Buy Bharat Electronics Ltd for the Target Rs. 410 by Motilal Oswal Financial Services Ltd

Consistent performer

BEL reported strong results for the quarter as well as for the full year, with stable margin improvements. The order inflow for FY25 was a bit weaker than the company’s initial guidance, but the order prospect pipeline for BEL stands strong for the next two years. Company is rightly positioned to benefit from the expected upcoming emergency procurement list and to cater to wider defense electronics components across the army, navy and air force for the next few years. We expect its margin performance to remain strong, driven by increased indigenization as well as continued R&D spend over years. We raise our estimates by 7%/8% for FY26/FY27 on a better-than-expected margin profile and slightly lower other income. The stock is currently trading at 43.5x/35.7x P/E on FY26/27E earnings. We arrive at a revised TP of INR410 based on 40x Mar’27E earnings and maintain BUY on BEL. We increase our valuation multiple to 40x from 36x earlier on its strong prospect pipeline.

Results were much ahead of our expectation

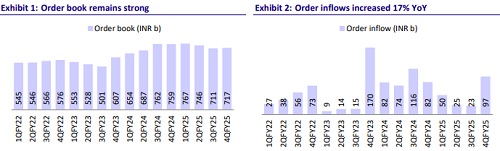

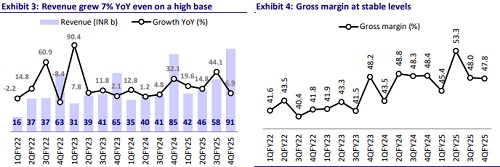

BEL results came in ahead of our estimates on EBITDA and PAT level. 4QFY25 revenue grew 7% YoY and was broadly in line with our estimate of INR88.8b. Revenue growth was driven by a strong order book of INR717b and an inflow of ~INR194b during FY25 vs. target of INR250b. EBITDA grew 22% YoY to INR28b, beating our estimate by 35%, while EBITDA margin expanded 390bp YoY to 30.6% vs. our estimate of 23.3% mainly due to lower-than-expected other expenses. Gross margin was ahead of our estimates at 47.8% in 4QFY25 vs. our estimate of 45.5%. Margin performance is dependent upon the project mix during the quarter. Strong margin performance resulted in a 27%/23% beat to our PBT/PAT estimates. PAT stood at INR21.0b, up 18.0% YoY vs. our estimate of INR17.1b. For FY25, revenue/EBITDA/PAT grew 17%/35%/32% to INR237b/INR68b/INR53b. OCF for FY25 stood at INR4.8b, a significant decrease compared to last year. This was due to a significant increase in net working capital led by higher inventory and receivables and lower customer advances. Lower OCF and higher capex led to FCF outflow of INR5.2b for the year.

Promising order inflow pipeline from emergency procurement and other long-term projects

BEL has an order book of INR717b and received inflows worth INR194b during FY25. Company is rightly positioned to benefit from the expected upcoming emergency procurement list, which will be finalized over the next 7-10 days. BEL is also eyeing inflows from various projects over the next two years, such as 1) QRSAM worth INR300b where BEL is the lead integrator and the project can be finalized by 4QFY26/1QFY27, 2) orders worth INR270b spread across nextgeneration corvettes from naval shipyards (worth INR60-100b), electronic warfare, electronic orders from Tejas Mk1A LCA, Atulya radar, ground-based electronic warfare systems, air defense fire control radar, etc. Along with this, the company is constantly eyeing opportunities from exports, particularly from Europe rearmament across platforms. In FY26, BEL expects an order inflow of INR270b and revenue growth of 15%.

EBITDA margin profile to stay strong on order book mix and indigenization

BEL’s EBITDA margin stood strong at 28.6% in FY25, led by improved gross margin and lower other expenses as provisions were lower. EBITDA margin has consistently improved for the last three years, from 21.6% in FY22 to 28.6% in FY25. This was driven by increased indigenization and continued R&D investments done by the company to indigenize production. Company has given EBITDA margin guidance of 27% for FY26 and it aims to constantly improve this going forward. BEL has judiciously maintained a right mix of orders across components and system integration-led orders, where components have higher margins and system integration orders have provided good revenue support. We expect this mix to be maintained over the next two years.

Looking to expand exports

Company is targeting export revenue of USD120m in FY26. The company is evaluating opportunities in various countries, including Europe. Europe rearmament has a lot of demand coming in for fuses, ammunition, contract manufacturing for aerospace and defense. BEL already has a presence in these components and is working on a plan to target these opportunities.

BEL is working across varied platforms

* QRSAM: BEL is working on a QRSAM project as the lead integrator, and this project is for both the Indian Army and Indian Air Force with a project size of INR300b. This project is expected to be awarded by 4QFY26/1QFY27.

* Next-generation corvette: For an NGC project, the company is eying 10-12 subsystems related orders from naval shipyards cumulatively worth INR60-100b, which can be finalized over FY26/27.

* Project Kusha: Project Kusha is for indigenous production of S400 missiles. This is being driven by DRDO, and BEL will be the development partner in this project. This project is worth INR400b and may be split into 1-2 lead integrators, with BEL being the preferred integrator, as major sub-systems, control systems, radar will be done by BEL. This project is still in R&D phase and the prototype will be there by 1-1.5 years. After that, trials for these system will take around 12-24 months.

* Brahmos missile: BEL is involved in two sub-systems for Brahmos missile. It is changing its scope of contribution in Brahmos, so the company is in constant discussions with Brahmos and working on designs for next-gen systems.

* Software-defined radios: BEL is already working with the Navy for replacing older radios with software-defined radios. It is also eyeing orders worth INR10b from army for the replacement of 40k-50k radios. While there will be competition in this space, BEL will be the nominated player for DRDO-led projects.

* Counter drone systems: BEL won recent orders from the army and BSF. It also expects repeat orders for counter-drone systems. The company has capabilities for both – soft kill as well as hard kill. It costs nearly INR150-200m for this type of anti-drone products.

Financial outlook

We raise our estimates by 7%/8% for FY26/27. We increase our order inflow estimates as we factor in large-sized order inflows from QRSAM and next-generation corvettes to materialize between FY26 and FY27. We also bake in a longer gestation period for these orders and expect a CAGR of 17%/16%/19% in sales/EBITDA/PAT over FY25-27. We expect OCF/FCF to remain strong over FY25-27, led by control over working capital. Further, the company had a cash surplus of INR94b as of FY25, providing scope for further capacity expansion.

Key risks and concerns

A slowdown in order inflows from the defense and non-defense segments, intensified competition, further delays in the finalization of large tenders, a sharp rise in commodity prices, and delays in payments from the MoD can adversely impact our estimates on revenue, margins, and cash flows.

Valuation and view

BEL is currently trading at 43.5x/35.7x on FY26E/FY27E EPS. We increase our estimates on a better-than-expected margin profile and slightly lower other income. We revise our TP to INR410 on 40x Mar’27E. We increase our valuation multiple to 40x from 36x earlier on a strong prospect pipeline for BEL. Reiterate BUY rating

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412