Buy Amber Enterprises India Ltd for the Target Rs. 9,782 By Prabhudas Liladhar Capital Ltd

Component led strategy to drive margin and scale

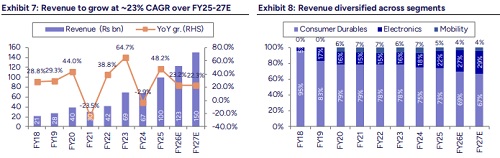

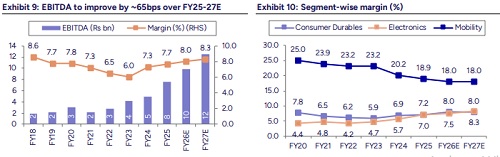

We initiate coverage on AMBER with ‘BUY’ rating and SOTP-based TP of Rs9,782 valuing its Consumer Durables segment at 25x EV/EBITDA Sep-27E, which implies 24x EV/EBITDA Sep’27E and 50x Sep’27E earnings. We believe AMBER is poised for healthy long-term growth on the back of 1) diversification of the Consumer Durables segment beyond room air conditioners (RACs), 2) improved capacity utilization and broader product offerings across segments, 3) capacity expansion, entry into the fast-growing PCB market, and a strong order book of Rs50bn in the Electronics segment, 4) revival in the Mobility segment, backed by a robust Rs20bn order book, product diversification, and execution of delayed projects, and 5) market leadership in RAC contract manufacturing. We estimate revenue/EBITDA/PAT CAGR of 22.8%/27.9%/49.6% over FY25-27E with EBITDA margin expanding by ~65bps to reach 8.3% by FY27E. Despite a strong capex plan, robust financials are expected to help maintain RoCE/RoE at healthy levels, 18.3%/19.3% by FY27E. Initiate ‘BUY’.

Well-diversified, expanding TAM: AMBER is strategically diversifying its Consumer Durables segment beyond RACs through both organic initiatives and acquisitions, including 50:50 JV with Resojet to enter fully automatic top and front load washing machines (WMs). This move will enhance capacity utilization, broaden product offerings, and increase non-RAC revenue share to 18.3% by FY27E. Further, AMBER is leveraging government incentives through ~Rs21bn capex (FY21–25), to expand its Consumer Durables facilities and reach 30-32% revenue contribution from components beyond RACs in the Consumer Durables segment. This segment is expected to deliver 17.1% revenue CAGR over FY25–27E with EBITDA margin expanding ~80bps.

Building full-stack EMS capabilities for long-term upside: AMBER is scaling its Electronics segment through backward integration, new product additions (HDI and semiconductor substrates), and diversified applications to drive long-term growth and margin expansion, supported by a strong Rs50bn order book. It is on track to become a full-stack electronics manufacturing services (EMS) provider, and the management expects Electronics margin to improve from ~7% in FY25 to 10–12% in the next 2-3 years. Further, AMBER has planned a capex of Rs6.5bn in Ascent Circuits and will invest Rs30bn over the next 5 years in the Electronics segment. We expect the Electronics segment to witness 41.2% revenue CAGR over FY25–27E, along with 125bps expansion in EBITDA margin, resulting in a robust 53.3% EBITDA CAGR.

Increased focus on Mobility segment to drive growth: AMBER's Mobility segment is poised 17.3% CAGR over FY25–27E, supported by a strong Rs20bn order book, product expansion, and revival of delayed projects like Metro and Vande Bharat. With targets to capture 28–30% of the BoM per railway coach and achieve 18% EBITDA margin, AMBER is scaling up through greenfield expansions, JVs with Yujin and Titagarh, deeper integration into high-value rail subsystems, and defense exports.

Above views are of the author and not of the website kindly read disclaimer

.jpg)

Ltd ( 1 ).jpg)

Ltd.jpg)