Buy Max Healthcare Institute Ltd For Target Rs.1,400 by Prabhudas Liladhar Capital Ltd

Strong quarter; insurance issues resolved

Quick Pointers:

* CGHS price hike to add Rs 2bn of revenues annually once fully implemented across schemes which are linked to CGHS rates

* Insurance issues of cashless with select insurance players being resolved

Max Healthcare Institute (MAXHEALT) reported strong EBITDA growth of 23% YoY to Rs 6.94bn. The company showed phenomenal growth with ~19% EBITDA CAGR over FY22-25. We expect pick-up in the growth momentum given 1) strong expansion plans (+3700 additional beds over FY25-28E), 2) improving payor mix and 3) Bolt on acquisitions like recently added in Lucknow, Nagpur and Noida. Operational efficiency has also been commendable, especially in competitive markets like NCR. Our FY27E/28E EBITDA stands cut marginally by 2-3% and we expect EBITDA/PAT to grow ~2x over FY25-28E. We ascribe 35x EV/EBITDA based on Sept 2027E. Maintain ‘BUY’ rating with TP of Rs. 1,400/share.

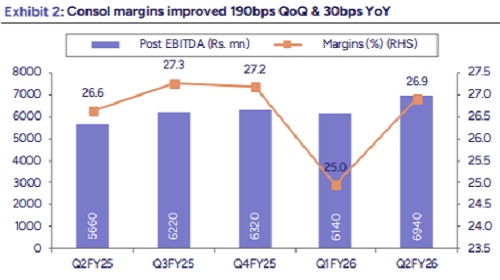

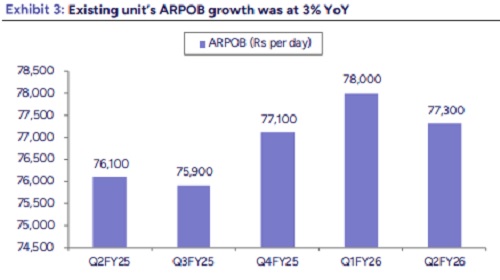

Strong quarter; EBITDA grew by 23% YoY: Base business EBITDA improved 19% YoY with margins expanding 90bps YoY to 27.5%, supported by contributions from the Lucknow Nagpur and Dwarka units, which had a low base. During Q2, the company operationalized 111 beds across Shalimar Bagh, Mohali and Dwarka. Additionally, it divested 100 beds at the Jaypee, Chitta facility. New units which now comprise of Noida contributed EBITDA of Rs 230mn vs Rs 250mn in Q1. Overall margins increased by 190bps QoQ to 26.9%. Consol occupancies decline by 400 bps YoY to 77% due to weak dengue season. ARPOB improved by ~2% YoY to Rs 77.3K. Existing units ARPOB which now includes Lucknow, Nagpur and Dwarka units came in at Rs78.7k; up 3% YoY.

Revenue traction across units: Consolidated revenues came at Rs. 25.8bn (up 21% YoY); of which Rs.1.44bn contributed by Noida unit. Base business revenue growth was 14%. Institutional revenue share was at 21.5% vs 21.8% in Q1. Max Lab and Max@Home revenue stood at Rs 540mn and Rs 630mn respectively. During Q2, net debt increased by Rs. 3.12bn QoQ to Rs20.7bn.

Key Conference Call Highlights:

* Bed Expansion plans: MAXHEALT continues with aggressive brownfield-led expansion, with ~50% of upcoming capacity being brownfield.

* Capex: Capex Q2FY26 capex stood at Rs 4.6bn, directed toward ongoing capacity expansion and hospital upgrades. H1FY26 total capex deployment was at Rs 8.9bn for expansion projects, in addition to Rs 1.3bn invested in land acquisition and the Vaishali brownfield development.

* Project updates:

* Nanavati (Phase 1 with 268 beds): Plans commissioning of multiple floors this week. Max Smart (400 beds): Commissioning targeted within 30 days; deep cleaning in final stages. MAX Vikrant (550 beds): Work to start immediately post Max Smart commissioning; completion expected in ~40 months. Sec56, Gurgaon (501 beds): Project progressing well, though some impact seen on base work. Nagpur (100 beds): Environmental clearance received; awaiting consent to establish. To complete within 24 months of CTE receipt. Patparganj (397 beds): All approvals received; barricading complete. Completion is expected by FY28. Zirakpur, Mohali (asset-light): 400-bed tower expected by CY27-end, progressing faster than planned. Thane (500 beds): Master plans finalized; project expected to complete in ~42 months. Pitampura, Delhi (250 beds): Building-plan approvals expected this quarter; post-approval timeline 36 months.

* Lucknow (Phase 2 with 550 beds): Current capacity of 413 beds, guided to increase to 550 by FY26-end. Onco-radiation + PET-CT to launch in two weeks. Lucknow margins remain at +30%; QoQ revenue growth of 17–18%, EBITDA up +5%.

* Max Mohali Brownfield (160 beds): Commercialized 53 beds, including the new radiation oncology program, from the 160-bed brownfield tower at Mohali in Q2. The remaining floors are being phased in, with ~95 additional beds expected to become operational in Q3.

* Max Vaishali (Brownfield; 140 beds): Demolition complete; approvals in process. Completion is expected 24 months after approvals.

* New Units:

* Noida: 18-acre of land parcel enables multi-phase expansion; additional 700- bed land (adjacent) + separate 400-bed Greater Noida parcel. Insurance empanelment was completed last quarter, and the unit is currently operating at ~18% EBITDA margins with 62% occupancy. Management expects a pickup from January, aided by new clinical program launches.

* Dwarka: Ramp-up is underway, with the addition of institutional business temporarily diluting ARPOB, and the oncology bunker yet to commence operations. Q2 occupancy remained strong at 81%+, while EBITDA margins stood at ~15%. Management expects ARPOB improvement, margin uplift and a rising oncology case mix once the radiotherapy bunker becomes operational, following which a 200-bed expansion is planned.

* Lucknow: Lucknow continues to deliver 30%+ EBITDA margins, which management expects to sustain.

* Chitta (Bulandshahr) & Anoopshahr hospitals divested in Sep’25 and reported a one-time gain of Rs 1.49bn in the quarter.

* International Business: Revenue stood at Rs 2.3bn, up 25% YoY and 11% QoQ, driven entirely by volumes with no price hikes. Geographic mix remained stable across the Middle East, Eastern Europe and Africa, with international patients accounting for ~6.5% of total occupied beds.

* Cashless issues with select insurers are resolved. The 13 Oct CGHS price revision should add incremental revenues of ~Rs 2bn annually once fully implemented, including other govt schemes which are linked to CGHS rates.

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271