Buy UTI AMC Ltd For Target Rs.1,300 by Motilal Oswal Financial Services Ltd

Strong SIP flows led to growth in the MF segment

Higher-than-expected other income drives a beat on PAT

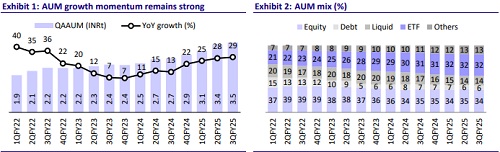

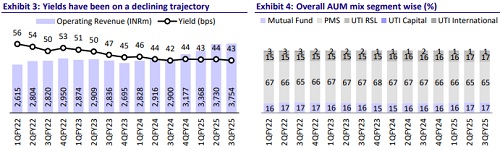

* UTI AMC’s operating revenue grew 29% YoY to INR3.8b (in line). Yields remained flat YoY and QoQ at 42.6bp in 3QFY25. For 9MFY25, revenue grew 26% YoY to INR10.9b.

* EBITDA was INR1.9b (4% beat) in 3QFY25, +68% YoY, and EBITDA margin improved to 50.8% in 3QFY25 from 39.2% in 3QFY24. Total opex came in at INR1.8b, recording 5% YoY growth. As bp of QAAUM, the costs declined YoY to 21bp in 3QFY25 from 25.8bp in 3QFY24 (vs. 22.2bp in 2QFY25).

* PAT for the quarter declined 14% YoY/34% QoQ to INR1.7b in 3QFY25 (8% beat). For 9MFY25, PAT grew 15% YoY to INR7.1b.

* Yields in the equity segment are likely to moderate due to the telescopic structure affecting the TER. However, expected stronger growth in longerterm debt funds should cushion the impact. We expect UTI to report FY24- 27 AUM/Revenue/Core PAT CAGR of 20%/17%/29%. The stock trades at FY26E P/E and core P/E of 13x and 21x, respectively. We reiterate our BUY rating with a one-year TP of INR1,300 (based on 24x Core Sep’26E EPS).

The distribution mix remains stable

* Overall MF QAAUM grew 29% YoY/3% QoQ to INR3.5t. This was driven by Equity/ETFs/Index/Debt funds’ growth of 21%/35%/76%/14% YoY.

* Equity QAAUM contributed 28% to the mix in 3QFY25 vs. 30% in 3QFY24. Debt/Liquid schemes contributed 7%/15% to the mix in 3QFY25 (7%/17% in 3QFY24).

* Overall net inflows for UTI were INR102b vs. INR35b in 2QFY25 and INR22b in 3QFY24. Strong flows were witnessed across categories, with Equity/Passives/Income/Liquid funds garnering inflows of INR10/INR38/ INR21/INR33b.

* Gross inflows mobilized through SIP stood at INR22b for the quarter ended Dec’24. SIP AUM stood at INR383.7b, +29.4% YoY. Total live folios stood at 13.2m (as of Dec’24).

* The market share declined to 5.14% from 5.54% in Dec’23 in the overall MF QAAUM. UTI AMC’s market share in Passive/NPS AUM stood at 13.54%/ 25.02%.

* The market share in the Equity/Hybrid/Index & ETFs/Cash & Arbitrage/Debt Funds stood at 3.16%/4.26%/13.54/4.53%/3.24%.

* On the product front, UTI AMC has launched two more index funds on the passives side during the quarter.

* UTI AMC has further expanded its geographical presence by opening 68 new branches, taking the total to 223 branches (172 located in B30 cities) in the underpenetrated Tier II and Tier III cities across India as of Dec’24.

* The distribution mix in the QAAUM for 3QFY5 remained largely stable with direct channel dominating the mix with 70% share, followed by MFDs at 23%, BND at 7%. However, with respect to equity AUM, MFDs contributed 55% to the distribution mix.

* Total expenses grew 5% YoY to INR1.8b with employee costs growing 7% YoY to INR1.1b while other expenses remained flat YoY at INR714m. Resulting in the CIR at 49.2% vs 60.8% in 3QFY24 and 51% in 2QFY25.

* Other income declined 72% YoY/73% QoQ to INR451m.

* The number of digital transactions during the quarter grew 20% at 5.1m showing a strong focus on growing SIP Book digitally. Capitalizing on crossselling and upselling opportunities has helped in growth in online gross sales at 95.02%.

* Total investments as of Dec’24 stood at INR39.8b, with 67%/17%/8%/8% being segregated into MFs/Offshore/Venture Funds/G-Sec/Bonds.

Growth across non-MF segments

* Total Group AUM stood at INR20.8t, up 18% YoY, of which MF AUM stood at 17%. The Non-MF AUM comprising PMS/UTI Capital//UTI RSL/UTI International grew 15%/41%/20%/4% YoY to INR13.5t/27b/3.4t/293b.

* Yields on MF/PMS/RSL remained stable YoY, while for the Capital and venture segment, it declined to 0.59bp. Yields on International business improved to 0.48bp from 0.45bp in 3QFY24.

* In the UTI International Segment, the UTI India Innovation Fund, domiciled in Ireland, has an AUM of USD50.41m as of Dec’24.

* The UTI Pension Fund manages 25.02% of the NPS Industry AUM as of Dec’24, with a market share of 25.02%.

* In the Alternatives Business, UTI AMC has gross commitments of USD200m in the IFSC GIFT City as of Dec’24.

Valuation and view: Reiterate BUY

* Yields on the equity segment are expected to decline at a relatively moderate pace compared to the past couple of years. The decline in overall yields will be protected by a higher share of equities and a mix in Debt AUM is likely to move towards longer-duration funds.

* Improving fund performance and scaling up non-MF business will improve profitability over the medium term. We reiterate our BUY rating with a TP of INR1,300, based on 24x Sep’26E Core EPS.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412