Buy Kotak Mahindra Bank Ltd for the Target Rs. 2,480 by Prabhudas Lilladher Ltd

PL&CC pick-up/stress reduction key to re-rating

Quick Pointers:

* Mixed quarter; lower opex cushions core PAT; provisions were a miss.

* For FY27/28, we trim opex growth but increase provisions.

KMB saw a mixed quarter. Core PAT was a 5.3% beat as opex was 6.9% below PLe, however, despite credit costs declining QoQ from 115bps to 92bps, they were elevated due to write-offs. Stress has been resolved in PL, reducing in MFI and gradually falling in CC. Retail CV continues to see stress. Loan growth was healthy at 4.0% QoQ mainly driven by corporate, housing/SME. Recovery in PL/CC has been slower as combined growth was -1.5% QoQ while peers like AXSB/ICICIB/HDFCB saw better growth at 4.2%/3.6%/1.9%. Opex continues to remain muted driven by automation and lower acquisition cost due to lesser CC volumes; however, we expect opex growth to normalize to 16% in FY27/28 vs 3.7% in FY26. Acceleration in unsecured loan growth and decline in credit costs remain key levers to re-rating. We keep multiple at 2.3x but increase TP to Rs2,480 from Rs2,350 as we roll forward to Sep’27 core ABV. Retain ‘BUY’.

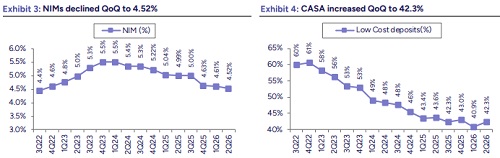

* Beat on core PAT due to lower opex: NII came in at Rs73.1bn (PLe Rs73.2bn). NIM (calc.) was higher at 4.52% (PLe 4.49%); reported NIM fell by 11bps QoQ to 4.54%. Loans/deposits as expected grew by 15.8%/14.6% YoY. CASA improved to 42.3% (40.9% in Q1’26). LDR was 87.5% (86.7% in Q1’26). Other inc. was lower at Rs25.9bn (PLe Rs29.5bn) due to treasury loss; fees came in at Rs24.2bn (PLe 24.7bn). Opex at Rs46.3bn was 6.9% lesser due to both, staff cost and other opex. Core PPoP at Rs50.9bn was 5.8% above PLe; PPoP was Rs52.7bn. GNPA was lower 1.39% (PLe 1.45%) due to write-offs at Rs11bn (PLe Rs7.4bn). Gross slippage was in-line at Rs16.3bn; recoveries were a tad lower at Rs6.9bn (PLe Rs7.7bn). Provisions were a drag at Rs9.5bn (PLe Rs8.6bn) that included Rs490mn reversal on AIF provision as per RBI circular. Core PAT was 5.3% above PLe at Rs31.2bn; PAT was Rs32.5bn.

* Sequential loan growth led by corporate/SME: Credit growth was healthy at 4% QoQ mainly led by: corporate 6.2%, HL 4.8%, BuB 7.5% & SME 6.9%. Wholesale loan growth was led by short-term/trade assets. Credit substitutes fell by 10% QoQ due to better pricing in loan market; as per the bank pricing continued to be challenging in long-term and project financing. Momentum in SME, mid-market, and BuB remains healthy due to WC demand and capital required in flow-based businesses. Retail CV is witnessing stress which is driving lower disbursals. Unsecured (PL+CC+MFI) growth remains sluggish (- 1.7% QoQ); recovery in CC segment has been slower than expected.

* NIM to pick-up in H2FY26; opex remains controlled: Bank expects NIM to recover in H2FY26 driven by TD rate cut and CRR benefit. Opex surprised positively and fell by 4.2% QoQ driven by (1) sizable payroll cost reduction as headcount is stable which is attributable to process de-congestion led by automation and efficiency and (2) lower variable acquisition cost due to lesser than expected CC volumes and spends also leading to muted rewards’ cost. We expect opex growth to normalize to 16% in FY27/28E vs 3.7% in FY26.

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271