Buy Crompton Greaves Consumer Electricls Ltd for the Target Rs. 350 by Motilal Oswal Financial Services Ltd

Crompton 2.0 unlocking potential!

Investing in the transition from tradition to technology

* A leading consumer electricals company: Crompton Greaves Consumer Electricals (CROMPTON) is a prominent player in India's consumer electricals sector, with a strong presence across fans, lighting, pumps, and household appliances. The company is a market leader in the fans segment with ~25% market share and in residential pumps with ~30% market share. CROMPTON is among the top three companies in the lighting segment and is also one of the top five companies in the consumer appliances segment.

* Butterfly to enhance the appliances portfolio: CROMPTON acquired a majority stake (55%) in Butterfly Gandhimathi Appliances (BGAL) in Mar’22; it currently holds a 75% stake in the company. BGAL is one of the largest integrated domestic kitchen appliance manufacturers in India, and this acquisition has allowed CROMPTON to expand its appliance portfolio. The company anticipates realizing various revenue and cost synergies in the short to medium term and plans to leverage mutual strengths to expand its industry share and market reach.

* CROMPTON 2.0 – a renewed focus on revenue growth to drive profitability: The company launched ‘Crompton 2.0’ in Jun’23, emphasizing a renewed focus on revenue growth and profitability improvement. The Crompton 2.0 strategy entails substantial investments in growth initiatives, including people and process capabilities, brand reinforcement, consumer-driven innovation, and advanced goto-market strategies.

* Higher advertising expenses to strengthen brand value: CROMPTON has established a robust brand presence in the Electrical Consumer Durables (ECD) segment, offering a diverse portfolio of products across various categories and maintaining a pan-India footprint. The company has intensified its spending on advertising and promotions to enhance overall brand visibility.

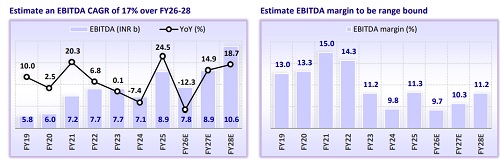

* Earnings and return ratios to improve following a dip in FY26E: We initiate coverage on CROMPTON with a BUY rating and a TP of INR350. Our TP is premised on 35x Dec’27E EPS. We estimate an EBITDA/PAT CAGR of 17%/21% over FY26-28 after a decline of 12%/16% in FY26E primarily due to weather-related disruptions, which impacted the ECD segment’s performance. We expect OPM to be 10.3%/11.2% in FY27/FY28E vs. 9.7% in FY26.

* Key downside risks: 1) higher competitive intensity and 2) a possible dip in demand due to the economic slowdown.

A leading consumer electricals company

* CROMPTON is a leader in the Indian fan market with ~25% market share. The company has a fan manufacturing capacity of 1.6m units per month. According to our channel checks, customers prefer the CROMPTON brand for its durability, efficiency, performance, and better after-sales services.

* It is among the leading players in the lighting segment with its innovative product launches in both B2B and B2C segments, market expansion, and excellent response to changing consumer demand. The company has a lighting manufacturing capacity of 5.6m units per month.

* CROMPTON is a leading player in the residential pumps segment with ~30% market share. In contrast, it holds a market share of ~7-8% in the agricultural pumps segment currently. CROMPTON’s pump capacity stands at 49,725 units per month currently

‘Butterfly’ to enhance the appliances portfolio

* CROMPTON acquired a majority stake (55%) in BGAL in Mar’22 and currently holds a 75% stake in the latter. The acquisition of BGAL expanded its appliances portfolio. The acquisition also fostered a synergistic partnership, allowing CROMPTON to enhance its appliance manufacturing capabilities, improve its operations and distribution, and integrate its businesses through the value chain.

* BGAL maintains a strong leadership position in the kitchen appliances sector in South India, particularly recognized for its wet grinders and LPG stoves. This sustained leadership is driven by compelling brand appeal, technical proficiency, and success in the e-commerce sector.

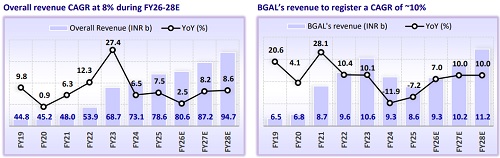

* In FY25, BGAL’s revenue dipped ~7% YoY to INR8.6b, and its share in CROMPTON’s consolidated revenue was ~11%. In FY24, it has implemented strategic initiatives aimed at business revival and improving profitability, which led to a revenue dip in FY24/1HFY25. We estimate BGAL’s revenue share will increase to ~12% over FY26- 28. We estimate BGAL’s revenue/EBITDA CAGR of ~10%/16% over FY26-28E

Crompton 2.0 – a renewed focus on revenue growth to drive profitability

* The company launched ‘Crompton 2.0’ in Jun’23, emphasizing a renewed focus on revenue growth and profitability improvement. The Crompton 2.0 strategy entails substantial investments in growth initiatives, including people and process capabilities, brand reinforcement, consumer-driven innovation, and advanced go-to-market strategies.

* Crompton 2.0 is centered on four key pillars: 1) growth and protection of the core portfolio; 2) wins in the kitchen segment; 3) transformation of the lighting business; and 4) foray into new segments. Organizational development, brand building, operational excellence, an effective go-to-market approach, digital enablement, consumer need-driven innovation, and portfolio premiumization are the key enablers to achieve the Crompton 2.0 objectives of accelerated growth and profitability.

* CROMPTON has stepped up investments in advertisements to enhance the overall brand visibility. Allocation towards digital platforms has been raised to drive consideration and preference for the brand. This has led to an increase in the brand’s salience and resulted in higher engagement on social media, given that the new-age audience spends significant time on social platforms.

Earnings and return ratios to improve; initiate coverage with a BUY rating

* We expect CROMPTON to report ~8% revenue CAGR over FY26-28. Revenue CAGR across key segments is estimated as follows: ECD (8%), Lighting (6%), and BGAL (10%).

* We estimate gross margin to improve over FY27-28, led by the company’s pricing strategies, product premiumization, and cost-efficiency measures. We estimate an EBITDA/PAT CAGR of 17%/21% over FY26-28 and an EBITDA margin of 10.3%/11.2% in FY27/FY28 vs. 9.7% in FY26E (avg. 12.3% over FY21-25).

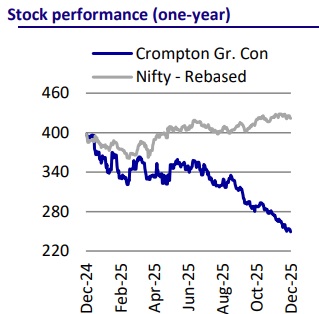

* We believe that higher investments in advertisement and promotional spending, along with its efforts to improve the brand strength and product portfolio, will bolster the future growth trajectory. The stock has traded at an average P/E of 35x in the last five years, and we assign the same multiple in Dec’27E to arrive at our TP of INR350. We initiate coverage on the stock with a BUY rating, implying a potential upside of 40%.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412