Neutral Bosch Ltd for the Target Rs. 36,289 by Motilal Oswal Financial Services Ltd

Mobility segment remains the key growth driver

* Bosch’s(BOS) 2QFY26 PAT at INR5.5b was in line with our estimates. The mobility business was the key growth driver in 2Q, having posted 14% YoY growth, while the non-mobility segment posted a 17% decline.

* The auto segment’s demand has picked up following the GST 2.0 reforms and is likely to benefit players like BOS. While BOS continues to work toward the localization of new technologies, given the long gestation of projects, its margin remains under pressure with no visibility of material improvement, at least in the near term. We factor in BOS to post revenue/EBITDA/PAT CAGR of 11%/14%/18% over FY25-28E. At ~44x FY26E/38x FY27E EPS, the stock appears fairly valued. We reiterate our Neutral rating with a TP of INR36,289 (based on ~36x Sep’27E EPS).

Earnings in line with estimates; Auto segment posts robust growth

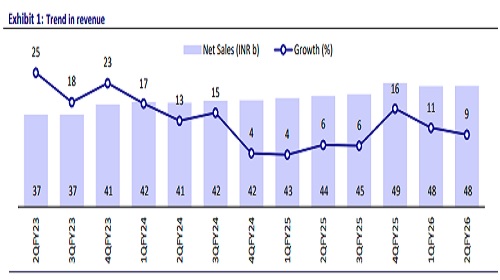

* Standalone revenue grew 9.1% YoY to ~INR48b, which was broadly in line with our estimates. This growth was primarily driven by a higher demand for PVs and off-highway segments. Auto products’ revenue grew ~14% YoY to INR42.7b, while the non-auto segment posted a ~17% decline to INR5.3b.

* Within auto, the power solutions business grew 9.5%, driven by growth in the PV and OHV segments. The 2W business grew 81.8% due to increased sales of exhaust gas sensors following the ramp-up of OBDII norm implementation. Meanwhile, the mobility aftermarket business grew ~4% YoY, driven by strong performance in diesel and filter systems.

* However, business beyond mobility declined 14.4% on account of the sale of the video solutions business last year.

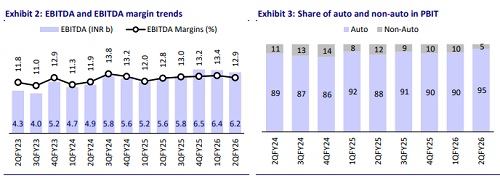

* EBITDA margin remained stable YoY at 12.9% (in line).

* EBITDA grew ~10% YoY to INR6.2b, led by revenue growth.

* On a segmental basis, the auto segment margin expanded 100bp to 14.9%. The non-auto segment’s margin contracted 460bp YoY to 6.5%.

* Adj. PAT grew 11% YoY to INR5.5b (in line).

* For 1HFY26, operational cash flow stood at ~INR9.9b, while capex stood at INR726m. BOS was net cash positive with INR9.2b free cash generated in 1H.

* Revenue/EBITDA/PAT grew 10%/16.3%/~27% YoY in 1HFY26 to INR95.8b/INR12.6b/INR12.2b, respectively. For 2HFY26, we expect these metrics to grow 8%/10%/13%, respectively, to INR101b/INR13.5b/INR11.8b, respectively.

Highlights from the management commentary

* BOS launched its sensorless quick-shift technology in India and deployed its Lambda Sensor in TVS Ntorq 150 and Bajaj Pulsar NS400.

* The EV segment saw steady progress, with key customers being 2W scooter OEMs.

* Management expects demand to pick up across key auto segments (2Ws, PVs, CVs, and tractors), supported by GST 2.0 reforms, improving rural sentiment, and a reduction in interest rates.

* The automotive segment is transitioning from legislation-led to feature-led demand, which is expected to drive higher content per vehicle. Clean energy technologies, hybrid systems, flex fuel systems, and electrification are expected to drive growth in the future.

* The company is actively engaging with Indian OEMs to develop hybrid powertrains.

* Hydrogen ICE systems in MHCVs are currently in the pilot stage, and various OEMs are test-marketing the same. Management expects hydrogen-powered HCV systems to reach 8-15% market penetration by 2030.

Valuation and view

* The auto segment’s demand has picked up following the GST2.0 reforms and is likely to benefit players like BOS. While BOS continues to work toward the localization of new technologies, given the long gestation of projects, its margin remains under pressure with no visibility of material improvement, at least in the near term. We factor in BOS to post revenue/EBITDA/PAT CAGR of 11%/14%/18% over FY25-28E. At ~44x FY26E/38x FY27E EPS, the stock appears fairly valued. We reiterate our Neutral rating with a TP of INR36,289 (based on ~36x Sep’27E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)