Buy Varun Beverages Ltd for the Target Rs. 665 by Motilal Oswal Financial Services Ltd

Double-digit volume growth in domestic market despite intensifying competition

In-line operating performance

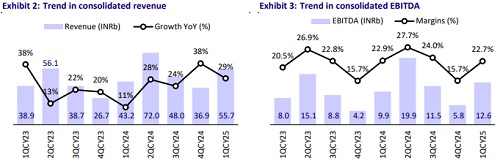

* Varun Beverages (VBL) reported a revenue growth of 29% YoY in 1QCY24, led by volume growth of 30% YoY, which was driven by organic volume growth of ~15.5% YoY and consolidation of South Africa & DRC in the current quarter. Realization remained flat YoY at INR178/case.

* VBL maintained its volume growth trajectory in the domestic market and its expansion in international markets, with the integration in South Africa progressing well. Management is confident about its double-digit growth guidance on the back of industry tailwinds and expansion into new markets every year via the addition of visi-coolers (in domestic and international markets).

* We largely maintain our CY25/CY26 earnings estimates. We reiterate our BUY rating on the stock with a TP of INR665.

Margins flat YoY due to higher mix of owned brands in South Africa

* VBL’s revenue grew 29% YoY to INR55.7 (est. in line) on account of healthy volume growth (+30% YoY to 312m cases). Realization was flat YoY at INR178/case.

* EBITDA margins were flat YoY at 22.7% (est. 22.9%) in 1QCY25 compared to 22.9% in 1QCY24 due to the consolidation of South Africa business (low margins due to high mix of owned brands). EBIDTA per case declined 2% YoY to INR40, while EBITDA stood at INR12.6b, up 28% YoY (est. in line).

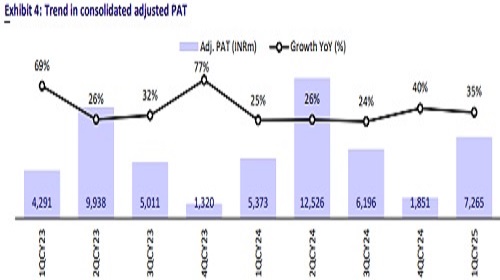

* Adj. PAT grew 35% YoY to INR7.2b (est. INR8.3b), driven by higher sales growth and stable margins YoY, partly offset by higher depreciation (up 45% YoY).

* Subsidiary (consolidated minus standalone) revenue/EBITDA grew 74%/51% YoY to INR15b/INR2.5b, while adj. PAT declined 29% YoY to INR484m in 1QCY25 ? CSD/Juice/water volumes grew 38%/22%/6% YoY to 234m/22m/56m unit cases in 1QCY25.

Highlights from the management commentary

* Domestic demand outlook: The company expects to sustain double-digit growth in the long term and ~21% margins in the Indian market. The Indian beverage market remains largely untapped and continues to grow. With an increase in competition, VBL is also increasing its efforts to put out more visi-coolers.

* International market: While the integration of the South Africa territory has progressed well, margins remain low as compared to India due to a higher mix of owned products. Going forward, the company aims to drop some of the non-profitable products in this market and increase the scale of PepsiCo’s portfolio.

* Change in consumer preference: There is a clear shift of consumer preference toward healthier products, including nimbooz, which is recording ~100% YoY growth. Energy drinks witnessed strong traction, remaining the fastest-growing segment in the market.

Valuation and view

* VBL is expected to maintain its earnings momentum, aided by: 1) scale-up in the international market, 2) stable growth in the domestic market, 3) continued expansion in capacity and distribution reach, and 4) growing refrigeration in rural and semi-rural areas.

* We expect a CAGR of 18%/16%/26% in revenue/EBITDA/PAT over CY25-26.

* We largely maintain our CY25/CY26 earnings estimates. We value the stock at 55x CY26E EPS to arrive at a TP of INR665. We reiterate our BUY rating on the stock

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412