Buy Transport Corporation of India Ltd for the Target Rs.1,420 by Motilal Oswal Financial Services Ltd

Resilient amid industry headwinds

Strong multi-modal presence to drive expansion

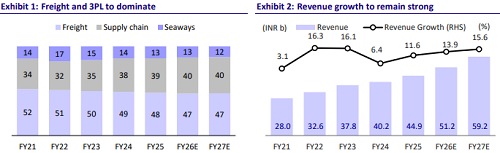

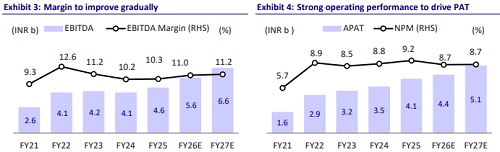

* Transport Corporation of India Ltd (TRPC) is well-positioned to benefit from structural tailwinds like the China+1 strategy, the PLI scheme, and rising infrastructure investments. Its multimodal capabilities and focus on highgrowth sectors strengthen its competitive edge. Despite macro challenges, TRPC has delivered 20 consecutive quarters of YoY growth, with all segments posting double-digit CAGRs over FY21-25—led by ~16% CAGR in the supply chain business—highlighting its strong execution and resilience.

* In FY25, TRPC delivered steady performance across its key business segments. The Freight division grew 11% YoY, overcoming challenges from weak rural demand and geopolitical tensions, supported by robust network expansion and a sharper focus on high-margin LTL services.

* The Supply Chain segment posted strong growth of 16% YoY in FY25, driven by new and expanded contracts in warehousing, quick commerce, and automotive logistics, with stable margins despite cost pressures.

* In the Seaways division, while cargo volumes remained flat, higher freight rates led to 12% YoY revenue increase in FY25, aided by stable fuel prices.

* Further, the company’s 49% JV, Transystem Logistics International Private Limited (TLI), also delivered a healthy performance, recording revenue of ~INR11.9b in FY25 (+46% YoY).

* TRPC's revenue is set to grow steadily, driven by increasing LTL share in freight, customized solutions, expansion in new-age sectors, and fleet addition in the seaway segment. We expect TRPC to post a 15% revenue CAGR over FY25-27, led by continued growth in the supply chain division, a rising proportion of LTL shipments within the freight division, and a presence across the multi-modal logistics value chain (including a JV with Container Corporation for rail transportation). We reiterate our BUY rating with a revised TP of INR1,420 (based on 21x FY27 EPS).

Freight business: Recovery ahead post soft patch

* In FY25, the Freight division grew 11% YoY, overcoming challenges from weak rural demand and geopolitical tensions, supported by robust network expansion and a sharper focus on high-margin LTL services.

* The long-term strategy remains robust, anchored by an increased focus on high-margin LTL services (targeting 40% mix by FY26 vs. 36% in FY25), deeper penetration through 90+ new branches, and a strategic shift away from the unorganized sector.

* Management expects this segment to clock 8-10% growth in FY26, with improving operating leverage and digital integration aiding profitability.

Supply chain business: Key growth engine

* The supply chain division continues to outperform, growing at a ~16% CAGR during FY21-25 and maintaining a 16% YoY growth in FY25 despite sectoral variances.

* Warehousing and automotive logistics remain key drivers, supported by a strong 15m sq. ft. warehousing base, 5,500+ customized vehicles, and robust demand from fast-growing segments like quick commerce and tractor logistics. FY25 saw the addition of 1m sq. ft. and servicing of 85 dark stores.

* TRPC expects this segment to grow at 12-15% in FY26.

Seaways business: Margins remain robust amid volume volatility

* Seaways posted 12% YoY growth in FY25, supported by higher freight rates despite flat cargo volumes. EBIT margins expanded ~720bp YoY to 32.3% in FY25, reflecting operational efficiencies and favorable realizations.

* Three dry-dockings are scheduled for FY26, which may impact capacity in the short term. However, long-term growth is secured through the planned addition of three ships (two new, one second-hand), targeting a 50% capacity expansion with sustained 30% EBITDA margins.

Valuation and view

* TRPC stands out as the only domestic logistics player offering road, rail, and sea services, backed by strong infrastructure, customer ties, and experienced management, positioning it as a preferred 3PL partner.

* We expect TRPC to post a 15% revenue CAGR over FY25-27, led by continued growth in the supply chain division, a rising proportion of LTL shipments within the freight division, and a presence across the multi-modal logistics value chain (including a JV with Container Corporation for rail transportation). We reiterate our BUY rating with a revised TP of INR1,420 (based on 21x FY27 EPS).

.

.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412