Neutral Exide Ltd for the Target Rs. 368 by Motilal Oswal Financial Services Ltd

Rising input costs drive margin pressure

Lithium-ion trial production to start in CY25; all eyes on firm order wins

* Exide's 4QFY25 performance was in line with our estimates, with PAT declining 10% YoY to INR2.5b. Margin contracted 170bp YoY to 11.2% due to the rise in input costs and write-offs taken in the quarter. Exide has implemented price hikes to offset the recent cost increase.

* We have maintained our estimates. Given the significant imminent risk to its core business, Exide has forayed into the manufacturing of lithium-ion cells in partnership with S-Volt, with a total investment of INR60b across two phases. While the market appears to be upbeat on Exide’s lithium-ion foray, we remain cautious of the returns from the same. Hence, we reiterate our Neutral rating on the stock with a revised TP of INR368 (based on 20x FY27E EPS).

Margin impacted by higher input costs and write-offs

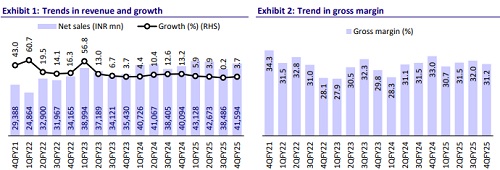

* Exide’s Q4FY25 revenue grew 4% YoY to INR41.6b, in line with our estimate.

* Nearly 75% of its business—comprising the mobility aftermarket segment, solar, and I-UPS—posted double-digit growth. However, the remaining 25%—including auto OEMs (especially PVs), telecom, and home inverters— saw a decline.

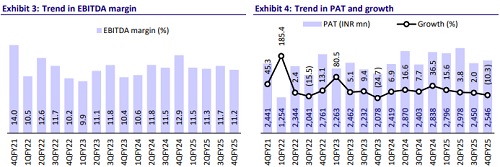

* EBITDA margin contracted 170bp YoY to 11.2%. Q4 margins were impacted by: 1) a sharp rise in input costs (impact of INR500m) and 2) write-off taken on certain non-moving assets in the quarter (INR250m).

* As a result, EBITDA declined 10% YoY to INR4.7b, in line with our estimates.

* Overall, PAT declined 10% YoY to INR2.5b and was in line with our estimates.

* For FY25, revenue grew 4% YoY to INR166b. About 75% of its business posted more than 10% growth. However, the remaining 30% witnessed a 9% decline in FY25.

* Margins contracted 30bp YoY to 11.4% due to the rise in input costs and an adverse mix.

* Overall, PAT grew 2% YoY to INR10.8b in FY25.

* FCF for FY25 stood at INR8.7b following a capex of INR4.2b.

Highlights from the management commentary

* For Q4, management indicated that almost 75% of its business—comprising the mobility aftermarket segment, solar, and I-UPS—posted double-digit growth. However, the remaining 25%—including auto OEMs (especially PVs), telecom, and home inverters—saw a decline. Additionally, exports demand remained weak, primarily due to weakness in Industrial demand in Europe, led by ongoing slowdown in the region.

* Exide implemented three price hikes over the past four months to pass on the rising cost impact

* The shift to punch grid batteries in motorcycles, along with investments in the continuous casting process, is expected to reduce costs and improve product quality.

* Exide has so far invested INR36b in the first phase of setting up a 6 GWh plant for its lithium-ion business. It is likely to be the first player to commence trial production of this plant in India in CY25. The company continues to be in advanced discussions for potential orders with several OEMs across segments. While the company is not concerned about plant utilization given the significant growth potential, it has refrained from setting specific targets for the project, with its immediate priority being to stabilize operations as quickly as possible.

Valuation and view

* We have maintained our estimates. Given the significant imminent risk to its core business, Exide has forayed into the manufacturing of lithium-ion cells in partnership with S-Volt, with a total investment of INR60b across two phases. While the market appears to be upbeat on Exide’s lithium-ion foray, we remain cautious of the returns from the same. Besides, the stock at ~25.8x/23.7x FY26/27E EPS appears fairly-valued. Hence, we reiterate our Neutral rating on the stock with a revised TP of INR368 (based on 20x FY27E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412