Buy HDFC Bank Ltd For Target Rs.2,050 by Motilal Oswal Financial Services Ltd

Marching towards normalized growth and profitability

Asset quality robust; Estimate RoA to gain traction from FY27E

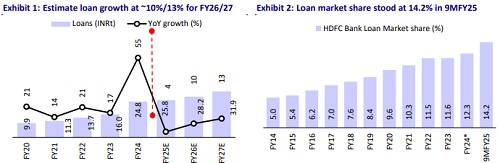

* HDFC Bank (HDFCB) has been reporting softer loan growth as the bank prioritized profitable growth over top-line and remains focused on reducing its CD ratio. We thus model in loan growth at 4%/10%/13% over FY25-27.

* HDFCB is re-orienting loan book towards higher-yielding CRB/retail assets and gradually replacing high-cost borrowings with deposits to improve margins. NIM is anticipated to exhibit a positive bias in the medium term, particularly from FY27 onwards, as a reduction in the repo rate pushes down lending yields in FY26.

* We note that while due to pressure on revenue lines (soft loan growth + muted margins) the C/I ratio remains sticky however the bank maintains a tight control on Cost-Assets ratio and we estimate further moderation in cost-ratios from FY27E onwards driven by operating leverage and margin recovery.

* Asset quality remained strong with robust underwriting and risk-calibrated lending, evidenced by the GNPA/NNPA ratios of 1.4%/0.5%, prudent provisions, and resilient asset quality across sectors. We estimate credit cost to remain at ~50bp over the medium term.

* The gradual retirement of high-cost borrowings, along with an improvement in operating leverage, will aid calibrated expansion in RoA over the coming years. We thus estimate HDFCB to deliver FY27E RoA/RoE of 1.8%/14.2%. Reiterate BUY rating with a TP of INR2,050.

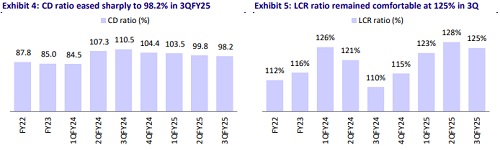

CD ratio restoration underway at an accelerated pace

HDFCB's loan growth was modest at ~3% YoY in 3QFY25, as the bank prioritized profitable growth over revenue growth and focused on reducing its CD ratio. The growth was mainly propelled by an ~11% YoY rise in the CRB segment, with the retail loan book expanding ~10% YoY, including a 9.7% growth in mortgages and a 10% rise in unsecured loans. The agricultural loan portfolio grew ~15.7% YoY. The deceleration in loan growth has eased the CD ratio, and the management expects FY26 loan growth to align with the system, with growth accelerating in FY27. We thus estimate ~10%/13% loan growth over FY26/FY27.

Liability momentum strong; moderation in rate environment to aid SA growth

HDFCB is focusing on building a granular, high-quality liability base by prioritizing customer engagement and service delivery, rather than competing aggressively on deposit rates. While shedding high-cost deposits from HDFC Ltd., the bank is not targeting large, high-ticket deposits. Efforts to convert mortgage customers into primary banking clients, particularly for savings accounts, are expected to drive sustainable deposit growth. Although its CASA mix deteriorated to 34% in 3QFY25, management noted strong gross inflows and improving relationship value with newly acquired customers, particularly savings account holders. We anticipate a gradual improvement in the CASA ratio and estimate a ~15% CAGR in deposits over FY25-27.

Unwinding of high-cost borrowings to continue

The bank has successfully reduced its borrowings, with a 23% decline in outstanding borrowings over the past year and a consistent reduction in its borrowing mix over the last four quarters. Following the merger with HDFC Ltd., ~15% of HDFCB’s INR4t borrowings will mature annually until FY27, with the remaining 55% maturing thereafter. While the bank shed INR630b in high-cost borrowings during 1QFY25, it managed to shed only INR291b in 2QFY25 and 3QFY25 due to the non-callable nature of these borrowings, making repayments challenging. HDFCB plans to continue growing its deposit base to replace maturing borrowings and support growth. Management anticipates significant funding needs, which will be required to replace high-cost debt.

