Buy Coal India Ltd For Target Rs.480 by Motilal Oswal Financial Services Ltd

In-line performance; higher e-auction premiums aid profitability

* Coal India (COAL)’s 3QFY25 revenue came in at INR358b (YoY/QoQ: -1%/ +17%), in line with our estimate of INR367b, primarily led by strong volumes (YoY/QoQ: +2%/+15%).

* Adj. EBITDA (excl. OBR costs) stood at INR104b (YoY/QoQ: -13%/+45%) in line with our est. of INR104b.

* EBITDA/t came in at INR536 (YoY/QoQ: -14%/+26%).

* APAT came in at INR85b (YoY/QoQ: -17%/+35%) against our estimate of INR84b. APAT was supported by higher-than-expected other income.

* During 9MFY25, revenue declined 2% YoY, adj. EBITDA dipped 9% YoY, and APAT declined 11% YoY.

* Production for 3QFY25 was 202mt (YoY/QoQ: +2%/+33%). The sequential spike in production was fueled by a low 2QFY25 base, which was hit by heavy monsoons. Offtake/sales stood at 194mt (YoY/QoQ: +2%/+15%).

* Blended ASP came in at INR1,667/t (-3% YoY/+3% QoQ) for the quarter.

* It reported an FSA revenue of INR259b (YoY/QoQ: -2%/+19%) with volumes of 171mt (YoY/QoQ: -1%/+15%) and ASP of INR1,514/t (YoY/QoQ:-1%/+4%).

* The e-auction revenue was INR51b (YoY/QoQ: -2% / +38%), and volume stood at 19mt. The realization came in at INR2,671/t translating to a 76% premium.

* The Board declared an interim dividend of INR5.60 per share, totaling INR21.35 per share as of 9MFY25.

Valuation and view

* COAL’s 3QFY25 witnessed a decent improvement following the drag seen in 2QFY25 (which was affected by extended monsoon). The e-auction volumes also remained elevated with some increase in e-auction premiums, which supported profitability.

* For FY26/FY27, we maintain our estimates and expect volumes to improve, which would boost earnings performance. The e-auction premium is expected to remain stable ahead.

* The company’s focus on increasing coal-washer capacity will improve its market share in domestic coking/non-coking coal. Further, management is focusing on coalmine expansions, which would be funded via internal accruals, or COAL might borrow to undertake certain strategic diversification projects, such as RE facilities and coal gasification, et al.

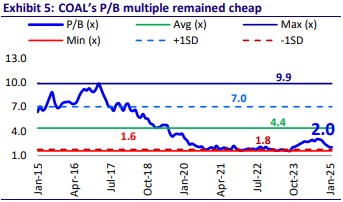

* At CMP, the stock is trading at 3.3x FY27E EV/EBITDA. We reiterate our BUY rating with a TP of INR480 (premised on 4.5x on FY27 EV/EBITDA).

* COAL remains our top pick in the metals and mining sector.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412