Buy Hindustan Aeronautics Ltd for the Target Rs. 5,800 by Motilal Oswal Financial Services Ltd

Ticking all the right boxes

Hindustan Aeronautics (HAL) has received the follow-on order of 97 light combat aircraft (LCA) Mk1A worth INR624b from the Ministry of Defence (MoD). This is in addition to the previous order of 83 Tejas LCA Mk1A received in Jan’21. GE has now overcome the supply chain issues it was facing previously and resumed normal deliveries of the F404 engines, and we expect aircraft deliveries to accelerate in the coming quarters. With the contract for 97 additional jets now signed, we expect the related order of USD1b for 113 new F404 engines with GE to be finalized too in a few weeks. Our estimates build in execution scale-up of the manufacturing order book as HAL begins deliveries of the Tejas aircraft from 3QFY25 onward. We retain our positive stance on the sector and maintain our BUY rating on the stock with an unchanged TP of INR5,800, based on the average DCF and 32x Sep’27E earnings.

Indigenization gains with additional 97 LCA Mk1A order

With GE F404 engine deliveries now normalizing after past supply chain disruptions, the MoD has signed an INR624b contract with HAL for the procurement of 97 additional LCA Mk1A aircraft for the Indian Air Force, comprising 68 single-seat and 29 twin-seat fighters. Deliveries are scheduled to commence in FY28 and conclude within six years. Importantly, the order carries at least 64% indigenous content, with 67 additional locally sourced components compared to the previous contract, including the UTTAM AESA radar, Swayam Raksha Kavach electronic warfare suite, and indigenous control surface actuators. While this order was largely anticipated, it represents a significant growth milestone for HAL, reinforcing visibility of its long-term revenue stream and positioning it strongly within India’s self-reliance goal.

Update on the existing Tejas Mk1A project

For its existing Tejas Mk1A project, HAL has already received its third GE F404 engine, with another expected by Sep’25-end and six more in Oct-Dec’25. With engine supply stabilizing, HAL is targeting delivery of the first two Tejas Mk1A aircraft by Oct’25, with production ramp-up contingent on steady engine supplies and the resolution of radar and avionics integration issues. Successful delivery stabilization will position HAL to unlock operating leverage as volumes rise, thereby supporting margin expansion. With the ageing Mig-21 fighter jets set to retire on 26th Sep’25, the IAF combat strength will drop to 29 squadrons, making the deliveries of Tejas MK1A key to strengthening the capabilities of the Indian Defence Forces. Overall, the dual tailwinds of (i) order book expansion through the new contract and (ii) near-term progress on Tejas deliveries significantly de-risk HAL’s growth trajectory and reinforce its visibility as the cornerstone of India’s indigenous aerospace push.

Other potential near-term positives for HAL

* HAL signed a manufacturing license agreement (MLA) with GE, formalizing the ToT structure and enabling local production of the F414 engine. This ToT is estimated to be worth ~USD1b and will result in the new fighter jets having an indigenous content of around 75%.

* Twenty-eight private sector firms have expressed interest in collaborating with HAL for the development of India’s fifth-generation stealth fighter (AMCA project).

* The ambitious INR600b Su-30 avionics upgrade project is in the government approval phase, with D&D beginning in FY26 and aircraft orders likely by FY31.

* TPCR 2025 provides HAL with a clear roadmap for future defense platforms, enabling the company to align its R&D, production, and indigenous development efforts, ensuring steady order inflows, technological advancement, and long-term revenue visibility.

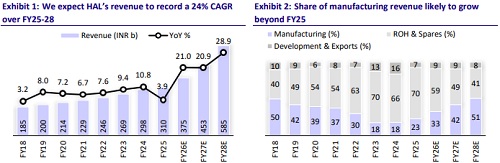

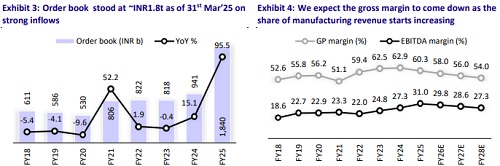

Financial outlook

We expect a CAGR of 24% in total revenue over FY25-28, primarily driven by a scaleup in manufacturing revenue. We project its EBITDA margin to remain strong at 29.8%/28.6%/27.3% in FY26/FY27/FY28, fueled by HAL’s indigenization efforts and lower provisions. With an annual capex of INR40b/INR50b/INR60b in FY26/FY27/FY28 and comfortable working capital, we expect a 17% CAGR in PAT over FY25-28. With improving revenue and stable margins, we expect RoE/RoCE to remain comfortable, reaching 22.2%/22.6% by FY28.

Valuation and recommendation

HAL is currently trading at 29.6x/24.1x FY27E/FY28E EPS. We maintain our estimates and reiterate our BUY rating on the stock with an unchanged TP of INR5,800, based on the average of DCF and 32x Sep’27E earnings.

Key risks and concerns

Key risks would include: 1) slower-than-expected finalization of large platform orders, 2) delays in deliveries of key components such as engines for Tejas Mk1A, 3) delays in payments from MoD, and 4) increased involvement of the private sector.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412