Buy Transport Corporation of India Ltd for the Target Rs. 1,500 by Motilal Oswal Financial Services Ltd

In-line performance; outlook remains bright

* Transport Corporation of India’s (TRPC) revenue grew 7.5% YoY to ~INR12b in 2QFY26 (in line). Revenue growth experienced a slowdown across segments despite the company witnessing strong demand across auto, FMCG, and consumer durables.

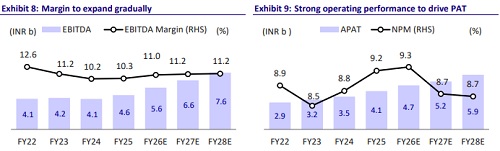

* EBITDA margin came in at 10.5% in 2QFY26 (+10 bp YoY and -10 QoQ), against our estimate of 10.9%.EBITDA grew 8.2% YoY to INR1.26b (6% below our estimate), while APAT grew 5.8% YoY to ~INR1.12b (in line).

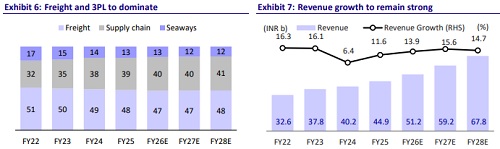

* Supply Chain revenue grew ~12% YoY, while the Freight and Seaways divisions reported ~7% and 2% YoY growth, respectively. EBIT margin for Freight/Supply Chain/Seaways divisions stood at 2.3%/5.6%/37.5%, respectively, in 2QFY26. EBIT margin contracted 40bp and 30bp YoY for the Freight and Supply Chain businesses, respectively, while it expanded 630bp on a YoY basis for the Seaways business.

* In 1HFY26, revenue grew 8%, whereas EBITDA and PAT grew 12% and 11%, respectively.

* TRPC delivered muted operational performance in 2QFY26. Supply Chain growth slowed down, while the Seaways division benefited from favorable market conditions. The Freight segment’s growth was weak amid sectoral weakness, partially offset by festive season restocking. We expect growth to be driven by higher margins in the Freight business, supported by an increased LTL mix, expansion of the supply chain and cold chain networks, favorable margins in the Seaways division, and greater adoption of multimodal logistics through new ships and rakes. We retain our estimates and reiterate our BUY rating with a TP of INR1,500 (based on 20x FY28E EPS).

Supply Chain’s growth slows down, while Seaways’ margin remains elevated and Freight remains flattish

* Freight Division: It reported ~7% YoY revenue growth, impacted by weakness in the infrastructure and capital goods sectors, though partly supported by festive season restocking. EBIT margin came in at 2.3%, declining 40bp YoY.

* Supply Chain Solutions (SCS): Revenue growth slowed to ~12% YoY despite the onboarding of new contracts and expansion in scope with existing customers. EBIT margin stood at 5.6%, contracting 30bp YoY. SCS has emerged as the largest business segment and is expected to remain the key growth driver for the company.

* Seaways Division: Revenue grew just ~2% YoY, aided by favorable freight rates and lower fuel costs. EBIT margin expanded significantly by ~630bp YoY to 37.5%, driven by operational leverage and lower depreciation as most vessels are depreciated.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

Ltd.jpg)