Add Exide Industries Ltd For Target Rs. 408 By Yes Securities Ltd

Maintain ADD; LIB ramp-up a key ahead

Valuation and View – Margin trajectory likely to be range bound

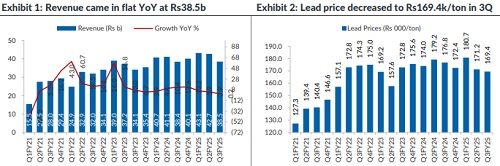

EXID’s 3QFY25 results were weak with EBITDA/Adj.PAT miss of 11-20% to our and consensus. This was led by lower-than-expected revenues which remained flat YoY (-10% QoQ) while gross margins at 32% were in-line (+50bp each YoY/QoQ), primarily led favorable product mix, benign RM. Further, lead prices have declined by ~5.6%/4% in 2Q/3QFY25 YoY at Rs169.4/kg, which should fully reflect from 4QFY25E. Co indicated double digit revenue growth in 2W/PV replacement while excess channel inventory impacted Auto OEM vertical. Within industrial, Solar saw double digit growth while industrial infra remained soft due to slow government spending. Exports remained healthy.

Over the mid-long term, EXID’s speedy ramp-up of lithium-ion battery (LIB) cell manufacturing and new order wins (in addition to MOU signed with Hyundai group), would be closely watched as the plant is expected to see production ramp-up over FY26E. While EXID’s LAB business is expected to grow 7-8% CAGR over 3-5 years, the recent valuation correction do factor in concerns around utilization of LIB vertical given competition stepup. Consequently, despite sharp recent valuations correction, we maintain the stock to ADD as it trades at 21.2x/19.5x FY26/27 S/A EPS (v/s 10-year LPA of ~20x). We cut FY26/27 EPS by ~6.5%/7% to factor in for weak revenues and slow OEM sales. We build revenue/EBITDA/Adj.PAT CAGR of ~7%/8%/12% over FY24-27E. We value EXID at Rs408/share as we value LAB at Rs312 (16x Mar-27 EPS + 50% holdco discount to HDFC Life stake at Rs31) and value of LIB business at Rs96/share.

Result Highlight – Weak revenues dented profitability

* S/A revenues were flat YoY (-9.8% QoQ) at ~Rs38.5b (est Rs43b, cons ~Rs41.7). Co indicated double digit revenue growth in 2W/PV replacement while excess channel inventory impacted Auto OEM volumes. Within industrial, Solar saw double digit growth while industrial infra remained soft due to slow govt. spending. Exports remained healthy.

* Gross margins expanded 50bp YoY (+50bp QoQ) at 32% (est 31.9%). This should be largely led by favorable product mix as well as benign lead prices which declined QoQ by average 5.6% (-5% YoY) to Rs170.6/kg in 2QFY25 and further declined by ~4% YoY in 3Q at Rs164.1/kg. This was partially offset by +13.5% YoY growth in other exp at Rs5.2b. Consequently, EBITDA grew ~2% YoY (-7.2% QoQ) at ~Rs4.5b (est ~Rs5.4b, cons Rs5b) with margins expanded 20bp YoY (+30bp QoQ) at 11.7% (est 12.5%, cons 12.1%). Weak operating performance restricted Adj.PAT growth at ~2% YoY (-17.7% QoQ) at Rs2.45b (est Rs3.1b, cons Rs2.8b).

* Key highlights from PR - Li-ion project – Co invested further Rs4b in 3Q and ~Rs1b in Jan’25, as equity in EESL with overall investments now stands at ~Rs33b. Customer onboarding across auto and non-auto segment underway.

Please refer disclaimer at https://yesinvest.in/privacy_policy_disclaimers

SEBI Registration number is INZ000185632