Buy Vishal Mega Mart Ltd for the Target Rs. 170 by Motilal Oswal Financial Services Ltd

Long runway for sustainable double-digit growth

We interacted with senior management of Vishal Mega Mart (VMM) to understand the company’s growth runway, scope of operating leverage and profitability in South India, among other things. Here are the key takeaways:

* Management remains optimistic about sustaining double-digit SSSG on an annual basis (quarterly deviations might happen due to a change in the festive season, etc.) for a fairly long period, driven by differentiated own brands portfolio (~75% of the revenue mix).

* VMM has focused on premiumization over the last few years to match the rising aspirations of its customer base while remaining competitive in the opening price points by investing the gains from better buying efficiencies to improve the product quality.

* The company’s focus on volume-led growth, technology (warehouse automation, RFID implementation), best-in-class supply chain management (<3% of revenue) and frugal operational philosophy should result in operating leverage and drive EBITDA margin expansion.

* Management noted that lower throughput in South India is a function of relatively new stores (3-4 year old vs. 10+ years in core states). However, driven by higher apparel salience, the profitability in South is similar if not better than the pan-India level, which has buoyed management to accelerate store expansion in South India.

* VMM offers quick commerce (QC) in 460 towns, with its share varying between 2% and 9% of in-store sales, depending on competitive intensity. Further, management indicated that despite higher FMCG salience (~70%, lower gross margin) and associated delivery costs (~INR30-40/order), VMM’s QC offering is largely profitable on cash basis as AoV at ~INR700 is similar to typical in-store sales.

* We remain positive on VMM for its consistent growth trajectory, along with potential for margin expansion. We reiterate our BUY rating with a revised TP of INR170, premised on ~40x DCF implied Dec’27E pre-INDAS 116 EV/EBITDA (implies ~61x Dec’27 P/E).

Confident of sustaining double-digit SSSG over fairly long period

* VMM management remains confident of sustaining double-digit SSSG on an annual basis over a fairly longer period, though on a quarterly basis, there could be deviations due to a change in the festive calendar, etc.

* VMM’s differentiated proposition (~75% of revenue from own brands), ownership of opening price points and loyal customer base (~95% of sales to repeat customers) remain key drivers for sustainable SSSG.

* Management noted that stores across various cohorts are delivering double-digit growth. For example, 7-10-year old stores with SPSF of ~1.7- 2x of system average remain among the best performing stores.

* Further, VMM’s focus on premiumization is helping it garner a higher wallet share from customers, especially during the festive period.

South India expansion remains profitable despite lower throughput

* Throughput in South India is optically lower due to 1) historically larger store sizes in Karnataka (~25k sqft vs. ~17-18k sqft national average) and 2) relatively new store footprint (3-4 years of operations vs. 10+ years in core markets).

* However, despite lower throughput, management noted that profitability in South India is at par, if not better than national average, given higher salience of apparel in the region.

* Buoyed by the performance of stores in South India, the company has added more stores than initially anticipated in key markets such as Bangalore and Hyderabad and remains bullish on store expansion prospects.

* Further, VMM has witnessed encouraging response in new markets such as Kerala, which has prompted the company to accelerate the pace of store expansion (~15 stores already opened in last 12-15 months).

Scale-up of QC offerings and small-format stores to expand VMM’s TAM

* VMM’s QC offering (now live in ~460 towns) is also bringing newer customers to VMM’s ecosystem. QC contributes ~2-9% of VMM’s in-store sales, depending on competitive intensity across regions.

* Further, management noted that VMM’s QC offering is broadly profitable on cash basis as a high average order value (~INR700, in line with typical in-store ABV) makes up for the lower gross margin (~70% FMCG salience vs. ~27-28% in store) and associated delivery costs (~INR30-40/order).

* VMM is also piloting small store formats to target ~50k population towns, which is leading to expansion in its targetable addressable market (TAM). As per management, the performance of these small-format stores has been broadly in line with large-format stores, providing encouragement to roll it out to 40-50 stores over the next 12 months.

Valuation and view

* We believe the company’s diversified category mix, ownership of opening price points, significant contribution from its own brands, and lean cost structure provide it with a strong moat against intense competition from both offline and online value retailers.

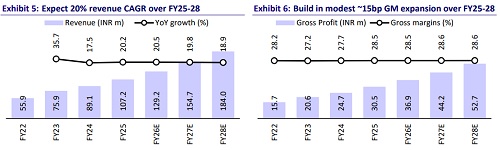

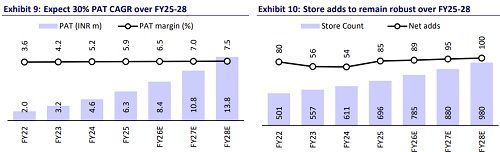

* Our FY26-28 earnings estimates remain broadly unchanged. We model a CAGR of 20%/22%/27%/30% in revenue/EBITDA/pre-INDAS 116 EBITDA/PAT over FY25-28E, driven by ~12% CAGR in store additions, consistent double-digit SSSG and ~160bp pre-INDAS 116 EBITDA margin expansion.

* We reiterate our BUY rating with a revised TP of INR170, premised on DCFimplied ~40x Dec’27E pre-IND AS 116 EV/EBITDA (implying ~29x Dec’27E reported EBITDA and ~61x Dec’27E P/E).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412