Neutral L&T Technology Ltd for the Target Rs.4,300 by Motilal Oswal Financial Services Ltd

Muted start to the year

Vertical-specific headwinds weigh on 1Q performance

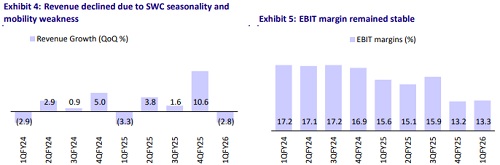

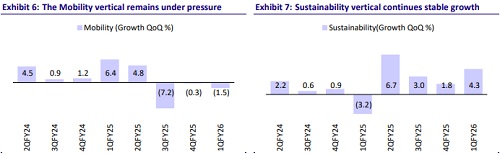

* L&T Technology’s (LTTS) 1QFY26 revenue declined 2.8% QoQ in USD terms vs. our estimate of ~1.1% QoQ decline. In CC terms, revenue was down 4.2% QoQ. Sustainability grew 4.1% QoQ, while Hi-Tech/Mobility was down 8.5%/1.5% QoQ.

* EBIT margin stood at 13.3% vs. our estimate of 12.8%. Adj. PAT stood at INR3.1b (est. INR3.0b), up 1.5% QoQ/1.0% YoY.

* For 1QFY26, revenue/EBIT declined 3.9%/1.0%, while PAT grew 1% YoY in INR terms. We expect revenue/EBIT to grow 2.5%/1.6%, while PAT to remain flat YoY in 2QFY26. We reiterate our Neutral rating on the stock with a revised TP of INR4,300 (based on 27x FY27E EPS).

Our view: SWC seasonality dampen 1Q; eyes on 2H margin recovery

* Revenue below expectations; pickup expected from 2Q: LTTS reported a soft 1QFY26, missing revenue estimates due to macro headwinds, SWC seasonality, and continued weakness in auto. That said, deal ramp-ups and a robust order book offer some visibility into a better 2H. LTTS maintained its double-digit growth guidance for FY26. We build in a gradual improvement starting 2Q, with broader vertical growth and deal ramp-ups expected in 2HFY25, resulting in 10.4% YoY CC growth for FY26.

* Margins stable sequentially; trajectory remains key to watch: Margins were flat sequentially and continue to hover at the lower end of expectations. While management reiterated its mid-16% EBIT margin aspiration by 4QFY27-1QFY28, the path remains back-ended and execution-heavy.

* While levers such as offshoring, automation, large deal wins in high-margin sustainability, and delivery pyramid improvements are in place, their full benefit is likely to play out over time. A visible improvement in margin trajectory remains critical for any sustained re-rating.

* Vertical performance mixed; auto drag continues: Mobility continues to face delays and pricing pressure, especially in auto, which has seen extended softness. While Off-highway and Airways performed slightly better, these are not large enough to offset the auto drag. Sustainability remains a relatively stable vertical, with good margin delivery. Hi-Tech declined due to SWC seasonality and continues to face pressure from selective deal participation and delayed deal closures.

Valuation and revisions to our estimates

* We expect USD revenue CAGR of 10% over FY25-27, with an EBIT margin of 14.1%/15.4% in FY26/27. We cut our FY26/FY27 EPS estimates by 4%/2% due to continued pressure in Mobility and a more gradual margin recovery trajectory. LTTS remains a diversified ER&D play, further strengthened by Intelliswift’s platform engineering capabilities. We reiterate our Neutral rating on the stock with a revised TP of INR4,300 (based on 27x FY27E EPS).

Miss on revenues and beat on margins (in line with consensus); maintains double-digit growth guidance for FY26

* USD revenue declined 4.2% QoQ CC, below our estimated decline of 2% QoQ CC. Revenue stood at USD335m.

* LTTS reaffirmed its guidance for double-digit growth in FY26.

* Sustainability grew 4.1% QoQ, while Hi-Tech/Mobility was down 8.5%/1.5% QoQ.

* EBIT margin stood at 13.3% (down 10bp QoQ) vs. our estimate of 12.8% (but in line with consensus).

* PAT increased 1.5% QoQ to INR3.1b, in line with our estimate of INR3.0b.

* The employee count declined 2.6% QoQ to 23,626 and attrition was up 50bp QoQ to 14.8%.

* Deal signings: Third consecutive quarter of USD200m in large deal TCV. One USD50m deal, three USD20-30m deals, six USD10+m deals.

Key highlights from the management commentary

* Clients remain cautious in their decision-making, though there are signs of stabilization. Management expects H2 to be better than H1.

* The AI wave in ER&D is gaining traction, driven largely by enterprise tech leaders recognizing a lag compared to peers in adopting AI to accelerate product development and productivity.

* Backed by a strong order book and a focus on resilience and profitable growth, the company is targeting double-digit revenue growth in FY26 and maintains its medium-term outlook of USD2b revenue.

* Macroeconomic challenges, softness in auto demand, and SWC seasonality weighed on growth this quarter.

* Revenue contribution from the top client is expected to improve, supported by targeted programs.

* EBIT margins are expected to improve gradually as growth becomes broadbased across segments. Intelliswift margins are expected to improve over the coming quarters.

* Mobility: A muted performance is expected in the near term, with a potential turnaround from 2H. US OEMs are uncertain about EV investments; European players are facing pricing pressure from Chinese competitors. SDV feature rollouts by US/UK OEMs are being delayed due to evolving market dynamics

Valuation and view

* LTTS’s strength lies in its engineering heritage from its parent company, as well as a well-diversified portfolio. The addition of Intelliswift enhances its capabilities in platform engineering, further strengthening its positioning in the ER&D space. That said, near-term growth visibility remains modest and margin expansion, while directionally intact, appears back-ended and executiondependent.

* We expect USD revenue CAGR of 10% over FY25-27, with EBIT margins of 14.1%/15.4% in FY26/27. We reiterate our Neutral rating on the stock with a revised TP of INR4,300 (based on 27x FY27E EPS).

.

.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)