0.06b in 1QFY25), which also hurt profitability.

* Overall, PAT declined 40% YoY to INR2.87b (vs est. INR4.3b), with PAT margins contracting to 10.4% (vs 17.4% in 1QFY25).

* The Board declared an interim dividend of INR4/share, maintaining payouts despite the decline in PAT.

Highlights from the management commentary

* Europe volumes declined 20% YoY as the farm sentiment in Europe is currently weak.

* Input costs are likely to remain stable QoQ in Q2.

* The Euro-INR rate for 1Q stands at INR93.6, while the hedge rate for the remaining period is closer to the spot rate.

* Despite the benefit from currency depreciation, management has maintained its margin guidance of 24-25% for FY26, citing an uncertain demand environment. Accordingly, it has refrained from providing any volume growth guidance for FY26E.

* As part of its diversification into the PCR/TBR segments, the company plans to focus on niche premium segments, including radial. It aims to commence SOP for this project by Jun’26.

Valuation and view

BIL continues to face demand headwinds in its key global markets. Further, its foray into the PCR/TBR segments is likely to be closely monitored for: 1) the pace at which it gains material traction and 2) whether the margins and returns will be materially dilutive in the long run. While the stock has underperformed in the recent past and valuations at 29.8x FY26E and 24.2x FY27E are not too demanding, the future target multiple is likely to depend on the company’s ability to succeed in these new segments—not only by capturing market share, but by doing so without materially hurting core returns—which, in our view, remains a challenge. We have not changed our target multiple for BIL yet and continue to value it at 22x June’27E. However, this may warrant a reassessment going forward if BIL’s returns plunge due to its foray. Reiterate Neutral with a TP of INR2,510

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412