Neutral R R Kabel Ltd for the Target Rs. 1,470 by Motilal Oswal Financial Services Ltd

Earnings above estimate; FMEG breakeven in 4QFY26E

Aiming ~18% volume CAGR in C&W over FY26-28E

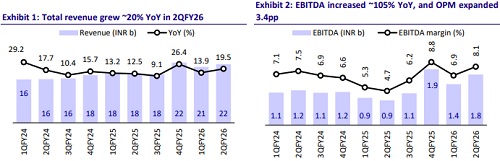

* RRKABEL’s 2QFY26 earnings were above our estimates, led by a higherthan-estimated margin in C&W. Revenue grew ~20% YoY to INR21.6b (in line), driven by robust growth of ~22% in the C&W segment. EBITDA grew ~105% YoY at INR1.8b (~14% beat). OPM expanded 3.4pp YoY to ~8% (80bp above estimate). Adj. PAT grew 135% YoY to INR1.2b (~20% beat).

* Management highlighted that the underlying demand environment continues to be favorable, led by infrastructure investments, formalization of the electrical sector, and rising consumer preference for branded and energy-efficient products. Margin expansion during the quarter was driven by positive operating leverage, better cost absorption, and sustained efficiency initiatives across the procurement and production chains. In C&W, the company targets ~18% volume CAGR, 10.5-11% EBIT margin (through better capacity utilization and product mix), and over 20% ROE over the next 2-3 years.

* We increase our EPS estimates ~6%-8% for FY26-FY28E (each) by increasing margins in the C&W segment (8.4%/8.6%/8.8% for FY26E/FY27E/FY28E). The stock is trading reasonably at 32x/27x FY27E/FY28E EPS. We value RRKABEL at 30x Dec’27E EPS to arrive at our revised TP of INR1,470. Reiterate Neutral.

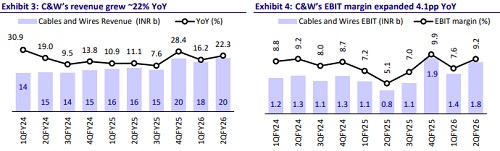

C&W revenue rises ~22% YoY and margin surges 4.1pp YoY to 9.2%

* Consolidated revenue/EBITDA/PAT stood at INR21.6b/INR1.8b/INR1.2b (up 20%/105%/135% YoY and +3%/+14%/+20% vs. our estimates). Gross margin expanded 3.0pp YoY to ~19%. Employee cost increased ~13% YoY (stood at 4.7% of revenue vs. 4.9% in 2QFY25). Other expenses increased ~16% YoY (stood at 6.1% of revenue vs. 6.2% in 2QFY25). Depreciation/interest cost increased ~25%/4% YoY, while other income increased ~134% YoY.

* Segmental highlights: a) C&W: Revenue increased ~22% YoY to INR19.7b, and EBIT increased ~120% YoY to INR1.8b. EBIT margin surged 4.1pp YoY to 9.2%. b) FMEG: Revenue declined marginally ~3% YoY at INR1.9b. The company reported a segment loss of INR117m vs. INR117m/INR71m in 2QFY25/1QFY26.

* In 1HFY26, Revenue/EBITDA/PAT stood at INR42.2b/INR3.2b/INR2.1b (up 17% /76%/81% YoY). OPM expanded 2.5pp YoY to ~8%. Operating cash outflow stood at INR1.3b vs OCF of INR338m in 1HFY25, mainly due to an increase in working capital. Capex stood at INR1.7b vs INR1.6b. Free cash outflow stood at INR3b vs INR1.3b in 1HFY25

Key highlights from the management commentary

* Capacity utilization stood at ~70% in wires and ~90% in cables. Demand visibility remains strong across both domestic and export markets, and the company expects 2HFY26 to be better than 1HFY26, supported by sustained infrastructure activity and retail traction.

* Management reiterated its guidance to achieve FMEG breakeven by 4QFY26, expecting overall losses for FY26 to be negligible.

* The company’s INR12b capex plan is progressing as per schedule, with ~80% allocated to the cables business. Net working capital stood at 57 days vs. 56 in Mar’25 and 64/75 days in Mar’24/ Mar’23

Valuation and view

* RRKABEL’s 2QFY26 earnings were above expectations, driven by higher-thanestimated margins in the C&W segment. It targeted a 100bp margin expansion in FY26 and, so far, is in line with its guidance. Since 2H remains better in terms of demand and industry trend, it estimates margins to sustain/expand in 2H. The FMEG segment is still facing challenges due to adverse market conditions. Its efforts towards product rationalization, operational efficiency, and cost control helped keep losses largely stable.

* We estimate RRKABEL’s revenue/EBITDA/PAT CAGR at 14%/26%/23% over FY25-28E. We estimate the company’s C&W segment margin at 8.6%/8.8% in FY27/FY28 vs. 8.4%/7.4% in FY26E/FY25. We project the company’s net debt (excluding acceptances) to increase INR5.6b by FY27 vs. INR3.1b in Sep’25 due to aggressive capex plans. The stock is trading fairly at 32x/27x FY27E/28E EPS. We value RRKABEL at 30x Dec’27E EPS to arrive at our revised TP of INR1,470 (earlier INR1,340). Reiterate Neutral

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412