Neutral Fsn E-Commerce Ventures Ltd for the Target Rs. 280 by Motilal Oswal Financial Services Ltd

Beauty, Fashion, and a Full Valuation

FSN E-Commerce Ventures (Nykaa) is a leading specialty platform for beauty and personal care (BPC) products, bringing brands, consumers and discovery together in one focused ecosystem. With a ~27% share in India’s online BPC market, Nykaa operates as a category specialist in a segment where product authenticity, brand trust and guided discovery drive purchase decisions more often than aggressive discounting or assortment.

* While generalist e-commerce platforms compete on logistics and discounting, Nykaa operates on a platform where content, influence and brand trust drive consumer behavior. Its inventory-led model for beauty products, direct brand relationships and omni-channel presence continue to differentiate it in a market plagued by counterfeits and commoditization.

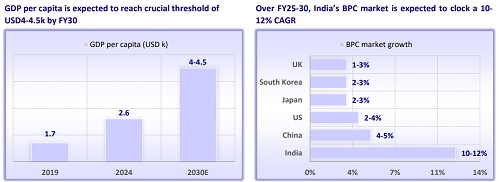

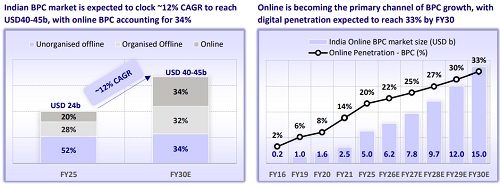

* India’s BPC market is at a structural inflection point. With online penetration set to rise from ~22% in FY25 to ~35% by FY30, the premium beauty product segment growing faster than the mass segment, and D2C brands proliferating, Nykaa sits at the convergence of all three tailwinds. Unlike generalist platforms and quick commerce players, Nykaa’s growth is aligned with premium skincare, cosmetics, fragrances and discovery-led consumption. ? We see Nykaa as a beneficiary of India’s shift from offline to online retail and from unorganized to organized formats, particularly in the BPC segment. With a leading position in the online BPC market, the company is well placed to scale up as the category matures.

* We estimate Nykaa to deliver a CAGR of 26% in BPC gross merchandise value (GMV) over FY25-30E and 22% over FY25-37E, driven by continued online adoption and a rising premium mix. BPC EBITDA is estimated to clock a CAGR of 35% over FY25-30E, supported by operating leverage and increasing contribution from owned brands under House of Nykaa. While we remain positive on the long-term fundamentals of both the BPC and Fashion businesses, we believe much of this growth trajectory is already reflected in current valuations.

* We value Nykaa on the SoTP basis. For the BPC business, we ascribe a 50x EV/EBITDA multiple, reflecting its category leadership, higher margins vs. horizontals, and better earnings visibility from owned brands, implying a pershare value of INR255. For the fashion business, we use the DCF approach, implying a per-share value of INR31. Adjusting for net debt, we arrive at a target price of INR280, implying 11% upside. Following the strong share price performance over the past year, the risk-reward appears balanced, limiting near-term upside; accordingly, we initiate coverage on Nykaa with a NEUTRAL rating.

Why Nykaa wins in beauty: Penetration, premiumization and D2C - Nykaa rides all three

* India’s BPC market is entering its strongest decade of value creation. The market size is expected to reach USD40-45b by FY30 at a 12% CAGR. Consumption is transitioning from utility to routine-driven segments (skin, hair, wellness), leading to structurally higher ticket sizes and frequency resilience.

* Online BPC market is expected to grow ~2x faster than the overall BPC market, supported by rising internet penetration, digital influence, and formalization of retail.

* Premium categories are driving a disproportionate share of incremental value. Nykaa’s portfolio is structurally skewed to skincare, cosmetics and fragrances – the categories that scale up faster as income rises.

* D2C acts as a flywheel - Nykaa gains trust, authenticity and exclusivity, while brands gain discovery and scale. Nykaa’s owned BPC brands now contribute 18% of BPC GMV, providing a structural margin tailwind and better unit economics.

* Premium beauty categories such as cosmetics and fragrance are expanding at 13-15% CAGR, outpacing mass personal care, reflecting rising willingness to pay.

House of Nykaa: Private labels as the margin compounding engine

* House of Nykaa has built a repeatable brand creation playbook, spotting whitespaces, incubating digitally, and scaling up via omni-channel.

* House of Nykaa has an annual GMV rate of ~INR29b as of 2QFY26, led by Dot & Key, Kay Beauty, and Nykaa Cosmetics.

* House of Nykaa has evolved from an experimentation layer into a meaningful profit engine, with owned/co-created brands now contributing ~14%/~11% of Nykaa’s FY25 GMV and scaling up faster than the platform average.

* Unlike pure marketplaces, Nykaa’s private labels structurally improve gross margins, reduce customer acquisition costs (CAC), and improve lifetime value (LTV) through higher repeat engagement.

* A higher owned-brand mix structurally improves gross margins and LTV/CAC ratio, supporting long-term operating leverage.

