Buy Devyani International Ltd for the Target Rs. 180 by Motilal Oswal Financial Services Ltd

Recovery awaited; pressure on margins

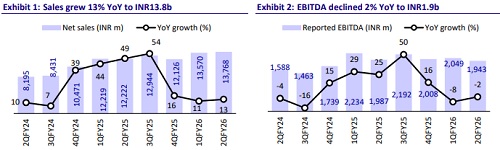

* Devyani International’s (DEVYANI) consolidated revenue grew 13% YoY in 2QFY26. The India revenue was up 12% YoY, led by the Skygate acquisition and 16% YoY store expansion. Organic India's revenue growth was ~5%. Demand was impacted due to both Shraavana and Navaratri occurring in the same quarter, coupled with unseasonal rains, particularly in the eastern region during the latter half of September. The company has not seen a material demand uptick in Oct’25 as well.

* KFC’s revenue grew 5% YoY, aided by 14% store expansion, though offset by a 4.2% decline in same-store sales (-3% for Sapphire). Pizza Hut (PH)’s revenue rose 1% YoY, with 5% new store additions, while SSSG declined 4.1% YoY (-8% for Sapphire). Costa Coffee’s revenue grew 5% YoY, with 8% YoY store additions.

* India ROM dipped 15% YoY to INR0.9b, and the margin contracted 320bp YoY to 10%, an all-time low, owing to operating deleverage. KFC’s ROM contracted 250bp YoY to 14.1% (13.8% for Sapphire), and PH’s ROM contracted 340bp YoY and turned negative at -0.2% (-1.8% for Sapphire).

* International revenue grew 14% YoY to INR4.5b with RoM at INR749m (vs. INR632m in 2QFY25), and margin expanded 70bp YoY to 16.7%.

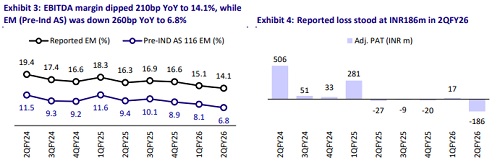

* Consolidated GP margin contracted 160bp YoY and 40bp QoQ to 67.8% (est. 69%). The Sky Gate portfolio impacted the GM by 50bp. EBITDA (Pre-IndAS) margin was down 260bp YoY/130bp QoQ to 6.8%. Consol. RoM margin contracted 190bp YoY and 140bp QoQ to 11.7%. Skygate impacted the consolidated RoM by 70bp.

* The growth weakness with continuous contraction in store profitability is a big concern for QSR players. KFC ADS has dipped ~25% over the last three years, and ROM contracted by ~750bp. DEVYANI is focusing on innovation, customer engagement, and value offerings to drive recovery. Although management commentary for recovery was muted, we will track whether overall consumption drivers help in recovering dine-in demand.

* We reiterate our BUY rating and value the India business at 35x EV/EBITDA (pre-IND-AS) and the international business at 20x EV/EBITDA (pre-IND-AS) on Sep’27E to arrive at our TP of INR180.

Weak performance; margin pressure sustains

* Muted underlying growth metrics: Consolidated sales grew 13% YoY to INR13.8b (est. INR 13.1b). The India revenue was up by 12% YoY to INR9.4b (est. INR8.8b), supported by the acquisition of Sky Gate. KFC’s sales grew 5% YoY to INR5.7b. Its SSSG declined 4.2% (est. -2.5%). PH sales grew 1% YoY to INR1.9b. SSSG declined 4.1% (est. -3%). ADS of KFC was down 7% YoY at INR89k, and PH ADS dipped 6% YoY to INR33k. Costa Coffee’s revenue rose 5% YoY, while ADS was down 11% YoY at INR24k.

* Store expansion: It added a total of 39 stores in 2QFY26 to reach 2,184 stores. The store additions in KFC/PH/CC/own brands/International are 30/3/2/0/4, taking the total store count for KFC/PH/CC/own brands/International to 734/ 621/224/223/382.

* Pressure on margins continues: Gross profit grew by 10% YoY to INR9.3b (est. INR9.1b) while margins contracted by 160bp YoY and 40bp QoQ to 67.8 (est. 69%). Consol. EBITDA margins contracted 210bp YoY and 100bp QoQ to 14.1% (est. 15%). Consol. ROM decreased 3% YoY to INR1.6b, and the margin contracted 190bp YoY and 140bp QoQ to 11.7%. The Pre-Ind-AS EBITDA declined 18% YoY to INR0.9b, while the margin dipped 260bp YoY/130bp QoQ to 6.8%.

* International revenue grew 14% YoY to INR4.5b with RoM at INR749m (vs. INR632m in 2QFY25), and margin expanded 70bp YoY to 16.7%.

* Reported EBITDA declined 2% YoY to INR1.9b (est. INR2.0b). Loss before tax stood at INR297m vs. a loss of INR9m in 2QFY25.

Highlights from the management commentary

* The out-of-home consumption was impacted due to both Shraavana and Navaratri falling in the same quarter, as well as unseasonal rains – especially in eastern parts of the country during the second half of September. The demand environment continues to remain weak. Oct’25 has seen no material uptick in demand.

* Lower gross margin and increased aggregator and delivery expenses due to higher saliency of off-premise sales in KFC led to overall lower brand contribution in India.

* KFC in India added 30 net new stores in 2QFY26, taking the total store count for KFC in India to 734 stores, and the company is on track to open ~100-110 new KFC stores in FY26.

* Biryani By Kilo and Goila Butter Chicken from the Skygate portfolio continue to do well, and Devyani has seen strong momentum in the business after Dussehra. BBK stores have been tested in Mumbai and Pune airport locations, and the brand has seen good traction.

Valuation and view

* Given DEVYANI’s weak performance, we cut our EBITDA by 4-6% for FY26E and FY27E. ? Management remains committed to improving ADS and profitability across the existing network across brands and will adopt a more cautious approach to future store openings for PH.

* DEVYANI is focusing on innovation, customer engagement, and value offerings to drive recovery. ADS and SSSG recoveries remain the key monitorables, as they are vital for improving unit economics. DEVYANI is in talks with Yum for PH turnaround and is expected to execute the initiatives in the coming months. This will be a positive trigger for the company. The stock price has been flat for the last three years due to growth challenges, and we believe most of the risks are largely priced in now.

* We reiterate our BUY rating and value India business at 35x EV/EBITDA (PreIND-AS) and international business at 20x EV/EBITDA (pre-IND-AS) on Sep’27E to arrive at our TP of INR180.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412