Buy Castrol Ltd for the Target Rs. 250 by Motilal Oswal Financial Services Ltd

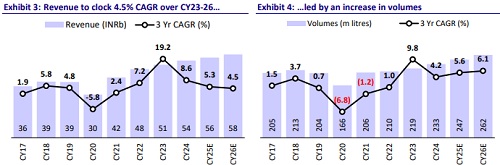

Volume growth outlook remains stable

* Castrol (CSTRL) 1QCY25 results were in line with our estimates. EBITDA margin contracted 55bp YoY/615bp QoQ due to a rise in other expenses. 1Q volumes stood in line with our estimate at 62m liters.

* Management highlighted that it remains focused on brand building, widening the distribution network, and launching new products, all of which we believe will drive volume growth and market share expansion.

* Management maintains a bullish outlook on India as a market and expects robust demand for lubricants to remain stable until late CY30s and early CY40s, largely attributed to low penetration of cars in the country. While the threat from electric vehicles (EVs) is real, the EV adoption is expected to be gradual.

* Key takeaways from the 1QCY25 earnings call:

* Key takeaways from the 1QCY25 earnings call:

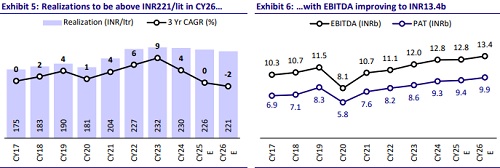

* CSTRL maintained its guidance of growing higher than the industry’s average growth rate of 4-5% and guided for 22-25% EBITDA margin for CY25. We estimate ~23% EBITDA margin in both CY25 and CY26.

* Net landed prices for base oil would be range-bound for the next 2-3 quarters. Management does not foresee any major benefits of soft crude oil prices. However, forex fluctuation headwinds prevail.

* All parts of automotive segment grew strongly in 1Q. CVs/PVs in double digits and 2W in high-single digits. Industrial segment volume grew in single digits.

* Auto care is already an INR20b+ market in India. These products are marginaccretive.

* CSTRL has always enjoyed a strong brand legacy, and we are confident in its ability to maintain profitability through an improved product mix, stringent cost-control measures, and the launch of advanced products that command better realization. We reiterate our BUY rating with a TP of INR250.

Earnings in line; EBITDA margin contracts QoQ

* 1QCY25 revenue came in at ~INR14.2b, in line with our est.

* EBITDA was also in line with our est. at INR3b (up 5% YoY).

* EBITDA margin contracted 55bp YoY/615bp QoQ due to a rise in other expenses.

* Gross margin dipped 423bp QoQ but remained flat YoY.

* PAT was in line at INR2.3b.

* Other key highlights:

* The relaunch of Castrol Activ, supported by a high-visibility campaign featuring Shah Rukh Khan, boosted volume growth. Additionally, the new range of rust-prevention products (Rustilo DW 800, 806, 809, 812) is gaining traction in the tube industry.

* The company secured a supply agreement with Triumph for their fully synthetic Castrol POWER1 two-wheeler engine oil.

* CSTRL has expanded its network nationwide to ~148,000 outlets.

* Industrial product visibility improved along with a rise in new customer acquisitions; CMS services added a major gearbox manufacturer in 1Q, and IMTEX 2025 generated business leads.

Valuation and view

* Our EBITDA margin assumptions are already within the company’s guided range of 22-25%.

* We value the stock at 25x P/E (average: 21.9x and mean + 1 S.D.: 28.6x) and arrive at our TP of INR250. We reiterate our BUY rating.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

Ltd.jpg)