Buy Indraprastha Gas Ltd for the Target Rs. 250 by Motilal Oswal Financial Services Ltd

Margin expansion ahead!

* In 2QFY26, Indraprastha Gas (IGL)’s EBITDA/scm margin came in 9% below our estimate at INR5.2, primarily driven by higher gas costs due to the rising share of R-LNG in gas sourcing. Total volumes were slightly below at 9.3mmscmd (our est.: 9.7mmscmd). The resulting EBITDA/PAT was 13%/7% below our estimate at INR4.4b/INR3.7b.

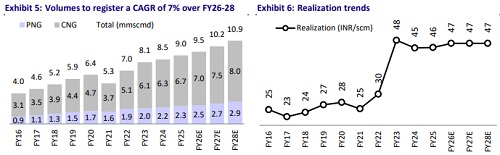

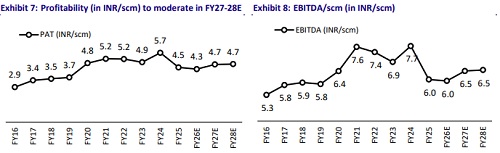

* Our earnings assumptions are conservative: We model an EBITDA/scm of INR6.0/ INR6.5/INR6.5 in FY26/FY27/FY28 vs. medium-term guidance of INR7-8. Further, we estimate 7% CAGR volume growth over FY25-28 vs. 10% YoY growth guided by management. Upside risks: 1) strong growth in new GAs (rising at 20%+ YoY), 2) majority of the GAs now reaching EBITDA positive levels, 3) margin expansion led by a change in taxation in the ONGC-GAIL contract and zonal tariff regulation, and 4) IGL's foray into natural gas distribution in Saudi Arabia, having a volume potential of 4.5- 5mmscmd.

* Trades at par with a one-year fwd. mean – 1 S.D. P/E: IGL currently trades at 17.2x 1yr. fwd. P/E (at par with its mean – 1 S.D. P/E). However, we believe that earnings have bottomed out now. We estimate a CAGR of 9%/9% in EBITDA/PAT over FY25-28. We value IGL at 16x Dec’27E SA P/E and add INR49/sh as the value of JVs to arrive at our TP of INR250/sh. At a 2.4% FY27E dividend yield and a 9% EPS growth, we believe the valuation remains attractive. Reiterate BUY.

Margin and volume growth guidance maintained

* In the 2QFY26 earnings call, IGL’s management maintained its EBITDA margin guidance of INR7-8 per scm in the long term. Management believes that the change in taxation in the ONGC-GAIL contract and the change in zonal tariff regulation will support margins. IGL has no exposure to spot LNG, which will reduce margin volatility. Additionally, the majority of its R-LNG term contracts are linked to HH prices, further enhancing stability.

* Management expects an exit rate of 10mmscmd in FY26 and maintains its long-term volume growth target of 10% YoY, driven by strong CNG PV sales. CNG volume, adjusted for DTC buses, grew 10% YoY in 2QFY26.

* Other key takeaways from the 2Q earnings call: 1) the company will incur a core capex of INR12-14b p.a. in FY26/FY27 (INR5.8b spent in 1HFY26). An additional INR7-8b could be spent on some diversification; 2) the 2Q gas sourcing split for priority segment sale: APM/NW gas/HP-HT/RLNG: 41%/13%/10%/37%; 3) outside Delhi GAs, the OMC trade margin contract includes a 5% YoY escalation clause. 4) IGL sees a very big opportunity in Saudi Arabia for I-PNG supply. IGL plans to generate revenue of INR1-1.5b and volumes of around 4-5mmscmd in the five cities of Saudi Arabia.

Miss due to lower-than-estimated EBITDA/scm margin; volumes in line

* IGL’s total volumes were slightly below our estimate at 9.31mmscmd (our est.: 9.66mmscmd), up 3% YoY.

* CNG and PNG volumes stood 4%/3% below est.

* EBITDA/scm came in 9% below our est. at INR5.2.

* Realization decreased ~INR0.1/scm QoQ, and gas costs increased ~INR1.5 per scm QoQ, while opex declined ~INR0.6 per scm QoQ.

* The resulting EBITDA was 13% below our estimate at INR4.4b (-17% YoY).

* IGL’s PAT came in 7% below our estimate at INR3.7b (-14% YoY), as other income came in above our estimates.

Valuation and view

* IGL currently trades at 17.2x 1-year fwd. P/E, at par with its mean – 1 S.D. P/E. However, we believe that earnings have bottomed out now. We estimate EBITDA margin to improve to INR6/INR6.5/INR6.5 per scm and volumes to clock 7% CAGR over FY25-28E. Resultant EBITDA and PAT are estimated to clock a CAGR of 9% each over FY25-28E.

* We value IGL at 16x Dec’27E SA P/E and add INR49/sh as the value of JVs to arrive at our TP of INR250/sh. At 2.4% FY27E dividend yield and 9% EPS growth, we believe the valuation is attractive. Reiterate BUY.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)