NIM to exhibit a positive bias in the medium term; turn in the rate cycle to alleviate funding cost pressures

HDFCB is realigning its portfolio towards higher-yielding retail assets and replacing high-cost borrowings with deposits to enhance margins amid rising funding costs and a declining CASA mix. Despite this shift, margins have remained under pressure, with NIM ranging between 3.43% and 3.47% over the past three quarters, after falling 100bp from the FY19 levels. The bank has raised yield thresholds on retail and rural loans and selectively grown its corporate portfolio. With a gradual reduction in high-cost borrowings and improved CASA mix expected over FY26-27, margins are likely to improve, particularly from FY27 onwards as the repo rate declines. The bank's lower exposure to repo-linked loans (~45%) and focus on improving CASA and asset mix position it well to revive NIMs to ~3.4% levels by FY27E.

Operating leverage to improve; estimate C/I ratio at 39.8% by FY27

HDFCB’s operational efficiency strategy focuses on increasing throughput and customer convenience through digital technology, alongside a consistent pace of branch expansion and investments in technology and staffing. The bank has added ~405 branches in 9MFY25, following strong branch additions in FY23 and FY24. Despite these investments, cost ratios have remained stable, with the C/I and cost/asset ratios at ~40.6% and 1.89%, respectively, in 3QFY25. While the merger with HDFC Ltd. initially brought in higher-cost borrowings amid rising interest rates, the recent repo rate cut is anticipated to lower funding costs and support savings deposit growth. Although pressure on CASA may keep cost ratios steady in the short term, improved margins and operating leverage are expected to enhance these ratios in the medium to long term, with C/I and cost/asset ratios estimated to improve to ~39.8% and 1.71% by FY27E, respectively.

Asset quality stable; robust underwriting provides comfort

The bank has maintained strong asset quality through robust underwriting and a risk-calibrated lending approach. It reported a GNPA/NNPA ratio of 1.4%/0.5% in 3QFY25, with credit costs at ~50bp and slippages controlled at INR88b – 1.4% of average loans (INR65b ex-agri). The bank adopts a prudent provisioning strategy, holding a floating provision of INR124b, specific provisions of INR244b, and a contingent provision of INR135b. Despite systemic stress in unsecured lending, the bank's unsecured portfolio remains resilient with a retail GNPA ratio of ~0.8%, reflecting its cautious growth strategy. Asset quality remains strong across Corporate, Rural Banking, and Agriculture sectors, positioning the bank to keep its credit costs contained at ~50bp over the medium term.

Valuation and view: Reiterate BUY with a TP of INR2,050

* HDFCB has intentionally slowed down its business growth and has maintained a healthy pace of liability accretion amid a very challenging macro environment. The bank has been delivering a resilient performance on asset quality supported by its robust underwriting and strong understanding of market cycles. Over the past few quarters, the margins have remained within a narrow range aided by improving asset mix and retirement of high-cost borrowings, though the CASA mix continues to remain under pressure. Asset quality remains broadly stable with PCR at ~70%.

* The bank holds a healthy pool of provisions (floating + contingent) at INR259b/ 1.0% of loans. While management has not given any specific guidance on the C/D ratio, it has indicated that it will actively focus on bringing the ratio down at an accelerated pace.

* Consequently, we have factored in loan growth of 9.5%/13% over FY26/FY27E, while deposit CAGR is likely to sustain at ~15%. However, the gradual retirement of high-cost borrowings, along with an improvement in operating leverage, will aid calibrated expansion in RoA over the coming years.

* We thus estimate HDFCB to deliver FY27E RoA/RoE of 1.8%/14.2%. We reiterate our BUY rating on the stock with a TP of INR2,050 (premised on 2.3x FY27E ABV + INR290 for subsidiaries).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412