Buy Lemon Tree Hotels Ltd For Target Rs.190 by Motilal Oswal Financial Services Ltd

Higher occupancy drives revenue growth

In-line operating performance

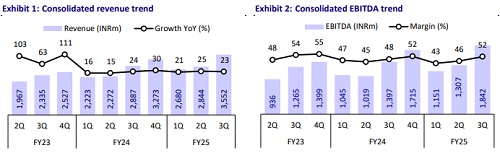

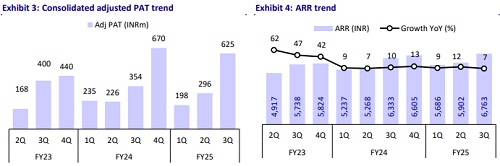

* Lemon Tree Hotels (LEMONTRE) reported strong revenue growth of 23% YoY in 3QFY25, led by significant improvement in occupancy (OR) to 74.2% (up 830bp YoY) and healthy growth in ARR (up 7% YoY). OR improvement was primarily led by the ramp-up of Aurika Mumbai. Further, operating leverage resulted in an EBITDA margin improvement of 350bp YoY.

* With a robust performance in 9MFY25 (revenue up 23%), we expect FY25 to end on a strong footing with healthy performance in 4Q. The continuous ramp-up of Aurika Mumbai and favorable demand-supply dynamics coupled with renovations (boosting ARR and OR) will be the key drivers.

* We broadly maintain our FY25/FY26/FY27 EBITDA estimates and reiterate our BUY rating on the stock, with an SoTP-based TP of INR190 for FY27.

Operating leverage drives margin expansion

* Revenue grew 23% YoY to INR3.6b (in line), and occupancy rose 830bp YoY to 74.2%, reflecting the ongoing ramp-up at Aurika Mumbai and higher ARR of INR6,763 (up 7% YoY). Management fees increased 23% YoY to INR184m.

* EBITDA rose 32% YoY to INR1.8b (in line). EBITDA margin expanded 350bp YoY to 52% (est. ~50.3%) driven by favorable operating leverage. Adj. PAT increased 71% YoY to INR625m (est. INR664m).

* During the quarter, LEMONTRE signed 13 new management and franchise contracts, which added 766 new rooms to its pipeline, and operationalized one hotel, which added 38 rooms to its portfolio.

* As of 31st Dec’24, the total operational inventory comprised 112 hotels with 10,317 rooms, and the pipeline comprised 88 hotels with 6,068 rooms.

* In 9MFY25, revenue/EBITDA/adj. PAT grew 23%/24%/37% YoY to INR9b/ INR4.3b/ INR1.1b

Highlights from the management commentary

* Guidance: The company expects mid-teen RevPAR growth through optimizing ARR and occupancy. It is also targeting to reach 20,000 rooms (operational and pipeline) ahead of FY27, i.e., within 12 to 15 months vs. the current 16,385 rooms (operational – 10,317; pipeline – 6,068).

* Aurika: The company expects Aurika Mumbai to stabilize by 2HFY26, with ARR reaching ~INR11.5-12.5k and occupancy stabilizing over 85%. The hotel is already doing ARR/OR of ~INR9,500/85% in Jan’25. Additionally, the company is close to signing Aurika in Varanasi, which is expected to have an ARR five times higher than the other Aurika properties.

* Aurika Shillong: LEMONTRE received a Letter of Award from the Directorate of Tourism, Government of Meghalaya, to redevelop Shillong’s Orchid Hotel as Aurika under a PPP model, featuring 120 rooms. The company will invest INR1.2b for all 120 rooms supported by a 5% interest subvention. It received the land for a 1% revenue share plus INR10-20m annually. The initial annual EBITDA from this hotel is expected to be ~INR150m.

Valuation and view

* LEMONTRE is likely to maintain a healthy growth momentum, led by 1) the stabilization of Aurika Mumbai, 2) accelerated growth in the management contract (pipeline of ~5,879 rooms), and 3) the timely completion of the portfolio’s renovation leading to improved OR, ARR, and EBITDA margins.

* We expect LEMONTRE to post a CAGR of 16%/19%/34% in revenue/EBITDA/ Adj. PAT over FY24-27 and RoCE to improve to 19.3% by FY27 from ~10% in FY24. We reiterate our BUY rating on the stock with our SoTP-based TP of INR190 for FY27.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412