Buy JSW Infrastructure Ltd For Target Rs.350 by Motilal Oswal Financial Services Ltd

Operating performance in line; lower tax outgo drives APAT

Outlook remains bright as expansion is underway

* During 3QFY25, JSW Infrastructure (JSWINFRA) completed the acquisition of a 70.37% share of Navkar Corporation (NAVKAR) through its subsidiary JSW Port Logistics (consolidated effective 11th Oct’24). The 3QFY25 results are not comparable with those of the corresponding periods. Navkar generated a revenue/APAT of INR1.2b/INR11m from 11th Oct’24 to 31st Dec’24.

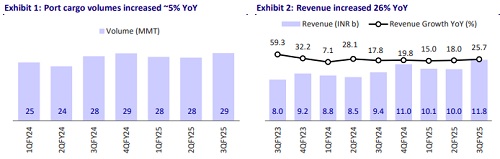

* JSWINFRA’s consolidated revenues grew 26% YoY to INR11.8b. During the quarter, the company handled cargo volumes of 29.4m tonnes (+5% YoY).

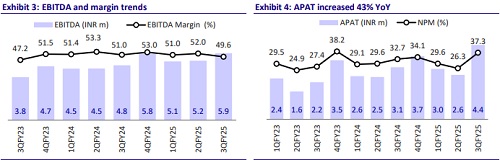

* EBITDA grew ~22% YoY to INR5.9b. EBITDA margin was 49.6% and was lower by ~150bp YoY/~240bp QoQ. APAT grew ~43% YoY to INR4.4b (our est. of INR3.3b). Lower tax outgo drove APAT. The increase in the third-party volume was stronger with 31% YoY growth, and the share of third parties in the overall volumes stood at 49% in 3QFY25 vs. 39% in 3QFY24.

* During 9MFY25, revenue was INR 31.9b (+20% YoY), EBITDA was INR16.2b (+17% YoY), and APAT was INR 10b (+23% YoY).

* The company’s 3QFY25 operational performance was in line (ex-Navkar’s financials). JSWINFRA expects to end FY25 with a 10% volume growth and a focus on building capacity in the ports and logistics segments. Management has come out with an aggressive roadmap to build its logistics infrastructure and network under JSW Ports Logistics with a capex of INR90b through FY30.

* With better-than-expected volumes and ramp-up of volumes at the recently acquired ports, along with Navkar consolidation, we raise our EBITDA and APAT estimates by ~2% and 10%, respectively, for FY25. However, we broadly retain our FY26 and FY27 estimates. JSWINFRA continues to pursue organic and inorganic growth opportunities to bolster its market footprint. We estimate a volume/revenue/EBITDA/APAT CAGR of 14%/22%/21%/20% over FY24-27. Reiterate BUY with a TP of INR350 (premised on 23x Sep’26 EV/EBITDA).

Cargo volumes up 5% YoY driven by third-party cargo; focus on building a pan-India logistics infrastructure and network

* During 3QFY25, JSWINFRA managed cargo volumes of 29.4MMT (+5% YoY). The volume increase was driven by higher capacity utilization at the Paradip coal terminal, contributions from PNP Port, and the UAE Liquid Storage Terminal, partially offset by lower cargo volumes at the Paradip iron ore terminal. The increase in the third-party volume was stronger with 31% YoY growth, and the share of third parties in the overall volumes stood at 49% in 3QFY25 vs. 39% in 3QFY24.

* JSW Ports Logistics aims to achieve INR80b in revenue and INR20b in EBITDA, and targets to invest INR90b in logistics infrastructure by 2030 by leveraging the Navkar acquisition, JSW Group synergies, and diverse operations to develop terminals, railway sidings, and value-added services across India.

Highlights from the management commentary

* Port capacity expansion is a key priority, with a target to achieve 400MTPA by FY30. The current capacity increased to 174 MTPA (from 170 MTPA). Projects at JNPA, Tuticorin, Mangalore, and TNT ports contributed to the increase in the current capacity.

* Management is targeting a revenue of INR80b, an EBITDA of INR20b, and it aims to undertake a capex of INR90b for building the logistics infrastructure under JSW Ports Logistics.

* The breakdown of capex of INR90b will be as follows: INR30b for GCT & terminal development, INR30b for rake acquisitions or leasing, INR15b for specialized containers and other types of containers, and INR5b for other activities.

* The EBITDA margin for the port cargo business is 50-53%. The EBITDA margin for the oil tank terminal business in the UAE is 85% plus. The inclusion of the oil tank business into the port business is generating a higher EBITDA margin.

Valuation and view

* Leveraging its strong balance sheet, JSWINFRA aims to pursue organic and inorganic growth opportunities, strengthen its market presence, and expand its capacity to 400MMT by 2030, up from the current capacity of 170MMT.

* Considering stable growth levers at its existing ports and terminals, a higher share of third-party customers, sticky cargo volume from JSW Group companies, and an expanding portfolio, we expect JSWINFRA to strengthen its market dominance, leading to a 14% volume CAGR over FY24-27. This should drive a 21% CAGR in revenue and a 23% CAGR in EBITDA over the same period. We reiterate our BUY rating with a TP of INR350 (based on 23x Sep’26 EV/EBITDA).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412