Buy HDFC Life Insurance Ltd for the Target Rs.910 by Motilal Oswal Financial Services Ltd

APE in line; VNB margin flat on YoY basis

* HDFC Life Insurance (HDFCLIFE) reported APE of INR32.3b (in-line) in 1QFY26, up 13% YoY, driven by 13%/12% YoY growth in individual/group APE.

* VNB grew 13% YoY to INR8.1b in 1QFY26 (5% below our estimates). Margins stood at 25.1%, a 90bp decline from our estimate of 26%, primarily due to the shift in the product mix towards lower yield offerings.

* For 1QFY26, HDFCLIFE reported a 14% YoY growth in shareholders’ PAT to INR 5.5b, (11% beat), supported by a 15% increase in back-book profits.

* VNB margins are expected to remain range-bound due to slower growth and the reinvestment of surplus into distribution expansion and fixed cost absorption.

* We trim VNB margin assumptions by 50bp each for FY26/FY27, factoring in 1QFY26 performance and guidance of flattish margins. We reiterate BUY with a TP of INR 910 (2.6x FY27E EV).

Share of non-PAR business to improve

* For 1QFY26, HDFCLIFE reported 16% YoY growth in gross premium to INR148.8b (in line), driven by 19%/17% YoY growth in renewal/single premium.

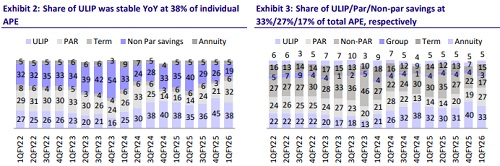

* Overall APE growth of 13% YoY was driven by the growth of 117%/16%/17% YoY in Par/ULIP/Term business, while non-par and group business reported a YoY decline of 36%/16%. Individual APE growth was 13% YoY, led by 13%/125% YoY growth in the ULIP/Par segment.

* Share of ULIPs was stable at 33% on an overall APE basis despite expectations of a slowdown, aided by favorable market conditions. Management guides for the share to gradually shift towards traditional products.

* The share of the par segment increased to 27% from 14% in 1QFY25 on account of new product offerings and the relaunch of the existing retirement product. The share of the non-par segment, however, dipped temporarily due to an irrational pricing environment. Management guides for these trends to normalize in the near term.

* The credit protect segment showed signs of recovery, supported by higher disbursements, better attachment rates, and entry into new lending segments.

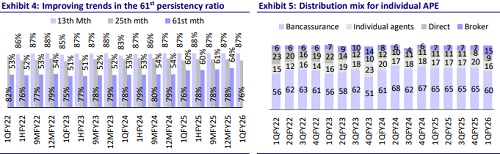

* On the distribution front, management guides for similar growth across channels, with the agency channel driving the uptrend due to strong additions and improved efficiency via transformation programs.

* On an individual APE basis, the banca/agency/brokers mix grew 4%/6%/141% YoY, while the direct channel saw a decline of 8% YoY.

* The 61st month persistency across cohorts improved, supported by stronger retention in long-term savings products. However, a decline was observed in the 13th month persistency, driven by a reduced proportion of large-ticket policies due to changes in taxation.

* ~70% of new customers acquired in 1QFY26 were first-time buyers, with a presence across Tier 1, 2, and 3 cities. Growth during the quarter was driven by higher average ticket sizes and increased traction in selected unit-linked and par products.

* As of Jun’25, total AUM increased by 15% YoY to INR3.6t.

* Embedded Value (EV) grew 18% YoY to INR584b as of Jun’25, reflecting RoEV of 17.6%. Solvency ratio for the quarter stood at 192%

Highlights from the management commentary

* Management expects growth in H2 to outpace H1; however, full-year FY26 growth is likely to come in below FY25 levels.

* Management expects the non-par product mix to rise to the mid-20% range, while the share of par products is expected to decline to around 25% during the year.

* While the counter share in the parent bank remained stable, strong growth from other bank partnerships and ongoing digital integration with the parent bank are expected to support a better channel mix in 2HFY26.

Valuation and view

* HDFCLIFE continues to focus on enhancing channel economics through a multipronged strategy—diversifying the product mix, driving cross-sell and upsell, leveraging the bank’s digital assets, and improving customer experience.

* We have trimmed our VNB margin assumptions by 50bp each for FY26/27 to reflect the 1QFY26 performance and management’s guidance of flattish margins. We reiterate BUY with a TP of INR910 (based on 2.6x FY27E EV).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412