Buy Indigo Paints Ltd for the Target Rs. 1,400 by Motilal Oswal Financial Services Ltd

Recovery momentum building up; positive outlook for 2H

* Indigo Paints (INDIGOPN) reported standalone sales growth of 3% YoY in 2QFY26 as demand was impacted by extended monsoon. Management highlighted that Jul witnessed healthy offtake, Aug was soft, and Sep saw a recovery, with strong secondary sales and dealer inflows. Oct continued to see healthy traction, and the company expects double-digit growth in 2HFY26, aided by a pickup in demand momentum. Apple Chemie (subsidiary) sales grew 23% YoY. Consolidated sales rose 4% YoY to INR3.1b (est. INR3.0).

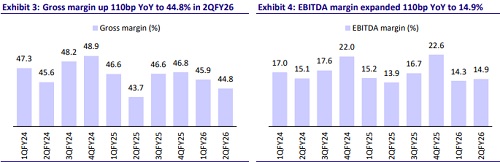

* Gross margin expanded 110bp YoY to 44.8% (est. 44.5%), led by favorable raw material prices and an improved product mix. EBITDA margin expanded 110bp YoY to 14.9% (above).

* INDIGOPN continues to focus on the premium and emulsion segments, with a deliberate shift away from the economy segment. It has consciously decided to not enter the low-margin general industrial segment, despite competitors pursuing it to boost revenue growth, as it affects margins and profitability. We model a CAGR of 13%/15% in revenue/EBITDA in FY26- 28E. We model EBITDA margin of 18.1% for FY26 and 18.6% for FY27.

* We reiterate our BUY rating with a TP of INR1,400 (based on 35x Sep’27E EPS), considering its growth outperformance, synergies with Apple Chemie, consistent capacity and distribution expansion, and its favorable valuation multiples vs. peers.

Demand shows improvement; beat on operating performance

Consolidated performance

* Mid-single-digit sales growth: Net sales grew by 4% YoY to INR3,121m (est. INR3,025m). Standalone revenue grew 3% YoY to INR2,985m. Apple Chemie revenue grew 23% YoY to INR136m.

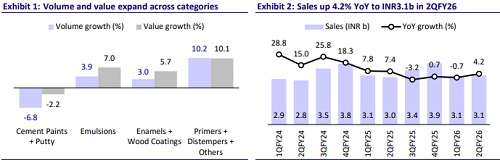

* Premium outpace economy segment: Putty & cement paint’s value and volume declined 2% and 7%, respectively. Emulsions reported 4% volume growth and 7% value growth. Enamel and wood coatings’ volume/value grew 3%/6% YoY. Primers and distempers posted volume growth of 10% and value growth of 10%.

* Expansion in margins: Gross margin expanded 110bp YoY to 44.8% (est. 44.5%), led by a better product mix. Employee expenses were up 5% YoY, while other expenses were up 4% YoY. EBITDA margin expanded 110bp YoY to 14.9% (est. 14.2%)

* Double-digit growth in profitability: EBITDA rose 12% YoY to INR465m (est. INR430m). PBT increased by 11% YoY to INR338m (est. INR322m). APAT grew 11% YoY to INR251m (est. INR240m).

Highlights from the management commentary

* Industry demand has improved after nearly six months of softness, despite continued weather-related disruptions from the extended monsoon. Jul saw healthy offtake, Aug was weak, and Sep showed a recovery trend.

* The company highlighted that larger competitors have not significantly impacted the company’s performance over the last two years. Despite unprecedented trade discounts offered by peers, the industry largely refrained from matching them, thereby preserving margins.

* For Apple Chemie, Maharashtra remains the key revenue contributor, while sales traction is strengthening in the Eastern and Southern regions.

* The Jodhpur water-based plant (90,000 KLPA capacity) is in the final stages of construction and is expected to be commissioned in 4QFY26.

Valuation and view

* We raise our EPS estimates by 5-6% for FY26 and FY27 on demand recovery and margin beat, led by an improving product mix.

* INDIGOPN's strategic shift to focusing on non-metro towns and increased investments in distribution and influencers as part of its Strategy 2.0 are proving to be a successful endeavor. That said, the company continues to focus on the premium and emulsion segments, with a deliberate shift away from the economy segment.

* Given the relatively small scale of INDIGOPN (INR13b revenue in FY25) in the paint industry, the company has been able to grow much faster than the industry. Consumers’ rising acceptance of the brand and the expansion of its distribution network have been driving its outperformance. However, the changing competitive landscape will be a key monitorable. We reiterate our

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412