Hold Lemon Tree Hotels Ltd for the Target Rs. 174 By Prabhudas Liladhar Capital Ltd

Operational performance turns out to be a drag

Quick Pointers:

* Plans to open Aurika with 500-550 keys at Nehru Place, NCR.

We cut our EPS estimates by 6%/5%/1% for FY26E/FY27E/FY28E as we fine tune a) our other expense assumptions given the ongoing renovation exercise and b) raise our interest expense forecast as we tweak our deleveraging timelines (debt reduction of Rs885mn in 1HFY26). LEMONTRE IN’s operational performance was disappointing with EBITDA margin of 42.7% (PLe 45.1%) due to increased investments in renovation, technology, and onetime ex-gratia payment to employees. Led by gradual stabilization of Aurika, MIAL and expected improvement in RevPAR given the ongoing renovation exercise, we estimate revenue/EBITDA CAGR of 9%/12% over FY25-FY28E. Near term growth will hinge on improvement in same-store RevPAR as 91/165 keys at Shimla/Shillong are expected to be operationalized in FY27E/FY28E while inauguration of Aurika, NCR is at-least 3-4 years away (exact timeline is not disclosed). We maintain HOLD on the stock with a TP of Rs174 (24x Sep-27E EBITDA; no change in target multiple)

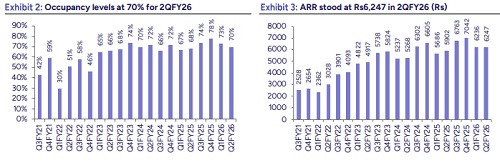

RevPAR increased 8.0% YoY: Revenue increased 7.7% YoY to Rs3,063mn (PLe Rs3,082mn). ARR increased 5.8% YoY to Rs6,247. RevPAR grew 8.0% YoY to Rs4,358, while occupancy stood at 69.8%.

EBITDA remains flat YoY: EBITDA was flat on YoY basis to Rs1,307mn (PLe Rs1,390mn) with a margin of 42.7% (PLe 45.1%). PAT after MI increased 16.7% YoY to Rs346mn (PLe Rs339mn) with a margin of 11.3% (PLe 11.0%) as against 10.4% in 2QFY25.

Con-call highlights: 1) Aurika, Nehru Place is likely to generate an IRR north of 15%. 2) Once operational, Aurika, Nehru Place is expected to generate ~Rs1.5bn of EBITDA, with one-sixth payable to the DDA. 3) During the quarter, Gurgaon’s RevPAR declined 9.0% YoY, as several rooms were temporarily closed due to renovations. 4) October’25 witnessed a 4% drop in occupancy, mainly impacted by festive season. Despite a weak October, revenue growth is expected to be in mid-teens for 3QFY26E. 5) EBITDA margins in FY26E are expected to remain in line with FY25 levels. 6) Aurika, MIAL’s negotiated room nights rose from 256 in 2QFY25 to 320 in 2QFY26. Retail/MICE room nights also increased from 80/19 to 180/41 over the same period. 7) In the first 45 days of 3QFY26E, Aurika, MIAL’s revenue was up ~30% YoY. 8) 1,600 rooms are slated for renovation by next year at an average cost of ~Rs1mn per room. 9) LEMONTRE IN has signed two new properties with RJ Corp Ltd, namely Lemon Tree Premier, Ayodhya and Lemon Tree Premier, Guwahati. Both hotels will be developed by RJ Corp, with LEMONTRE IN providing technical expertise. For this LEMONTRE IN would charge a fee of ~Rs150mn per property, along with a management fee of ~9% on revenue. 10) RJ Corp will also hold a 50% stake in Aurika, Shillong. 11) Aurika, Shillong is expected to open by mid-2027E. 12) The construction timelines for Aurika, Shimla has been deliberately delayed. Renovation of existing rooms was given priority over Aurika, Shimla.

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271