Buy JSW Infrastructure Ltd For Target Rs. 380 by Motilal Oswal Financial Services Ltd

Ports and logistics expansion plans to fuel sustainable growth

* JSWINFRA has reaffirmed that port capacity expansion remains a key priority, with a goal to achieve 400mtpa by FY30. With expansions at JNPA, Tuticorin, Mangalore, and TNT ports, its port capacity has increased to 174mtpa now from 170mtpa in Sep’24.

* Further, the company has an aggressive roadmap to build its logistics infrastructure and network under JSW Ports Logistics with a capex of INR90b by FY30. This investment is expected to generate revenue of INR80b and EBITDA of INR20b.

* With a focus on expanding capacity, improving the third-party mix in overall cargo, and improving utilization levels at existing ports and terminals, we expect its volume growth trajectory to remain intact. JSWINFRA expects to end FY25 with 10% volume growth.

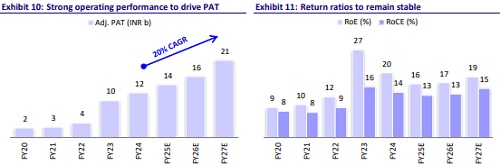

* Considering stable growth levers at its existing ports and terminals, a higher share of third-party customers, steady cargo volumes from JSW Group companies, and an expanding portfolio, we expect JSWINFRA to strengthen its market dominance, leading to a 14% volume CAGR over FY24-27E. This should drive a 22% CAGR in revenue and a 21% CAGR in EBITDA over the same period. We reiterate our BUY rating with a TP of INR380 (premised on 23x FY27 EV/EBITDA).

Updates about its 2030 expansion plan for various terminals and ports

* Port capacity expansion is a key priority, with a target to achieve 400mtpa by FY30. At JNPA (liquid terminal), the company is constructing two liquid cargo berths with a total capacity of 4.5mtpa at a capex of INR1b. Interim operations began in Nov’24, with full completion expected by 2QFY26. At Mangalore, it is expanding the container terminal capacity from 4.2mtpa to 6mtpa for a capex of INR1.5b. The project is slated to be completed by 2QFY27.

* JSWINFRA has also undertaken some greenfield projects, e.g., a) Keni Port, a 30mtpa deep-water commercial port, is under development for an estimated capex of INR41.2b, and operations are expected to commence in FY29; and b) Jatadhar Port is planned as a 30mtpa facility with a capex of INR30b, with the concession agreement expected in 3QFY25 and operations targeted for early FY28.

* Furthermore, a 302km slurry pipeline in Odisha, connecting Nuagaon to Jagatsinghpur, is under construction at a capex of INR40b. It is expected to be operational by Apr’27.

Building pan-India logistics network with focus on last-mile connectivity

* While the port expansion is on track, the company is also increasing its presence in the logistics business. The board has earmarked INR90b till FY30 for the development of logistics infrastructure, which is expected to generate revenue of INR80b and EBITDA of INR20b.

* As part of this plan, JSWINFRA has acquired a 70.37% stake in Navkar Corp. (integration completed in 3QFY25). Navkar provides comprehensive logistics services, including transportation, consolidation/de-consolidation at Panvel, storage at inland container depots (ICD), and warehousing.

A dominant port operator with multiple growth levers

* JSWINFRA has demonstrated exceptional growth, achieving a CAGR of 25% in cargo volumes over FY19-24 (11% YoY growth in cargo handled in 9MFY25 and 45% YoY growth in third-party cargo in 9MFY25), well above India’s growth rate of 5%. This surge has allowed JSWINFRA to command a 7% market share in the Indian port sector.

* In the past one year, the company has signed concession agreements, and it intends to develop five more ports/terminals in India. In addition, it operates two port terminals under the operation and maintenance agreements and one liquid storage terminal in the UAE.

* JSWINFRA has transitioned from predominantly handling captive cargo for JSW Group and related entities to handling volumes for third-party customers (48% of volumes in 9MFY25).

Valuation and view

* Leveraging its strong balance sheet, JSWINFRA aims to pursue organic and inorganic growth opportunities, strengthen its market presence, and expand its capacity to 400mmt by 2030 from 170mmt currently.

* Considering stable growth levers at its existing ports and terminals, a higher share of third-party customers, steady cargo volume from JSW Group companies, and an expanding portfolio, we expect JSWINFRA to strengthen its market dominance, leading to a 14% volume CAGR over FY24-27E. This should drive a 21% CAGR in revenue and a 23% CAGR in EBITDA over the same period. We reiterate our BUY rating with a TP of INR 380 (premised on 23x FY27 EV/EBITDA).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412