Buy CIE Automotive India Ltd for the Target Rs.502 by Motilal Oswal Financial Services Ltd

India business likely to be the key growth driver

Earnings beat driven by improved operational performance

* CIE India (CIEINDIA)’s consolidated PAT at INR2b came in ahead of our estimate of INR1.9b, fueled by better-than-expected performance at both India and Europe and favorable currency movement. With the EU demand remaining uncertain, management continues to focus on driving growth in India through capacity expansion, deeper customer engagements, and leveraging its existing product and segment diversification.

* The Indian business is projected to be the primary growth driver for the company even in CY25. CIEINDIA remains focused on sustaining profitability through operational efficiencies. The stock trades at 19.7x/18.7x CY25E/ CY26E consolidated EPS. Reiterate BUY with a TP of INR502 (based on ~21x Jun’27E consolidated EPS).

India continues to be the key growth driver

* CIEINDIA’s consolidated PAT at INR2b came in ahead of our estimate of INR1.9b, led by better-than-expected performance at both India and Europe and favorable currency movement.

* Consolidated revenue grew ~3% YoY to INR23.7b (est. INR21.9b) in 2QCY25. Growth was largely led by the India business (+6% YoY) and positive exchange rate impact, while the EU business continued to remain subdued (-1% YoY). 1HCY25 revenue/EBITDA declined ~2%/7% YoY, while Adj. PAT declined ~8% YoY.

* EBITDA stood at ~INR3.4b (est. INR3.2b) and was down ~6% YoY. EBITDA margin came in at 14.2% (est. 14.5%), down 150bp YoY and 60bp QoQ. This included a 100bp impact of restructuring at Metalcastello.

* Adj. PAT stood at INR2b (est. INR1.9b) and was down ~6% YoY.

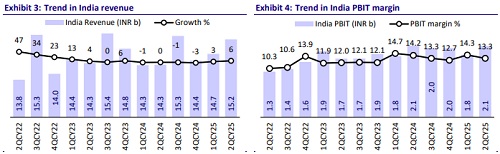

* India business performance: Revenue grew 6% YoY to INR15.2b (est. INR14.7b), ahead of blended average market growth of ~5% YoY. India EBITDA margin remained stable QoQ at 15.7% (est. 15.5%, flat YoY). PBT grew 3% YoY to INR2.1b.

* EU business performance: Revenue declined ~1% YoY to ~INR8.5b (est. ~INR7.2b). This was led by a 4% dip in revenue in euro terms and a 4% reduction in input costs, which was offset by a 7% benefit due to forex fluctuation. EBITDA margin contracted 140bp QoQ/400bp YoY to 11.7% (est. 12.5%). 2Q included a 120bp impact of restructuring costs at Metalcastello. Adjusted for this, the EBITDA margin would have been ~14.5%.

* CIEINDIA’s 1HCY25 CFO/FCF declined ~10%/5% YoY to INR5.5b/INR4.8b. Operating cash flow was INR5.5b (~76% of EBITDA) but was offset by high working capital needs (INR5.9b) and dividend payout of INR2.65b.

Highlights from the management commentary

* The order book at the end of 1HCY26 stands at INR6b (was INR3.5b at the end of 1Q). Management expects a steady improvement in the India business in the coming quarters on the back of its healthy order backlog and stable domestic growth in core segments.

* Management has guided for a 17.5-18.0% margin range for the India business.

* The PV and CV markets in Europe are likely to remain weak in the near term. OEMs are now indicating they expect the market to recover by Jan’26. However, the management is not as optimistic on the same, as the outlook continues to be highly uncertain.

* Given the weak demand in Europe, supply is much higher than demand, and a lot of companies are undergoing financial stress. This is likely to drive industry consolidation, and CIE is likely to emerge as a key beneficiary of the same.

* Management has given a recurring margin guidance of about 14-15% for Europe in the long run.

Valuation and view

* The Indian business is projected to be the primary growth driver for the company even in CY25. However, the weak outlook for the EU business and Metalcastello is likely to weigh on the overall performance in the near term. CIEINDIA possesses some of the financial attributes unique to a global ancillary player including being net debt-free, having strict capex/inorganic expansion guidelines, generating positive FCF, and tracking an improving return trajectory.

* On account of a better-than-expected performance in 2QCY25, we raise our CY25/CY26 EPS estimates by 6%/2%. However, CIEINDIA remains focused on sustaining profitability through operational efficiencies. The stock trades at 19.7x/18.7x CY25E/CY26E consolidated EPS. Reiterate BUY with a TP of INR502 (based on ~21x Jun’27E consolidated EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412