Buy Coforge Ltd for the Target Rs. 2,200 by Motilal Oswal Financial Services Ltd

Executable order book sets the floor for a solid FY26E

Margin set to expand too with one-offs behind

* We recently interacted with COFORGE’s CFO to understand the company’s growth outlook, execution strategy, and margin trajectory. Key takeaways: 1) COFORGE has reiterated its target of reaching USD2b revenue by FY27, driven by strong organic momentum and cross-selling opportunities from Cigniti; 2) With an executable order book of ~USD1.5b (+47% YoY), near-term revenue visibility remains high, and management expects organic growth in FY26 to outpace FY25 levels; 3) The company’s BFSI and transportation verticals remain core growth engines, each delivering +20% YoY growth in FY25 despite a challenging macro environment; and 4) Margin outlook is constructive, with oneoffs behind and levers like delivery mix and lower ESOP costs offering ~100-120bp upside by FY27.

* We continue to view COFORGE as a structurally strong mid-tier player well-placed to benefit from vendor consolidation/cost-takeout deals and digital transformation. Cigniti could also prove to be an effective longterm asset. We value COFORGE at 38x FY27E EPS with a TP of INR2,200, implying a 18% potential upside. We reiterate our BUY rating on the stock.

USD2b revenue in sight as organic growth and deal TCV accelerate

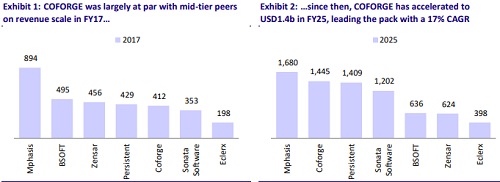

* COFORGE has scaled its revenue from around USD400m in FY17 to USD1.4b in FY25, clocking a 17% CAGR—the highest among peers (refer to Exhibits 1 and 2). PSYS and Sonata followed with ~16% CAGR over the same period.

* This growth was driven by strong organic performance in the BFSI and transportation verticals, further supported by M&As like Cigniti. Notably, both verticals grew 20%/32% YoY (in USD terms) in FY25 despite an uncertain macro environment.

* High revenue growth visibility led by executable order book: COFORGE’s executable order book remains a reliable indicator of shortterm revenue growth outlook; it stood at USD1.5b in FY25, up 47% YoY.

* The underlying business momentum is healthy, driven by consistent deal wins and resilient client spending across key verticals. Looking ahead, management expects organic growth in FY26 to outpace FY25 (~15% cc YoY), reflecting continued confidence in the core business.

* Further, management remains committed to achieving the USD2b revenue mark by FY27, backed by digital transformation-led demand, strong cross-sell traction, and momentum in large managed services deals. We believe these factors collectively ensure high revenue visibility over the next 12-18 months.

Sabre deal: Ramp-up on track

* COFORGE secured a landmark USD1.6b, 13-year engineering services agreement with Sabre in 4QFY25. Management highlighted that the Sabre deal is a pureplay engineering deal, reinforcing the company’s shift toward engineering-led engagement and reaffirming its strong domain expertise in the travel tech space.

* Sabre deal ramp-up on track; management confident of margin expansion despite the ramp-up: Management indicated that the Sabre ramp-up is on track and, importantly, expressed confidence that it will not be margin dilutive, supported by steady execution and a favorable offshore delivery mix.

* COFORGE has proactively de-risked the engagement through credit insurance, and Sabre’s ongoing deleveraging further strengthens its confidence.

* Winning Sabre validates COFORGE’s domain expertise in the travel vertical and its ability to deliver engineering solutions.

* Management highlighted that this deal marks COFORGE’s entry into ‘the leader’s box’ within the travel services tech partner landscape.

Margins to expand to 18% by FY27

* Margin guidance constructive; room for upside as one-offs normalize: FY25 adjusted EBITDA margin stood at 18%, which was weighed down by one-time M&A-related costs, including the Cigniti integration, Rhythmos acquisition, and the AdvantageGo divestment. With most of these one-offs now behind, margin pressures are expected to ease going forward.

* We expect EBITDA margins to expand 100-120bp over the next 12-18 months, with management guiding for ~18% reported EBITDA margin by FY27. COFORGE expects reported EBIT margin to expand materially in FY26 and reach 14% by FY27. ESOP costs are also expected to decline ~80bp by 2HFY26, providing further tailwinds to margin expansion.

Valuation and view

* We believe COFORGE’s strong executable order book and resilient client spending across verticals bode well for its organic business. Cigniti may prove to be an effective long-term asset. We value COFORGE at 38x FY27E EPS with a TP of INR2,200, implying a 18% upside potential. We reiterate our BUY rating on the stock.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)