Neutral IDFC First Bank Ltd for the Target Rs. 80 by Motilal Oswal Financial Services Ltd

Asset quality stress peaks out; earnings set to gain pace

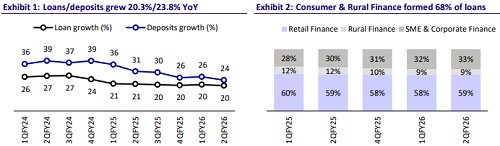

Business growth remains robust

* IDFC First Bank (IDFCFB) reported 2QFY26 PAT of INR3.5b (up 76% YoY/ down 24% QoQ, in line).

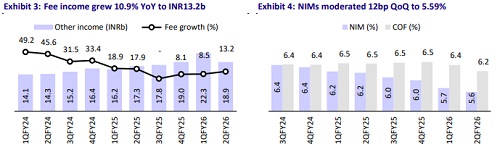

* NII grew 7% YoY/3.6% QoQ to INR51.2b (in line). NIMs declined 12bp QoQ to 5.6%. Opex grew 13% YoY to INR51.2b (in line).

* Net advances rose 20% YoY/5.5% QoQ. Deposit growth was robust at 24% YoY/4.5% QoQ, with CASA mix improving to 50.1% (up 210bp QoQ).

* GNPA/NNPA ratios declined by 11bp/3bp QoQ to 1.86%/0.52%. PCR ratio was stable at 72.2%.

* We fine-tune our estimates for the bank and expect a healthy CAGR of 20% in loans and 63% PAT during FY25-28E. We estimate RoA/RoE of 1.0%/9.3% for FY27E. Retain our Neutral rating with a TP of INR80, based on 1.4x FY27E ABV.

NIM decline controlled at 12bp QoQ; CASA mix improves to ~50%

* IDFCFB reported 2QFY26 PAT of INR3.5b (up 75% YoY/down 24% QoQ; in line), aided by a lower tax rate, which was partly offset by lower other income.

* NII grew 7% YoY/4% QoQ to INR51.1b (in line). NIMs declined by 12bp QoQ to 5.59%, while provisions stood broadly in line at INR14.5b. Other income grew 9.5% YoY/fell 15.1% QoQ to INR18.9b (6% miss).

* Opex grew 12.5% YoY/4.1% QoQ to INR51.2b (in line). C/I ratio thus rose to 73.2%. PPoP declined 4% YoY/16% QoQ to INR18.8b (largely in line).

* On the business front, net advances grew 19.5% YoY/5.5% QoQ, led by 5.9% QoQ growth in retail finance, 7% QoQ growth in wholesale, and 8% in business banking. Within retail, growth was led by VF (12% QoQ), gold (11% QoQ), credit card (7% QoQ) and consumer (8% QoQ). The share of consumer & rural finance was ~67.4% as of 2QFY26.

* Deposit growth remained robust at 24% YoY/4.5% QoQ, with the CASA mix increasing 210bp QoQ to 50.1%. CD ratio was up 93bp QoQ at 93%.

* GNPA/NNPA ratios declined by 11bp/3bp QoQ to 1.86%/0.52%. PCR ratio was stable at 72.2%. Gross slippages declined to INR22.6b vs. INR24.9b in 1QFY26. SMA book declined to 0.9% vs. 1.01% in 1QFY26.

* Excluding MFI, slippage ratio improved to 3.4% vs. 3.54% in 1QFY26. Excl. MFI, the credit cost for the bank stood at 2.03%. With the stress easing out, the bank expects the credit cost to improve from hereon.

Highlights from the management commentary

* NIMs are expected to improve sequentially and reach ~5.8% in 4QFY26, factoring in one rate cut by the RBI.

* Credit cost is expected at 2.1% for FY26, trending lower at ~1.8% in 2H.

* C/I ratio should trend lower as operating leverage improves from MFI normalization kick-in.

* ECL transition is still under assessment; initial view suggests higher Stage-1/2 provisioning, but overall impact is likely to be neutral or slightly positive when factoring in operational risk weights.

Valuation and view: Maintain Neutral with TP of INR80

IDFCFB reported an in-line quarter, with NII, PPoP, and PAT broadly meeting expectations. The 12bp sequential decline in NIMs was also in line with estimates, and the bank expects margins to improve to 5.8% by 4QFY26, factoring in one repo rate cut. On the business front, deposit traction remained robust, with the CASA mix improving to 50%, while loan growth remained healthy, led by steady momentum across Retail and Business Banking segments. Asset quality saw a marginal improvement, with the SMA book remaining well contained at 0.9%. We expect the C/I ratio to moderate from 70.3% in FY26 to 66.2% in FY27, as revenue growth gains pace and operating leverage begins to play out. We fine-tune our estimates for the bank and expect a healthy loan CAGR of 20% and PAT CAGR of 63% over FY25-28E. We estimate RoA/RoE of 1.0%/9.3% for FY27E and retain our Neutral rating with a TP of INR80, based on 1.4x FY27E ABV.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412