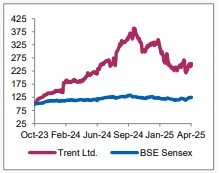

Buy Trent Ltd for the Target Rs. 6,650 by Axis Securities Ltd

.jpg)

Beat On All Fronts; Maintain BUY

Est. Vs. Actual for Q4FY25: Revenue –BEAT; EBITDA – BEAT ; PAT – BEAT

Changes in Estimates post Q4FY25

FY26E/FY27E – Revenue: 7%/9%; EBITDA: 5%/10%; PAT: 0%/6%

Recommendation Rationale

* Strong Performance - Trent delivered strong performance in Q4FY25, with revenue rising ~29% YoY to Rs 4,106 Cr, surpassing expectations. The fashion segment maintained its growth momentum with mid-single-digit like-for-like growth in Q4 and double-digit growth for the whole year. FY25 revenue rose 40% YoY, and volume growth stood at 40%, which was led by rapid store expansion. The company’s total retail area stood at 13 Mn sqft.

* Strategic Expansion Driving Market Penetration: In Q4, Trent added 10 Westside and 130 Zudio stores on a net basis, taking the total count to 248 and 765, respectively. The expansion strategy remains anchored in deepening its presence across metro and Tier 1 cities, while strengthening performance across key micro markets

Sector Outlook: Positive

Company Outlook & Guidance: We maintain our BUY recommendation as a sharp correction provides a better entry point, as the long-term outlook remains strong

Current Valuation: SOTP

Current TP: Rs 6,650/share (Previous TP: Rs 7,100/share).

Recommendation: With a 24% upside potential from the CMP, we maintain our BUY rating on the stock.

Financial Performance

The company’s revenue grew ~29% YoY to Rs 4,106 Cr, while its fashion concept registered midsingle digit LFL growth in Q4FY25. EBITDA increased by ~38% YoY, while EBITDA margins improved by 101bps YoY to 16% due to store optimisation. PAT stood at Rs 350 Cr, down by ~47% YoY, primarily due to a one-off gain in the base quarter

Outlook: Trent continues to deliver strong revenue growth despite macro headwinds. The correction in stock price has improved the risk-reward profile, offering a favourable entry point for long-term investors. With structural tailwinds in organised retail and ample headroom for market share gains, Trent remains well-positioned to benefit from the sector's multi-year growth trajectory. Furthermore, we remain positive on Trent as we expect robust sales growth to continue ahead of its peers, underpinned by its strategic focus on rapid store expansion and continual assortment refreshment, which should drive higher footfall. Furthermore, earnings improvement across all formats reinforces our confidence. Trent’s recent approach to implementing its successful playbook at Star Business, driven by private labels, has proven beneficial and is expected to be a key growth catalyst. Additionally, the company's geographical expansion into the UAE, the launch of Zudio Beauty, and its entry into the fast-growing LGD Jewellery segment are anticipated to contribute significantly to long-term growth. Based on this thesis, we maintain a positive long-term outlook on Trent.

Valuation & Recommendation

We remain positive on the company and expect Revenue/EBITDA growth of 29%/31% CAGR on a standalone business over FY24-27E. We maintain our BUY rating on the stock and value the company on an SOTP basis with a revised TP of Rs 6,650/ share. Our TP implies an upside of 24% from the CMP.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633