Buy Hindustan Aeronautics Ltd For Target Rs. 5,570 By Choice Broking Ltd

Engine Supply Eases; Provisions Dent Profitability

We believe HNAL delivered a reasonably strong operational performance in Q2FY26, even though profitability witnessed some contraction. The shortfall in EBITDA margin was primarily driven by higher provisioning expenses this quarter.

Despite this, we remain confident that HNAL is well-positioned for a stronger second half in FY26, with topline acceleration expected from multiple ongoing and new programs.

Operationally, HNAL’s momentum continues to strengthen – production lines across Bengaluru and the newly-commissioned Nashik facility are being ramped up. A robust order backlog of over 7.1x of FY25 revenue provides a multi-year revenue runway. The key execution constraint – GE F404 engine supply – appears to be easing, supported by resumed deliveries and the signing of a contract to supply an additional 113 F404- GE-IN20 engines. We believe this development is helping to pare down a major execution overhang and significantly de-risks HNAL’s FY27– FY28E revenue trajectory.

In our assessment, Tejas Mk1A delivery schedule remains a key investor monitorable in the next few quarters. We maintain our BUY rating on the stock with a target price of INR 5,570, valuing the company at 35x of FY27/28E EPS.

Revenue Largely in line; EBITDA Margin Falls Short

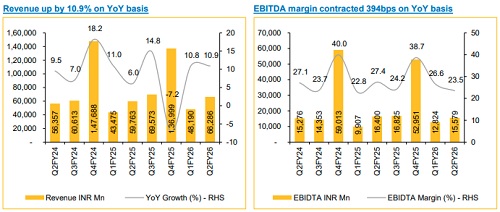

* Revenue for Q2FY26 up 10.9% YoY and up 37.6% QoQ at INR 66.3 Bn (vs CIE est. INR 65.6 Bn)

* EBIDTA for Q2FY26 down 5.0% YoY and up 21.5% QoQ at INR 15.6 Bn (vs CIE est. INR 17.9 Bn). EBITDA margin stood at 23.5%, contracted by 394bps YoY (vs CIE est. of 27.4%)

* The shortfall in margin can be primarily attributed to higher provisioning expenses this quarter, which temporarily impacted operating profitability.

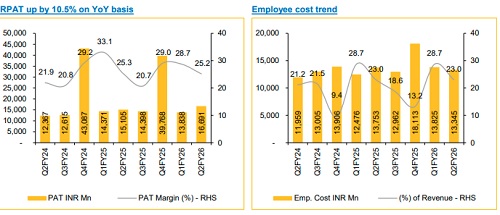

* PAT for Q2FY26 up 10.5% YoY and up 20.6% QoQ at INR 16.7 Bn (vs CIE est. INR 17.1 Bn). PAT margin contacted marginally by 10bps YoY, reaching 25.2% (vs CIE est. 26.0%).

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131