Neutral Mahindra Lifespaces Ltd for the Target Rs.382 by Motilal Oswal Financial Services Ltd

Lack of launch approvals impacts performance

No completions in 1QFY26

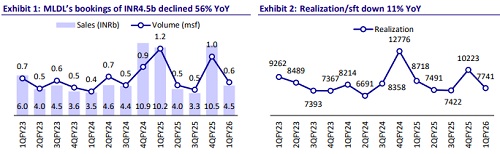

* Mahindra Lifespaces (MLDL) achieved bookings of INR4.5b, down 56% YoY and 57% QoQ (35% below estimate), due to fewer launches during the quarter. Launches stood at INR4.5b.

* Sales volume in 1QFY26 stood at 0.6msf, down 50% YoY and 44% QoQ (11% below estimate).

* Blended realization in 1QFY26 declined 11% YoY and 24% QoQ to ~INR7,741 psf (27% below estimates).

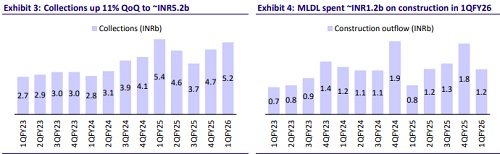

* The company achieved quarterly collections of INR5.2b, down 4% YoY and up 11% QoQ.

* In 1QFY26, MLDL added a project with INR35b GDV, up 2.5x YoY.

* Revenue from the IC&IC business stood at INR1.2b, up 17% YoY. Total leased area stood at 18.7 acres.

* The INR15b rights issue approved in 4QFY25 was completed in 1QFY26. Post this, the company is in a net cash position, with a net cash-to-equity ratio of 0.23x.

* P&L performance: MLDL’s revenue came in at INR320m, down 83% YoY and up ~3.5x QoQ (77% below estimate).

* For 1QFY26, MLDL reported an operating loss of INR550m against a loss of INR416m for 1QFY25.

* PAT was up 4x YoY at INR512m (3.5x above estimates) due to a higher share of profit realization from minority interest as compared to our estimates.

Key highlights from the management commentary

* MLDL is exiting NCR to deepen its presence in MMR, Pune, and Bengaluru, focusing on large-scale projects like Bhandup and strengthening brand positioning and execution.

* The company has launched New Haven (Bangalore), Citadel (Pune), and Marina64 (MMR) in 1Q/2QFY26; upcoming launches include Project Pink (Jaipur), Citadel Phase 3, Saibaba redevelopment (Borivali), and Bhandup Phase 1.

* The company signed three BD projects in 1QFY26—Lokhandwala 2 (INR11.5b), Mulund (INR12.5b), and Navrat (INR11b)—adding INR35b GDV. Of the INR450b GDV target, INR410b has already been secured.

* Of the INR410b GDV pipeline, INR200b is in Bhandup/Thane, INR120b in redevelopment, INR30b in Rajasthan/Murud, and INR60b is outright, with outright projects expected to launch within 12 months.

* Post the rights issue, the company is net cash positive with D/E of -0.23x. Operating cash flow in 1QFY26 stood at INR1.96b, while land-related spends stood at INR2.25b.

* Bhandup spans ~6.4msf, expected to deliver 3,000+ units and INR120b sales over 8-9 years. Phase 1 is targeted for launch in FY26, with strong infrastructure connectivity.

* Project-level IRRs improved from 3% in FY18 to 26% across five projects worth INR50b by FY24; current IRR stands at ~20%.

* A structured distribution model across retail, institutional, and national partners supports scalable execution and sourcing strength.

* FY27 pre-sales guidance stands at INR45–50b, driven by an active launch pipeline and strong market presence.

* MLDL targets INR95b in sales over the next five years, supported by end-user demand and improved execution momentum.

Valuation and view

* MLDL posted strong booking growth and is well-positioned to improve this momentum, given the healthy project pipeline across its key markets.

* We have incorporated the recent rights issue proceeds of INR15b and accordingly adjusted equity, debt, and cash components.

* We value the Residential business on a DCF basis, with a WACC of ~14% translating into INR44b.

* We reiterate our NEUTRAL rating on the stock with a TP of INR382, implying a 6% upside

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412