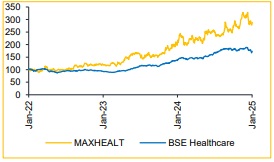

Hold Max Healthcare Ltd For the Target Rs.1,200 by Choice Broking Ltd

Revenue & EBITDA Beat Estimates; PAT Impacted by Jaypee Acquisition

* Revenue grew 34.9% YoY and 7.1% QoQ to INR 22.7 Bn (vs. consensus estimates at INR 21.7 Bn), driven by a 35% YoY increase in occupied beds.

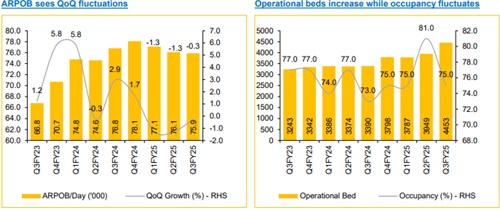

* ARPOB stood at INR 75.9K, down 2.8% YoY. Occupancy remained strong at 75% vs 81% last quarter.

* The company added 504 new operational beds, bringing the total to 4,453.

* EBITDA rose 31.2% YoY and 8.9% QoQ to INR 6.1 Bn. EBITDA margin contracted by 76bps YoY but expanded 46bps QoQ to 26.9% (vs. consensus estimates at 26.4%).

* PAT increased 14.8% YoY and 7.5% QoQ to INR 3.9 Bn (vs. consensus estimates at INR 3.6 Bn) with a PAT margin of 17.3%.

Max Healthcare to add ~3,500 beds over 3-4 years

The company plans to add approximately 3,500 beds, a 68% increase from FY25-27E, driven by an aggressive expansion strategy.We expect bed additions as follows:

* FY26: ~1,123 beds from expansions at Nanavati, Smart Saket, Mohali, and Phase 1 of the Gurugram facility.

* FY27: ~1,517 beds from Phase 2 of Gurugram, Patparganj, Vikrant Saket, Mohali, and other locations. Additionally, the company has entered into an asset-light, built-to-suit agreement to develop a 500-bed hospital in Thane, a high-growth micromarket, with commissioning expected by 2028

Occupancy to improve; EBITDA margin expected to cross 30% by FY27

We expect the company’s occupancy to witness steady growth as new facilities and bed capacity become scalable. ARPOB growth is likely to remain flat in FY25, with some improvement expected in FY26 and FY27. Additionally, the company's increased focus on high-margin therapies like oncology, which now contributes ~25% of network revenue, along with the anticipated CGHS (Central Government Health Scheme) rate hike in the next 1-2 months, is expected to drive EBITDA margin expansion. Management expects EBITDA margin to exceed 30% by FY27.

View and Valuation:

We have increased our FY26/27 EPS estimates by 4.2%/21.4% and upgrade our rating to ‘HOLD' with a target price of INR 1,200, valuing it on an SOTP basis with an EV/EBITDA of 26x for Max Healthcare factoring in its aggressive expansion plans, 15x for Max Lab, and 3x for Max Home. We believe growth will be driven by new bed capacities, improved occupancy, and steady growth in ARPOB, along with EBITDA margin expansion. We expect revenue to grow at a CAGR of 29% from FY24-27E.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131