Sell India Cements Ltd For Target Rs. 240 by Motilal Oswal Financial Services Ltd

Strong volume growth; profitability targets set for FY26-28

* India Cements (ICEM), following the recent change in management (the first quarter after UTCEM took control), has reported an improved performance in 4QFY25. It has reported an EBITDA of INR5m (vs. an estimate of an operating loss of INR1.2b) in 4QFY25. Sales volume grew ~8% YoY to 2.6mt (~12 above our est.). Net loss stood at INR736m (estimated loss of INR1.1b) vs. a loss of INR435m in 4QFY25.

* The company’s capacity utilization stood at ~73% in 4QFY25 vs. ~61%/59% in 4QFY24/3QFY25. ICEM achieved an EBITDA break-even in the first quarter after the takeover. UTCEM’s management has indicated that with the price improvement in the south region in Apr’25, ICEM’s performance will further improve. It aims to achieve an EBITDA/t of INR500/INR700/INR1,000+ by FY26E/FY27E/FY28E.

* We broadly retain our EBITDA estimates for FY26/FY27. We value ICEM at an EV/t of USD70 to arrive at our TP of INR240. Maintain Sell.

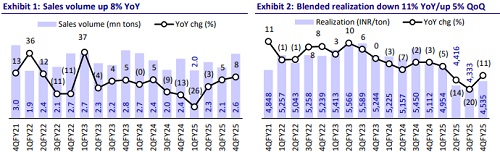

Volume up ~8% YoY, realization down 11% YoY (up 5% QoQ)

* ICEM’s revenue declined ~4% YoY to INR12.0b in 4QFY25 (~18% beat). Sales volume increased ~8% YoY (up ~27% QoQ; +12% vs. est.) to 2.6mt. Blended realization/t declined ~11% YoY to INR4,535 (up 5% QoQ; +6% vs. estimate).

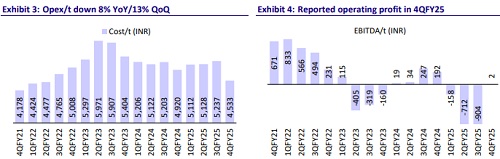

* Variable cost/other expenses/freight cost per ton declined 6%/8%/11% YoY. Employee cost declined 16% YoY. Opex/t declined ~8% YoY to INR4,533 (~6% below our estimate). Finance costs declined ~25% YoY. It reported a net loss of INR736m vs. a net loss of INR435m in 4QFY24.

* In FY25, ICEM’s revenue declined ~17% YoY to INR40.9b. Operating loss stood at INR3.8b vs. EBITDA of INR1.1b in FY24. Net loss stood at INR7.4b vs. a net loss of INR2.3b in FY24. Volume/realization declined 5%/13% YoY. OCF stood at INR602m vs. INR3.1b in FY24. The sale of assets stood at INR4.5b vs. capex of INR893m in FY24. FCF stood at INR5.1b vs. INR2.2b in FY24.

Highlights from UTCEM’s management commentary

* Sales volume stood at 2.64mt and ICEM achieved 1mt+ in volume in Mar’25. After achieving an operating profit in 4QFY25, the target is to achieve an EBITDA/t of INR500/INR700/INR1,000+ by FY26W/FY27E/FY28E. Improvement in capacity utilization, logistics costs, overhead optimization, and cement prices would lead to profitability improvement for the company.

* Capex planned for ICEM is INR15b, out of which INR10b will be for WHRS (21.8MW) and efficiency improvement in FY26E/27E. The payback period for this capex will be three years, and benefits would start accruing from 4QFY27. Brownfield opportunities for expansion have been identified for ICEM, and the timing will be decided based on market demand.

* UTCEM will enter into tolling arrangements with the company first and then rebrand its products to UTCEM by FY27-end. However, UTCEM’s holding in the company needs to be brought down to 75% to meet the regulatory requirements.

Valuation and view

* ICEM’s operating performance has improved sequentially, led by strong volume growth, improvement in realization, and cost structure. It has shown improvement in working capital led by a reduction in loans and advances given to related parties and others. The company’s net debt declined to INR10.8b in FY25 (net debt stood at INR8.9b as of Dec’24) from INR25.9b in FY24. The company utilized proceeds from the sale of fixed assets, divestment in a few associate companies, and recoveries from loans and advances to repay debt.

* We estimate the company’s revenue CAGR at ~12% over FY25-27, fueled by a volume/realization CAGR of ~7%/5%. We estimate ICEM to achieve an EBITDA/t of INR310/520 in FY26/27. We value ICEM at an EV/t of USD70 to arrive at our TP of INR240. Maintain Sell.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412