Neutral Eris Lifesciences Ltd for the Target Rs. 1,530 by Motilal Oswal Financial Services Ltd

Steady execution in DF drives earnings

Capacity build-up and CDMO momentum to support medium-term growth

* Eris Lifesciences (ERIS) reported in-line revenue/EBITDA for the quarter. However, there was a slight miss on earnings due to higher interest costs and tax rate for the quarter.

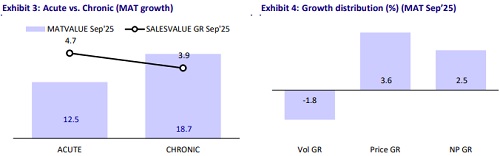

* Eris outperformed the industry in the domestic formulation (DF) segment, driven by steady growth across diabetes, cardiac, and dermatology. The company continued to leverage Biocon’s acquired portfolio, which supported overall YoY growth in the DF segment. ERIS has decided not to pursue further work on g-Saxenda, given the delay in regulatory approval.

* ERIS is tracking well on the CDMO segment, having recently secured projects worth INR1.2b-INR1.5b, which are scheduled for execution in FY27. It continues to build a healthy order book to be executed over the next 2-3 years.

* ERIS is also working to bring its sites under compliance (ANVISA approval for injectable units) to improve business prospects in international markets.

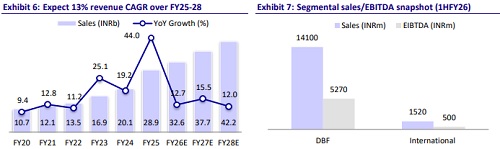

* We reduce our earnings estimate by 5%/6%/2% for FY26/FY27/FY28, factoring in: a) delays in the commissioning of the cartridge line at Bhopal, b) the cancellation of certain product launches (g-Saxenda), and c) extended debt repayment timelines due to near-term capex requirement.

* We value ERIS at 30x 12M forward earnings to arrive at a TP of INR1,530. While ERIS is making efforts to build capacities and capabilities to support 13%/15%/34% revenue/EBITDA/PAT CAGR over FY25-28, we believe the earnings upside is adequately factored in current valuations. Reiterate Neutral on the stock.

Better operating efficiency offsets the product mix impact

* ERIS’s 2QFY26 revenue grew 7% YoY to INR7.9b (vs our est: INR8.1).

* Gross margin contracted 40bp YoY to 74.5%.

* However, EBITDA margin expanded 70bp YoY to ~36.4% (our est. 36.2%), despite decreased gross margins. Employee cost/other expenses rose 40bp/declined 150bp YoY as a % of sales for the quarter.

* EBITDA increased 9% YoY to INR2.8b (vs our estimate : INR2.9b).

* Adj. PAT increased 31% YoY to INR1.2b (vs our estimate: INR1.3b), driven by lower depreciation/interest and tax rate.

* For 1HFY26, revenue/EBITDA/PAT grew 7.2%/9.8%/35.8% YoY.

Highlights from the management commentary

* In addition to its ongoing collaboration with Biocon, ERIS has expanded the partnership to include Aspart for the Indian market.

* While vial manufacturing recently commenced at the Bhopal unit, ERIS is currently completing stability testing for the products and, hence, has not yet released them in the market. Cartridge production has been delayed from 4QFY26 to 1QFY27.

* Due to expedited strategic investments, the target for reducing outstanding debt to INR18b has been pushed from 4QFY26 to 3QFY27.

* ERIS will not launch g-Saxenda due to delays in product approval.

* The company has identified three key growth drivers for the next 3-4 quarters: its diabetes franchise/integration of biotech manufacturing /ramp-up of international business.

* In the DF segment, price/volume contributed 2.5%/2.1% growth for the quarter, with the remaining YoY growth driven by new launches.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)