Buy Yatra Online Ltd For Target Rs. 215 By JM Financial Services Ltd

Steady performance amidst drag on margins due to MICE

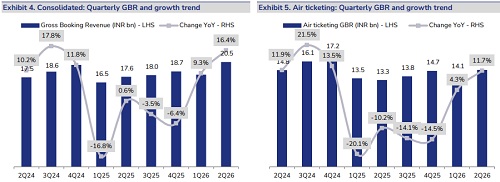

Yatra delivered a healthy performance in 2Q led by strong momentum in its Hotels & Packages (H&P) segment. Consol. GBR rose 16.4% YoY (+13.7% QoQ), ahead of JMFe by c.10%, driven by ~40% YoY growth in H&P amidst robust corporate and MICE demand. Air bookings grew 11.7% YoY (+5% QoQ) led by higher realisation despite a 3.5% decline in passengers due to capacity constraints. Revenue rose 48.4% YoY while EBITDA grew ~1.6x YoY to INR 239mn (1% ahead of JMFe), though margin at 6.8% (-419bps QoQ) was a miss due to elevated service costs from MICE mix. The management raised its FY26 guidance for revenue less service costs to 22–23% (from 20% earlier) and Adj. EBITDA growth to 35–40% (from 30%+) underpinned by robust corporate traction and improving operating leverage. We, however, continue to build above guidance estimates due to strong corporate client additions and margin normalisation expected in 2H. We maintain ‘BUY’ with a revised Sep’26 TP of INR 215 (32x NTM PER vs. 30x earlier).

* H&P segment drives steady growth: Consol. gross bookings (GBR) in 2Q stood at INR 20.5bn (16.4% YoY, 13.7% QoQ), a beat on JMFe by 10.3%. Air segment bookings grew 11.7% YoY (+5.0% QoQ) due to 15.7% YoY growth in realisation, while passengers booked declined 3.5%. The decline was primarily due to capacity constraints. H&P bookings, on the other hand, grew 40.4% YoY (+49.8% QoQ) due to strong demand from corporates. While standalone room nights booked grew 9.3% YoY, sequential growth was 19.1%. Consol. revenue grew 48.4% YoY (49.8% QoQ) to INR 3.51bn, driven by ~59% growth in the H&P segment. EBITDA margin expanded 292bps YoY to 6.8 % (-419bps QoQ), but was a miss on JMFe of 10.1% due to due to higher-than-expected service cost on account of sharp increase in MICE bookings. Nevertheless, EBITDA grew at a robust 159.8% YoY to INR 239mn, a marginal beat on JMFe by 1%. However, Adj. PAT was INR 143mn, a miss on JMFe of INR 173mn due to lower-than-expected other income and higher depreciation expenses.

* Management raises FY26 guidance: While retail bookings remained under pressure in the air business, the management expects the trend to flat line/slightly improve going ahead. Overall, it revised revenue less service costs guidance to 22-23% (from 20% earlier) and Adj. EBITDA growth guidance to 35%-40% (from 30%+), for FY26. We, on the other hand, are building in consol. revenue less service cost and Adj. EBITDA growth of 31% and 63%, respectively, basis healthy trends in 1H and a favourable base. The company also suggested reduced working capital needs going ahead as it is moving corporate clients from direct credit to corporate credit cards. Accordingly, it expects to report positive OCF in FY26.

* New corporate client addition remains strong: Yatra added 34 new corporate accounts in 2Q with an annual billing potential of INR 2.6bn. Since listing, the company has added 290+ corporate clients with combined billing potential of ~INR 18bn. Its customer base now spans over 1,300+ large corporates and ~58k SME clients.

* Maintain ‘BUY’ with a revised Sep’26 TP of INR 215: We raise consol. revenue estimates by 25-28% over FY26-28 factoring in higher MICE mix. However, our revenue less service costs estimates go up only ~2% due to sharp proportionate increase in service costs. Our EBITDA margin forecasts are also trimmed by 70bps-150bps over FY26-28 due to growing MICE mix. Nevertheless, our EBITDA forecasts are raised by 7-19% as we build in lower incentives (on account of growing share of corporate business) and better operating leverage. While higher D&A and lowering down of other income leads to ~7% cut in FY26 EPS, FY27-28 EPS is raised by 8-9% over FY27-28 due to higher EBITDA expectation.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361

.jpg)