Buy Sapphire Foods Ltd for the Target Rs.400 by Motilal Oswal Financial Services Ltd

Subdued performance but in-line with expectations

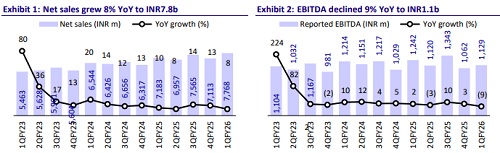

* Sapphire Foods India (SAPPHIRE) reported revenue growth of 8% YoY (in line) in 1QFY26, driven by a 10% YoY increase in store count. KFC’s revenue grew 11% YoY, supported by 15% store expansion. KFC’s same store sales growth (SSSG) remained flat (in line). Pizza Hut’s (PH) revenue declined 5% YoY, as same store sales (SSS) declined 8% (est. -6%). PH’s new store additions were 5%. Sri Lanka posted healthy revenue growth of 19% YoY (+15% in LKR), driven by 12% LKR SSSG and 7% store growth.

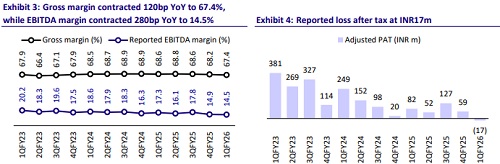

* Gross margin contracted 120bp YoY and 80bp QoQ to 67.4% (est. 68.3%). KFC’s ROM contracted 310bp YoY to 15.7%, impacted by lower ADS (down 5% YoY to INR116k), higher mix of delivery orders, and operating deleverage. PH’s ROM contracted 710bp YoY to -2.5%. Sri Lanka’s ROM contracted 50bp YoY to 12.7%, impacted by higher employee costs. Consolidated restaurant EBITDA pre-Ind-AS declined 13% YoY to INR943m (in line), and margins contracted 300bp YoY to 12.1% (12% in 4QFY25). PreInd-AS EBITDA was down 22% YoY to INR548m, with a 280bp contraction in margin to 7.1% (7.1% in 4QFY25).

* The company continues to face challenges in unit economics, with dine-in seeing more pressure than delivery. To drive recovery, the focus remains on product innovation, enhancing customer engagement, and strengthening value-led offerings. However, improvement in ADS and SSSG will be key monitorables, as they are essential for restoring unit-level profitability. The store expansion spree is expected to slow down in FY26 (mainly in PH) to fix profitability metrics. We reiterate our BUY rating on the stock with a TP of INR400 (32x Jun’27 pre-IND-AS EV/EBITDA).

Operationally in-line; growth weakness persists

* In-line revenue growth: Consolidated sales grew 8% YoY to INR7.7b (est: INR7.8b). KFC’s revenue grew 11% YoY, while SSS remained flat. PH’s revenue declined 6% YoY, with an SSS decline of 8%. KFC’s ADS declined 5% YoY to INR116k and PH’s ADS declined 8% YoY to INR44k. Sri Lanka sales grew 19% YoY (+15% in LKR terms) to INR1,164m and SSSG stood at 12%. ADS grew 16% YoY to INR103k.

* Moderate store addition: Store growth was 10% YoY in 4Q to 974 stores. It added net 11 stores during the quarter (8 KFC, 2 PH, and 1 in Sri Lanka).

* Contraction in margins: Consolidated gross profit grew 6% YoY to INR5.2b (est. INR5.3b). GM contracted 120bp YoY to 67.4%. Reported EBITDA declined 9% YoY to INR1.1b (est. INR1.2b), while margins contracted 280bp YoY and 40bp QoQ to 14.5% (est. 15.1%). Consolidated ROM (Pre-Ind-AS) contracted 300bp YoY to 12.1%. EBITDA Pre-Ind AS contracted 280bp YoY to 7.1%. The company’s reported loss before tax (after 14 quarters) amounted to INR18m.

Highlights from the management commentary

* The demand situation remains neutral, showing no significant improvement or deterioration compared to the last 3-4 quarters. Competitive pressure has intensified, but efforts are underway to drive growth.

* KFC reported flat SSSG for the quarter, while SSTG turned positive after several quarters with low single-digit growth. The pickup in transactions is a positive indicator.

* The ‘Juicylicious’ pizza range launched in Apr’25 received encouraging feedback from consumers. In Tamil Nadu, mass media advertising support drove positive SSSG and SSTG, with a double-digit delta vs the rest of the market. In other regions, marketing remained focused on below-the-line (BTL) activities.

* The company plans to implement a 3-5% price hike in Sri Lanka, which is expected to support margin expansion from 2Q onwards.

Valuation and view

* We marginally cut our EBITDA estimates by ~3% for FY26/FY27.

* KFC’s store addition is expected to continue in FY26, while PH’s store addition will be muted as management focuses on addressing ADS and profitability challenges within the current network.

* The company continues to face challenges in unit economics, with dine-in seeing more pressure than delivery. To drive recovery, the focus remains on product innovation, enhancing customer engagement, and strengthening value-led offerings. However, improvement in ADS and SSSG will be key monitorables, as they are essential for restoring unit-level profitability. The stock trades at 38x and 29x pre-Ind-AS EV/EBITDA on FY26E and FY27E, respectively. We reiterate our BUY rating on the stock with a TP of INR400 (32x Jun’27 pre-IND-AS EV/EBITDA).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)