Neutral Exide Ltd For Target Rs.360 by Motilal Oswal Financial Services Ltd

Weak demand drags quarterly performance

OE and industrials demand weak; replacement/exports better off

* Exide (EXID)'s 3QFY25 performance was disappointing, primarily driven by subdued demand in the Auto OE segment and a decline in industrial infrastructure activity. Despite the challenges, the company benefited from lower lead prices, which supported a sequential margin expansion of 40bp QoQ to 11.7%, slightly surpassing our estimate of 11.5%

* To factor in the weakness in the above-mentioned categories, we cut our FY25E/26E EPS by 5%/13%. Moreover, while the market appears to be upbeat on EXID’s lithium-ion foray, we remain cautious of the returns from the same in the long run. The stock at ~24x/22x FY26/27E EPS appears fairly valued. Reiterate Neutral with a TP of INR360 (based on 20x Dec’26E EPS).

Commodity benefits aid margin expansion

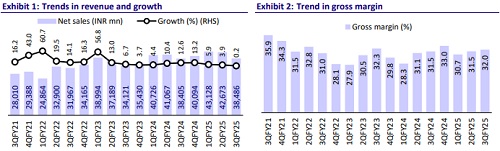

* EXID’s 3QFY25 standalone revenue growth was flattish YoY at INR38.5b (est. INR43b), while EBITDA/Adj. PAT grew ~2% YoY each at INR4.5b/2.5b (est. INR4.9b/2.8b). 9MFY25 revenue/EBITDA/PAT grew 3%/5%/7% YoY.

* The 2W and 4W replacement segments posted double-digit growth, supported by strong demand in the Automotive aftermarket. Solar revenue also grew robustly, driven by govt. incentives and solarization programs.

* However, muted demand from Automotive OEMs and subdued industrial infrastructure performance impacted overall growth. Automotive exports continued strong growth, fueled by export-focused strategies.

* Gross margin expanded 50bp YoY/QoQ to 32% (est. 31%), led by a decline in lead prices.

* However, higher other operating expenses hurt EBITDA, which grew by just 2% YoY. EBITDA margin expanded 20bp YoY/40bp QoQ to 11.7% (est. 11.5).

* Weak operating performance & lower other income led to a miss on adj. PAT.

* During the quarter, EXID invested nearly INR4b as equity in its wholly owned subsidiary, Exide Energy Solutions (EESL), with an additional INR1.5b invested in Jan’25. This brings the total equity investment in EESL to INR33.02b, including investments in the erstwhile merged subsidiary EEPL.

From the Press Release

* Overall sales were flat during the quarter due to a slowdown in government capex and macroeconomic factors, but the auto replacement and export segments showed promising growth.

* The near-term outlook remains positive, supported by buoyant replacement markets and expectations of a rebound in government and private capex, which could boost industrial demand.

* With stable commodity prices and a diversified product portfolio complemented by strong brand recall, the company is well-positioned to capture growth across sectors and deliver robust performance.

* Construction for the lithium-ion cell manufacturing project is progressing rapidly, with the team focused on timely completion. Commercial operations are targeted to begin in FY26.

Valuation and view

* We cut our EPS estimates by 5%/13% over FY25/FY26 to factor in slower-thanexpected demand pick-up in key segments, including Auto OEM and Industrial.

* Given the significant imminent risk to its core business, Exide has forayed into the manufacturing of lithium-ion cells in partnership with S-Volt at a total investment of INR60b in two phases. While the market appears to be upbeat on EXID’s lithium-ion foray, we remain cautious of the returns from the same. We, hence, reiterate our Neutral rating on the stock with a revised TP of INR360 (based on 20x Dec-26E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412