* As D2C brands mature and competition for attention rises, we believe Nykaa’s platform will increasingly become the distribution partner of choice, creating a virtuous cycle: platform scale attracts brands -> brand exclusivity drives traffic.

* We believe House of Nykaa is becoming an increasingly meaningful contributor to BPC, supporting a higher blended margin profile over time.

Vertical specialist vs. Horizontals vs. Quick commerce: Nykaa in sweet spot

* In our view, BPC is fundamentally a discovery-led category rather than a convenience-led one. While quick commerce is structurally well-suited for replenishment, it does not address the influence, exploration and trust that drive beauty product purchases.

* Beauty product consumption is shaped by shade matching, routines, content-led education and brand storytelling capabilities that neither horizontals nor QC platforms are structurally designed to deliver at scale. Generalist platforms optimize for logistics and price comparison, while QC optimizes for speed. Neither is optimized for authenticity and persuasion.

* Nykaa’s omni-channel strategy strengthens this further. Beauty is one of the few categories where offline discovery converts into online replenishment.

* We believe Nykaa is structurally positioned between offline inefficiency and online commoditization, owning the premium digital middle.

Fashion: Strategic adjacency, not core valuation driver

* Nykaa Fashion operates in a structurally different category from beauty, with lower customer loyalty, higher return rates, and greater pricing fragmentation, which inherently compress margins and elongate the path to profitability.

* While the average order value (AOV) remains among the highest in online fashion, sustained profitability is structurally harder to achieve due to returns, discounting cycles, and competitive intensity.

* We believe Fashion remains an optional growth vector rather than a core thesis driver. Management’s focus on tightening curation, improving repeat rates and reducing return intensity is directionally right, but the category lacks the predictability of the beauty segment.

* Nykaa’s defensibility in fashion lies in narrow, high-intent consumer cohorts – affluent, brand-conscious shoppers in Tier 1 and emerging urban markets. Access to differentiated labels, fresher collections and a higher-quality user base positions Nykaa Fashion as a premium niche platform rather than a massmarket competitor.

* We expect Fashion to move toward breakeven over FY26-27E but do not assume material margin contribution in our valuation.

Valuation and view: Initiate with NEUTRAL

* Nykaa stands to benefit from the growing influx of digital native consumers as India’s retail landscape continues to shift from offline to online and from unorganized to organized formats.

* With a leading share in the beauty segment, a portfolio of premium and exclusive brand partnerships, continued momentum in the House of Nykaa portfolio, and improving unit economics within Nykaa Fashion, the company has built a differentiated platform across BPC and Fashion.

* For Nykaa’s BPC segment (~90% of revenue), the company continues to deepen its presence across pockets of affluence. With ~18m transacting customers, it recorded customer additions of 18.1%/27.4% in FY24/FY25, and we estimate Nykaa to sustain a healthy customer addition of 25.2%/22.5% in FY27/FY28. We estimate GMV to compound at 26% during FY25-30E and 22% during FY25-37E.

* On profitability, EBITDA is estimated to grow at a CAGR of ~35% over FY25–30E, supported by robust gross margins and operating leverage. In addition, the rising contribution of owned brands under the House of Nykaa portfolio is expected to support medium-term margin expansion.

* For Nykaa Fashion, GMV is estimated to grow at 26.0% over FY25–30E. While the Fashion business remains at an early stage of profitability, but its unique and differentiated product listings and fresher assortments keep Nykaa’s competitive advantage relevant.

* The marketplace-led model limits inventory intensity and working capital requirements. The Fashion segment is expected to achieve EBITDA breakeven by end-FY26, with margins gradually expanding to low single digits over FY25–37E.

* We value Nykaa on the SoTP basis. For the BPC business, we ascribe a 50x EV/EBITDA multiple, implying a per-share value of INR255, reflecting Nykaa’s leadership in online BPC, superior gross margins versus horizontal platforms, and visibility on medium-term growth driven by premiumization and owned brands.

* We value the Fashion business using a DCF framework, assuming a GMV CAGR of 20% over FY25-37E and gradual EBITDA margin expansion over the same period (per share contribution of INR31). Our WACC and terminal growth assumptions stand at ~11% and 5.5%, respectively. Adjusting for net debt, we arrive at a TP of INR280 per share (implying 11% upside).

* While we remain positive on the long-term fundamentals of both the BPC and Fashion businesses, we believe current valuations already reflect much of the prevailing growth expectations. Following the strong share price performance over the past year, the risk-reward appears balanced, limiting near-term upside. Accordingly, we initiate coverage on Nykaa with a NEUTRAL rating.

* Key downside risks: 1) failure to continuously refresh assortments in a fastevolving beauty landscape, 2) demand slowdowns in discretionary consumption, 3) escalation in customer acquisition costs, and 4) slower-than-expected profitability in Fashion. Additional risks stem from intense competition across platforms and D2C brands, and any lapse in product authenticity could materially impair customer trust and platform equity.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412