Buy Laurus Labs Ltd for the Target Rs. 1,110 by Motilal Oswal Financial Services Ltd

Healthy momentum in CDMO/FDF; earnings upcycle intact

ARV recovery, CDMO scale-up, and operating leverage drive a 2Q beat!

* Laurus Lab (LAURUS) delivered yet another better-than-expected quarter with a 6%/18%/38% beat on revenue/EBITDA/PAT. Higher formulation sales (FDF; backed by robust ARV revenue), a superior mix in the CDMO segment, and improving operating leverage led to a strong 2QFY26 performance.

* Along with improving traction in the human health CDMO segment, the company has invested in manufacturing assets for the animal health and crop science aspects of the CDMO segment. In fact, the validation batches for certain products in the animal health segment are ongoing, with scale-up likely from FY27.

* The non-ARV formulation sales have witnessed a healthy scale-up QoQ, fueled by newer introductions and higher off-take of existing products.

* LAURUS has shown encouraging performance in the ARV segment, led by higher volumes of products sold during the quarter.

* We raise our earnings estimates by 11%/10%/6% for FY26/FY27/FY28, factoring in 1) improved ARV prospects, 2) steady pick-up in CDMO projects, and 3) higher generics business backed by CMO opportunities.

* We expect a 50% earnings CAGR over FY25-28 and value LAURUS at 58x 12M forward earnings to arrive at our TP of INR1,110. Reiterate BUY.

Better operating efficiency fuels margin expansion

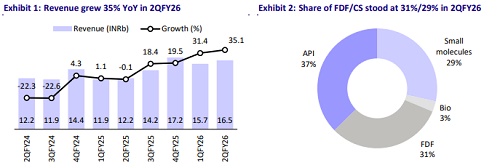

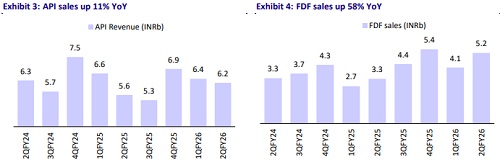

* LAURUS’ 2QFY26 revenue grew 35.1% YoY to INR16.5b (our est. INR15.6b). Synthesis business (29% of sales, small molecules) was up 58% YoY to INR4.7b, led by expansion of the project funnel and a healthy client base.

* FDF sales grew 58% YoY to INR5.2b (31% of sales). API sales (37%) rose 11% YoY to INR6.2b. Bio division sales (3%) grew 18% YoY to INR470m.

* Gross Margin (GM) expanded ~470bp YoY to 59.9%, with a change in business mix. Notably, GM expanded 50bp QoQ despite the share of Synthesis business dipping 300bp during the same period.

* EBITDA margin expanded ~980bp YoY to 24.4% (our estimate: 21.9%) due to better operational efficiency (other expenses/employee costs dipped 360bp/160bp YoY as a % of sales).

* EBITDA grew 126% YoY to INR4.0b (our estimate at INR3.4b).

* The company’s Adj. PAT scaled from INR198m in 2QFY25 to INR1.9b (our estimate at INR1.4b) for the quarter.

* LAURUS’ 1HFY26 revenue/EBITDA grew 33%/125% YoY to INR32/INR8b. PAT sharply moved from INR330m in 1HFY26 to INR3.5b in 1HFY26.

Highlights from the management commentary

* LAURUS guided the ARV business to be INR25b (+/-INR2b) for FY26.

* The favorable mix of commercial molecules within CDMO is driving better gross margin despite a lower share of CDMO revenue on a QoQ basis.

* In addition to the INR50b capex planned over the next five years, LAURUS has been allotted 532 acres in Vizag by the Govt. of Andhra Pradesh. The company plans to invest USD600m (~INR50b) over eight years on this land to expand pharma manufacturing and R&D infrastructure, with a focus on scaling and technology advancement.

* Of the total capex outlay of INR36b over FY22-26, about 23% would be spent on the API/CDMO projects, while the remainder would be spent on drug products.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412