Buy Kajaria Ceramics Ltd for the Target Rs.1,430 by Motilal Oswal Financial Services Ltd

Muted revenue growth; cost optimization fuels margin expansion

Unified sales framework to drive efficiency and dealer servicing

* Kajaria Ceramics (KJC)’s 1QFY26 EBITDA was above our estimate, led by cost optimization efforts. Revenue inched up ~1% YoY to INR11.0b (in line), while EBITDA increased ~9% YoY to INR1.9b (~24% beat), and OPM surged 1.3pp YoY to ~17% (vs. ~13% est.). PAT increased ~17% YoY to INR1.1b (~33% beat).

* Management indicated that demand continues to be soft in the near term; however, it anticipates volume growth in 9MFY26, aided by improvement in export markets. The company is undertaking unification initiatives to integrate its tile sales and marketing functions. This will drive cost efficiency, resource optimization, and long-term volume growth. KJC believes margins will remain stable due to its continued focus on cost optimization and operating efficiency. Notably, promoters are forgoing salary for FY26 (INR170m in FY25).

* We raise our EPS estimates by ~24%/10% for FY26/FY27 to factor in strong margin expansion fueled by cost optimization. We also introduce our FY28 estimates with this note. We value KJC at 40x Jun’27E EPS to arrive at our revised TP of INR1,430. Reiterate BUY.

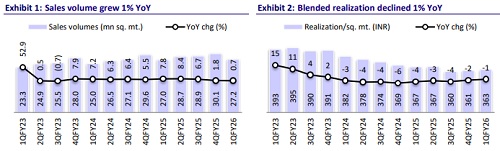

Volumes inch up ~1% YoY; tile realization dips ~1% YoY

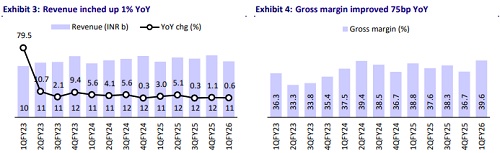

* Consol. revenue/EBITDA/PAT stood at INR11.0b/INR1.9b/INR1.1b (+1%/+9% /+17% YoY and -4%/+24%/+33% v/s our estimates). Tiles volume inched up ~1% YoY to 27.2msm, while realization declined ~1% YoY to INR363/sqm. Sanitaryware revenue remained flat YoY at INR915m, while revenue from adhesives increased ~64% YoY to INR249m. It closed the plywood business.

* Gross margin improved 75bp YoY to ~40%. Employee costs increased ~1% YoY (12.3% of revenue and similar to 1QFY25). Other expenses declined 5%/ 32% YoY/QoQ (10.3% of revenue vs. 10.9% in 1QFY25). OPM increased 1.3pp YoY to ~17%. Depreciation/interest expenses increased ~4%/57% YoY, while other income grew ~31% YoY. ETR was 24.8% vs. 24.0% in 1QFY25.

Highlights from the management commentary

* Management is prioritizing cost rationalization and better utilization of existing capacity. Further, government spending has also started to improve and will help in overall growth.

* Average gas prices were INR37/scm, with the North at INR38/scm, the South at INR39/scm, and the West at INR36/scm. KJC is focusing on optimizing input costs, including packaging material, raw material sourcing, and other overheads.

* Capex is pegged at INR1.0-1.5b for FY26, mainly towards maintenance and the new corporate office.

Valuation and view

* KJC’s earnings in 1Q were significantly above our estimates, led by strong cost control initiatives. Though the near-term demand outlook remains subdued, management expects margins to be sustained due to the cost rationalization efforts. Its strategic decisions, like the transition in the marketing team and efficiency improvement, are likely to fuel profitable growth going forward.

* We estimate KJC to post a revenue/EBITDA/PAT CAGR of 10%/18%/22% over FY25-28. We estimate ~9% CAGR in the tile volume over FY25-28. We factor in a margin improvement of 2.6pp YoY in FY26E to 16.2% and a marginal improvement of 20bp in FY27/28E (each). Valuations at 41x/36x FY26E/27E EPS appear reasonable, and we believe demand recovery would be the key trigger for stock price performance. We reiterate our BUY rating with a revised TP of INR1,430, based on 40x Jun’27E EPS.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412