Buy Tech Mahindra Ltd for the Target Rs. 1,900 by Motilal Oswal Financial Services Ltd

Continues to impress

Disciplined execution gets it closer to FY27 targets

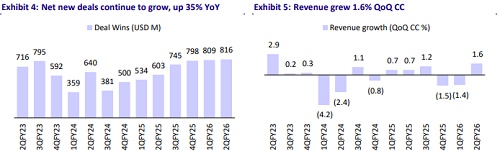

* Tech Mahindra (TECHM) reported 2QFY26 revenue of USD1.6b, up 1.6% QoQ in CC vs. our estimate of 1.0% CC growth. Retail/Manufacturing/BFSI grew 9.0%/5.3%/3.8% QoQ, whereas Communications/Others fell 2.0%/8.8% QoQ (in USD terms). EBIT margin was up 100bp QoQ at 12.1%, beating our estimate of 11.6%. PAT stood at INR11.9b (up 4.7% QoQ/down 4.4% YoY), below our estimate of INR13b.

* In INR terms, revenue/EBIT/PAT grew 4.0%/33.3%/11.1% in 1HFY26 YoY. In 2HFY26, we expect revenue/EBIT/PAT to grow by 8.3%/34.7%/39.0% YoY. We reiterate BUY on TECHM with a TP of INR1,900 (implying 29% upside), based on 23x Jun’27E EPS.

Our view: Deal momentum improves, margins to expand linearly

* Broad-based growth across all verticals: Revenue was up 1.6% QoQ CC, led by strength in manufacturing, BFSI, and logistics, while telecom stayed weak, down 2% YoY. The drag was mainly in Europe; the US and Asia books improved. Management said the largest client is growing again and expects telecom to turn up in 2H as vendor consolidation deals start contributing.

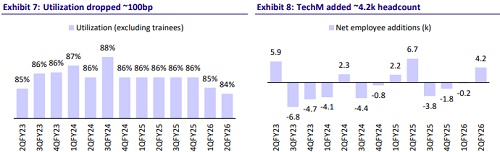

* Margin performance continues: EBIT margin rose to 12.1%, helped by better fixed-price delivery, lower SG&A, and some forex gains (40bp). TECHM continues to deliver on margins, and while admittedly FY27E expansion is contingent on growth returning, we believe the execution has so far been on point. We expect margins to come in closer to its FY27 target (our estimates at 14.4% in FY27E). While this may be a tad lower than 15%, we believe steady-state margins for a company of TECHM’s size are above 16%, and the margin expansion should extend beyond FY27, in our view.

* Deal wins continue to improve: Deal TCV reached USD815m, up 35% YoY. Management aims to see this number closer to USD1b to meet growth targets. However, the current deal win run rate may suffice if discretionary demand improves.

* All in all, steady progress amid muted demand: Growth remains slow, but operational discipline and improved client mining are visible. The focus on larger accounts and efficiency programs is helping TECHM deliver margin goals even as the broader demand environment stays soft. We expect gradual and linear margin improvements through 2H, with FY27 likely to be a year of steady rather than sharp gains.

Valuation and change in estimates

* We keep our estimates unchanged, reflecting steady directional progress. We estimate FY26/FY27 EBIT margins at 12.3%/14.4%, which will result in a 28% CAGR in INR PAT over FY25-27. The ongoing restructuring under the new leadership is tracking well, and this quarter was another step in the right direction. We continue to like TECHM’s bottom-up turnaround story. We value TECHM at 23x Jun’27E EPS with a TP of INR1,900 (29% upside). We reiterate our BUY rating on the stock.

Beat on revenue and margins; healthy deal TCV growth

* Revenue stood at USD1.6b, up 1.6% QoQ CC (up 1.4% QoQ in USD terms), above our estimates of 1.0% QoQ CC growth.

* IT service/BPO were up 4.5%/ 6.7% QoQ. Americas and RoW grew 2.6%/1.6% QoQ.

* Retail/Manufacturing/BFSI rose 9.0%/5.3%/3.8% QoQ, whereas Communications/Others fell 2.0%/8.8% QoQ (in USD terms).

* EBIT margin was up 100bp QoQ at 12.1%, beating our estimate of 11.6%.

* Net employee addition was 4,200 (up 2.8% QoQ). Utilization (ex. trainees) was down 60bp QoQ at 84.4%. LTM attrition was up by 20bp at 12.8%.

* NN Deal TCV was USD816m, up 1% QoQ/35.3% YoY.

* Adj. PAT stood at INR11.9b (up 4.7% QoQ/down 4.4% YoY), below our estimate of INR13b.

* FCF conversion to PAT stood at 176% vs. 65% in 1QFY26.

Key highlights from the management commentary

* The company remains pleased with the progress made in 1HFY26, which was focused on building a strong foundation. 2HFY26 is expected to mark a shift toward decisive execution and comparable gains.

* 2HFY26 performance is expected to improve, supported by strategic actions, seasonality, and an improving demand environment.

* While customers continue to expect productivity gains, these expectations are now at more realistic levels.

* Management reiterated confidence that FY27 will be a better year for both the industry and the company compared to FY26.

* The deal pipeline remains healthy and well-diversified across verticals.

* As discretionary spending improves, revenue conversion from deals is expected to accelerate. If the current environment remains steady, TCV should rise further, and if the environment improves, the existing run rate will remain strong.

* Margin expansion was driven by fixed-cost project optimization, SG&A rationalization, and a 40bp currency tailwind.

* Around 55-60% of the portfolio comprises fixed-price projects, providing levers for GM improvement.

* Communication and Media: APAC and US regions performed well, while Europe faced temporary challenges expected to recover in 2H.

* Comviva continues to perform strongly and is expected to deliver growth for the year.

* Europe: Vendor consolidation opportunities are progressing well; while some decisions are deferred, others are mid -discussion. Positive outcomes are expected in coming quarters.

Valuation and view

* We remain positive about the restructuring at TECHM under the new leadership. But we expect the impact from these steps to be visible gradually. With the continued strength in BFSI and improving operational efficiency, we see room for continued margin improvement ahead. We value TECHM at 23x Jun’27E EPS with a TP of INR1,900 (29% upside). We reiterate our BUY rating on the stock

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412